Introducing the Natural Resources and Electricity Cap-and-Trade Act

by David Shreve

In cap-and-trade systems, the government places a “cap,” or limit, typically on pollution or resource extraction. The amount of pollution or extraction is then divided into “allowances,” which are allocated to the polluting or extracting corporations. These corporations can trade their unused allowances in the marketplace.

Cap-and-trade policies promise significant abatement at an optimally low cost. But does experience with cap-and-trade systems vindicate this promise?

The United States and other countries have tested a variety of cap-and-trade systems. We’ve identified factors that often determine success or failure. Trading participants’ differing capacities for conservation and technological innovation, for example, often determine relative success.

Minntac Mine in Minnesota is the United States’ largest iron ore mine. (Bjoertvedt, Wikimedia Commons)

The macroeconomic and climatological backdrops also matter. Economic recession, for example, can reduce demand (and cap-and-trade allowance prices) to the point at which allowance trading becomes irrelevant.

These and other lessons learned are applied to CASSE’s Natural Resources and Electricity Cap-and-Trade (NRECT) Act, a feeder bill of the Steady State Economy Act. The NRECT Act embodies real sustainability, which entails limiting material and energy throughput across the spectrum of production and consumption.

Timber, a renewable resource, and iron ore, a nonrenewable resource, serve as prototypes for sectors at the beginning of the production process. As an example of limiting production and consumption across the board, the NRECT Act includes a cap-and-trade system for electricity generation. The primary intent is braking a runaway economy, but capping electricity also helps mitigate climate change, because electricity generation is the second-biggest source of greenhouse gases in the United States.

The Recent History of Cap-and-Trade Systems.

Companies started adding toxic tetraethyl lead to gasoline in the 1920s. (Plazak, Wikipedia)

There is great interest in the development of new cap-and-trade emissions reduction programs. China, for example, is testing them in a variety of markets. Several dozen systems have been implemented around the world, many with limited reach or impact. Most cap-and-trade system analysts, however, recognize seven landmark programs, often placed into three broad categories.

The first category comprises two early U.S. systems, led by the Environmental Protection Agency (EPA): one designed to phase out leaded gasoline and the other to reduce acid rain. The government implemented these pathbreaking programs from the 1970s to the 1990s. They were followed by four U.S. regional programs in California and the Northeast. Focused on ground-level ozone, sulfur dioxide, and greenhouse gas reductions, these compose the second category of landmark cap-and-trade programs. The third category includes the largest of the seven notable systems: the 31-nation European Union greenhouse gas reduction system, which was introduced with a pilot phase in 2003.

The Pathbreaking Acid Rain Program

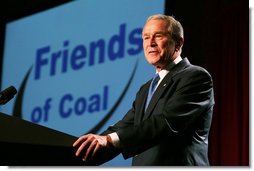

A clean(er) coal industry proved politically seductive in the early 21st century. (The White House Archives)

Title IV of the 1990 Clean Air Act amendments established the first large-scale emissions allowance trading system. EPA designed the system to reduce sulfur dioxide emissions from coal-fired electricity-generating plants, the clearly implicated source of the nation’s acid rain. The rationale was that allowance trading would address the disparity in compliance costs among electricity generators.

However, the emissions trading program was introduced only after a stringent Phase One (1995-1999) “command-and-control” regulation of the nation’s largest and most polluting plants. Trading commenced in Phase Two (2000-2010). Allowances were allocated based on fuel use during the 1985-87 period.

From 1990-2007, sulfur dioxide emissions declined by 43 percent, even though electricity generation from coal-powered plants increased by approximately 26 percent. Targets were met as rapidly as predicted. This program came to be regarded as a successful test of cap-and-trade efficiency.

Lessons Learned: Principles of a Good Cap-and-Trade Program

What have we learned from experience with cap-and-trade systems? For one thing, the electric power industry has been the most successful target in terms of impact.

In past electric power cap-and-trade programs, compliance was universal, due to the pre-existing regulation and monitoring framework for the industry. Also, the rising presence of interstate wholesale electricity markets facilitated trading. This provided flexibility for participants with differing capacities for change, a key factor in all cap-and-trade systems.

These programs can be successful in other industries, especially those industries with pre-existing regulation or production limits and interstate wholesale markets. The U.S. timber and iron industries provide examples of renewable and nonrenewable resources for which cap-and-trade systems may function efficiently and effectively.

Another lesson learned is that allowance trading is susceptible to leakages. When the market extends beyond a cap-and-trade system’s jurisdiction, concerns about competitiveness and ease of relocation hamper allowance trading effectiveness. However, international markets are also difficult to monitor and police. When it comes to protection from leakage, national programs likely fit the sweet spot. They provide less opportunity for the relocation of pollution or extraction than with regional programs, and they are more feasible to regulate than international programs.

Added costs are essential to cap-and-trade systems. If allowance trading prices fall too low, companies may be incentivized to extract or pollute more. For electric power systems, allowance prices tend to fall short of a workable standard because of the large gap between fossil fuel and renewable energy prices.

