An Act of Congress for the Steady-State Timeline

by Brian Czech

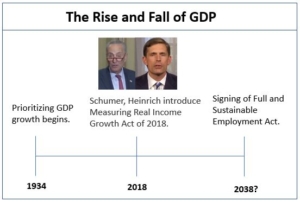

Some years down the road—probably decades—we’ll pass the Full and Sustainable Employment Act, calling for a steady state economy in the USA. This is our vision at CASSE. When that day comes, scholars and commentators will construct a timeline demarcating the major steps along the way. On that timeline, August 28, 2018 will be duly noted. This was the day when the Measuring Real Income Growth Act, “MRIGA,” was introduced in the U.S. Senate by Chuck Schumer (D-NY) and Martin Heinrich (D-NM).

Even if MRIGA is never enacted, the Senate bill will belong on the timeline. It recognizes one crucial point on the way to a steady state economy: namely, that something is wrong with using GDP as an indicator of success. It represents an American paradigm shift, away from the bankrupt notion that “a rising tide lifts all boats” to the reality that some boats are falling to pieces while others are accruing new decks.

Now it’s true that MRIGA is far from a Full and Sustainable Employment Act. It’s all about a more equitable distribution of wealth, and says nothing about limits to growth. And that is precisely why it will be an early mark on the steady-state timeline, as opposed to the culmination of steady state economics.

Steady state economics centers around the themes of sustainability, distribution of wealth, and allocation of resources. When asked for advice, the steady state economist will prescribe stabilized GDP (for sustainability), an equitable distribution of wealth, and efficient allocation of resources using a variety of approaches. In contrast, conventional economics deals almost entirely with the allocation of resources by prescribing especially the “free market.”

Similarly, American political history has favored the free market. The American Constitution was conducive to the fast track of a capitalist economy. The founding fathers – and certainly subsequent politicians – emphasized economic freedom over issues of fairness and sustainability.

Chuck Schumer explaining the bill on C-SPAN.

As we start bumping up against limits to growth in the 21st century, some cold hard facts reveal themselves. One is the accelerating pace of environmental deterioration. Another is that a rising tide no longer lifts all boats. When it takes drastic measures to grow the economy – including the revocation of longstanding environmental protections – the benefits accrue to fewer individuals, such as oil and chemical company executives.

Environmental deterioration is noticed by ecologists and overlooked by most others, while the general inability to get ahead financially is experienced by the vast majority of individuals. Therefore we can expect political action on the distribution of wealth before any action on protecting the environment, much less any steady statesmanship to intentionally limit the size of the economy. And this is precisely what we are seeing in MRIGA: political action on the distribution of wealth, with no heed paid to sustainability (in the current bill at least).

So we suffer no illusions that Schumer and Heinrich are attacking GDP out of a concern for environmental protection or even long-term economic welfare. Even their apparent concern for the current distribution of wealth doesn’t hide the obvious fact that MRIGA is a political response to President Trump’s braggadocio over GDP growth rates. Nevertheless, the mere fact that Schumer and Heinrich focused in on GDP, rather than for example a progressive tax reform, will help us immensely as we raise awareness of the trade-off between GDP growth and environmental protection, economic sustainability, national security, and international stability.

Brian Czech is the executive director of CASSE, and author of several books including Supply Shock.

Brian Czech is the executive director of CASSE, and author of several books including Supply Shock.

See and sign my petition. I’m afraid there’s not enough room for the article I wrote it’s based on. I’ll try to send it as an attachment.

Complicated topic…are there any Economists out there who are willing to comment on this? I’d like to learn more. I’ve been casually following Steady State for years — when I during a local book club presentation, I first asked myself the question — “Why does there always have to be GROWTH?” More is not necessarily better.

Gayle

I really dislike Schumer and his ilk, but this policy of guaranteed income for all, much like the promise of College for all, is just too much of a State Takeover.

We must first attack Growth of all kinds, on every occasion, and do it often. Growth is the Killer of the planet, and the people. There are in fact too many people, people produce pollution, waste, over-heating of earth. Reduce the growth of PEOPLE first, and then pick a target for Steady-State population of the world: 3 billion, 2 billion etc., but this target must be < 4 billion. We are currently approaching 7 billion people, fast approaching 10 billion. When the flock is culled, we should support the procreation of only the brightest and best. Equality is not a truly sustainable option. We need the same breeding protocol as we use on our horses, cows, and even dogs. Good people = good earth.

Three billion people is a sustainable SS population. The problems of overheating the atmosphere, polluting of our rivers and oceans and the excess investment in infrastructure will disappear, and the threat of future wars will be diminished. Socialism is not the key to get this final SS done.

Dick, I agree that we need to readjust our obsession with “growth is good.” That’s why this bill seems like a good first step. As long as we define a healthy economy in terms of GDP, we will continue to be focused on growth = good. If we can begin to define economic health in a different way, we change perceptions and can start having a different conversation.

Regarding population – a good start would be for governments to stop offering financial incentives (such as one-off baby payments and family allowances) for people to breed, especially if they already have 2 children.

Not recycling should not be an option and waste collecting utilities should refuse to collect unsorted waste. Newspaper and magazine publishers should make it possible to save digital subscriptions permanently onto hard disk because, at present, they expire after a certain period of time. Alternatively or in addition to this, paper manufacturers should use agricultural waste, such as wheat stalks, instead of wood.

It is necessary to stop the expansion of (non-indigenous) human activities, such as agriculture, roads and suburbs that is causing the destruction of tropical forests and other natural ecosystems, the extermination of plant and animal species and genocide against indigenous peoples. A shift to veganism is great but it is unacceptable that vegans often advocate the consumption of products from lands in which these problems continue, especially Southeast Asia and South America, or when a person who claims to be concerned about these problems emigrates from Europe or Asia to North America or Australia. Manufacturers in Europe should use raw materials from Europe.