Increasing the cost of pollution or extraction always generates inequitable price effects. (Advantus Media Inc., QuoteInspector.com)

However, we’ve also learned that commodity price increases tend to impact low-income consumers most. This is because consumer demand for many basic commodities, such as electricity, is very inelastic; people continue to buy it at a minimal level even as the price increases. To deliver pollution reduction or resource conservation without the poorest citizens paying the heaviest cost, companion price mitigation is a key principle.

Finally, we have learned that allowances must be linked to prior “business-as-usual” production levels. These levels may be difficult to determine. An EU emissions trading program failed noticeably in this regard, allocating allowances based on a multiplicity of political and social considerations. It had to lean heavily, as a result, on traditional command-and-control regulations.

Introducing the Natural Resources and Electricity Cap-and-Trade Act

These principles of cap-and-trade allowance trading are applied to the Natural Resources and Electricity Cap-and-Trade (NRECT) Act, a feeder bill of the Steady State Economy Act. Sections 1–3 of the proposed bill establish its short title, Congress’s findings and declarations, and definitions.

American forests keep us all alive and healthy. (Rawpixel)

Section 4 outlines the limits and operating procedures of a Timber and Pulp Cap-and-Trade system. The U.S. Forest Service is to establish a 10-year schedule of declining annual limits for national timber harvests. These limits are based on goals of no net deforestation or forest degradation and no conversion of natural forests to plantation forests. 90 percent of the aggregate allowances under the timber harvest cap are allocated to companies based on prior production levels. The other ten percent are auctioned by the Forest Service. Companies within the system can trade unused allowances.

Section 5 establishes a companion measure designed to fortify this system. U.S. Forest Service studies reveal that most owners of modest timber holdings have little access to professional forestry planning. Such planning is essential to eliminate readily avoidable deforestation on these lands, which could markedly offset the success of the cap-and-trade system. To bring modest-timber-holding owners into the cap-and-trade fold, section 5 requires State Forest Action Plans for private, non-corporate owners of timber stands greater than ten acres.

Section 6 of the NRECT Act outlines the limits and operating procedures of an Iron Ore Extraction Cap-and-Trade system. This is a trading network comprising the few iron ore mining companies that remain active in the United States. Extraction limits comport with the limited capacity of major mine operations, mostly located in Minnesota and Michigan. These limits should be accompanied by efforts to recycle and re-use iron and steel products, given the impending exhaustion of existing deposits and/or reaching of NRECT caps. This cap-and-trade system is limited to one significant industry but serves as a useful prototype for other industries engaged in similar nonrenewable resource extraction.

Section 7 outlines the limits and operating procedures of an Electricity Cap-and-Trade system. Whereas prior electricity-industry cap-and-trade programs have capped emissions, NRECT caps electricity generation, measured in megawatt hours. It is a steady state we seek in this section, though we expect corollary emissions reduction as well.

Electric power: the second largest emitter of greenhouse gas in the U.S. (Hippo PX)

All energy consumption—all economic activity, for that matter—is linked to ecological impact. Climate change is only one of the six planetary boundaries we’ve crossed. If we were to maintain (or increase) current levels of electricity consumption but source it all from renewables, this would mitigate climate change. Reflecting the phenomenon known as Jevons Paradox, however, it might drive us further past other boundaries, such as biosphere integrity and freshwater depletion.

Targeting electricity generation as opposed to emissions could result in some undesirable externalities. Without accompanying emissions regulations, companies would be incentivized to use the cheapest energy source, which is often coal or natural gas. Regulatory, command-and-control policy may be used to limit the use of fossil fuels. Otherwise, a cap-and-trade program for coal and natural gas extraction could serve as an early amendment to the NRECT Act.

Another concern is that an electricity-generation cap could lead to black- or brown-outs in some communities, especially in politically marginalized areas. To obviate this, section 7 includes limits to how many allowances a company can trade. The NRECT Act also includes pricing standards, in section 8, designed to encourage efficient residential, commercial, and industrial electricity usage. Reduction of overall demand for electricity is the key to avoiding inequitable service interruptions.

Section 8 is also designed to mitigate the inequitable price effects of the cap-and-trade system. It calls for the Federal Energy Regulatory Commission (FERC) to establish three tiers of electricity usage. The first tier represents “sustainable and equitable” levels of electricity usage that a household or company needs to operate. The second and third tiers represent progressively higher levels of electricity usage. Progressively higher tier two and (punitive) tier three prices are used to cross-subsidize tier-one usage, prices for which cannot rise above a FERC-established ceiling. This pricing-standard mechanism ensures that higher prices aren’t passed on disproportionately to low-income households, who cannot avoid a certain level of subsistence electricity consumption.

Section 9—also meant to offset inequitably distributed costs—outlines the provisions for two new greenhouse gas reduction funds. One is for renewable energy research and development projects, and the other is for electric power company assistance during extreme climate events. These funds are the repository for all proceeds from Electricity Cap-and-Trade allowance auctions. (These are similar to the auctions described for the Timber and Pulp Cap-and-Trade system.)

Integrating the principles of effective capping and trading, the proposed system, pricing standards, and funds promote verifiable and equitable reductions in unnecessary economic activity, greenhouse gas emissions, and other ecological impacts.

Last of all, sections 11-12 outline penalties for violators of the NRECT Act. For the iron ore and electricity programs, penalties run as high as $10 million and $1 million, respectively. The timber program is policed by the Department of Agriculture’s Forest Service, the iron ore program by the Department of the Interior’s Office of Surface Mining Reclamation and Enforcement, and the electricity program by the FERC.

The NRECT Act leverages lessons learned from past and current cap-and-trade structures. It promises advanced environmental protection while protecting the most vulnerable consumers. The NRECT Act pairs trading with traditional command-and-control regulation and confines trading systems to readily monitored participants.

If participants are short of the wherewithal to comply with limits, allowance-trading proceeds can help them make the necessary changes. For renewable resources like timber, nonrenewable resources like iron, and electricity generation (environmentally impactful no matter how it’s produced), cap-and-trade can help us meet our needs while bringing us closer to a bona fide, sustainable, steady state economy.

David Shreve is a Senior Economist at CASSE.

David Shreve is a Senior Economist at CASSE.

Thank you for this interesting and informative article. I think section 9 should also include funding for energy efficiency research and projects, the cheapest form of demand reduction.

Thanks, Jacob. Indeed, there is ample room for significant investment in energy efficiency, both for research and development and for subsidies, for already proven techniques, materials, etc. In this proposed legislation, we confined such investment to the rather small-scale, but not insignificant, funds generated by the allowance auction. There is plenty of room to augment these with other programs and proposals.

That’s a really good idea. I would say as a general rule (be careful about the details, of course) one really can’t go wrong by minimizing the inputs required for a good or service, if the quality of the same good or service can be maintained. That’s a very big “if” but anyway: efficiency is good stuff.

I only read the opening lines to know there’s a better way. A simple carbon tax like the Energy, Innovation and Carbon Dividend Act, first introduced during Obama’s last months in office. It was re-introduced in every Congress since until our current congress. Cap and trade has a long lists of shortcomings when dealing with carbon emissions. Cap and trade doesn’t cross international borders easily, it is very complex requiring a lot of bureaucracy and traders find ways to cheat the policy’s purpose. Cap and trade worked great with Ozone, with few producers easily identified and managed.

We acknowledged some of these shortcomings, and largely attempted to convey our skeptical view of stand-alone cap-and-trade systems, for example, with difficult-to-police offsets and boundaries that can readily be drawn too small or too broadly for adequate enforcement. We also acknowledged the overarching problem with the predominant price effect, here with our somewhat modest cap-and-trade proposal, and implicitly, with systems such as you recommend for purer carbon pricing. For the latter, even though further research and analysis may still yield feasible potential pathways out of the conundrum, we reckoned that price effect mitigation–which we deemed necessary–could really be applied simply and feasibly enough only in the limited cap-and-trade markets such as we proposed.

I commend you for this work. It is rare to see discussion of how a sustainable steady-state economy could be established in practical terms. Never mind the idiocies now coming out of the White House, this is the kind of thinking that must go on and hopefully bear fruit in later times.

Still, the proposal faces a major hurdle: How can restrained consumption and production be made palatable to the broad swath of people in Western societies. I fear that nothing but civilization-destroying catastrophe will be required to get us there.

Indeed, making restrained consumption and production “palatable” in a world where we imagine that a new technology will ultimately save us from ourselves, or that the many can easily afford to withdraw from the global supply chains that help them sidestep misery and illness, is a supreme challenge. Given the limitations and pitfalls of all cap and trade systems, the “caps” in the prototype systems here are designed with modest goals, unequal to this larger task. If we design them carefully, combine them with planning and regulation, and target key resources that can be conserved, they can help. A sufficient “bending of the arc,” however, cannot really happen without addressing the wholly unnecessary inequality bias or indifference at the heart of the world’s “normal” macroeconomic policies, or without also encouraging and speeding along the developing fertility transition. Nothing else has the capacity for sufficient change while not only avoiding increased misery or economic depression, but also reducing significantly the consumption and production needed to achieve and sustain general prosperity. The good news, I think, is that however powerful and well rationalized it has become, our (extreme) inequality bias is new, and can be discarded. Developed nations did this in the mid-20th century and can do it again. And the fertility transition, mostly a product of popular struggles for equal opportunity and reproductive rights, can become much more popular still, if only the quite myopic and profoundly ignorant pro-Natalists can get out of the way. Moreover, if we address the first (inequality) challenge firmly and confidently, it should also go a long way to convince many more that these pro-Natalist obstructionists don’t know their macroeconomic policy from a hole in the ground.