Approaching the Energy Cliff

by Dave Rollo

Back to the future? (Getarchive)

Warn anyone in the USA about the coming energy crisis and you’re likely to see eyes roll. “What energy crisis? That was half a century ago! Markets and technology won. Today we’re back among the top oil suppliers!”

All true, but the response gives a false sense of security that has policymakers and publics sleepwalking toward a cliff. An energy crisis is likely ahead, no matter our rank (currently third) among oil supplying nations. Seeing the coming crisis requires looking beneath the veneer of oil supply claims and asking some deeper questions.

The issue of energy scarcity is important because energy, fossil or otherwise, is tightly tied to economic output. A prolonged energy crisis—one in which substitutes for scarce energy are too expensive, environmentally harmful, or beyond humanity’s technological capabilities—would likely put an end to growth of industrial economies. While degrowth to a steady state economy is what steady staters seek, a lengthy and substantial period of degrowth would be a nightmarish outcome that would produce unnecessary suffering and conflict.

Revisiting an Energy Price Shock

Fifteen years ago, the world suffered an economic downturn that required intervention by central banks and governments to prevent a depression-level economic collapse. Economies in much of the world had been expanding since 2001, but deregulation of mortgage lending produced a bubble that sent shockwaves through the global financial and economic system. This much is well understood, but what is little recognized is the pin that burst the bubble. The pin was the price of oil, which doubled between 2007 and 2008.

Fracking has left its mark. (Flickr)

Oil prices rose because world petroleum output could not keep up with demand. Because oil is a “master resource” used for energy or as a feedstock in practically every economic sector, rising prices caused the global economy to slow. The over-leveraged housing industry, already vulnerable because of a lack of credit-worthiness of some buyers, began to unravel. And although government intervention has been extensive, GDP growth after the 2008 crisis remained tepid.

But the economy recovered as energy extraction picked up, underlining the critical importance of energy to the economy. With higher oil prices and a period of low interest rates, extraction relying on a new technology—fracking—was added to the oil industry’s toolbox. Fracking increased oil supply by opening access to so-called “light tight oil” from mid-continental U.S. shale deposits. This period of increased supply is known as the “shale boom.” It made the USA a major supplier, and concerns about energy supply slid into the rear-view mirror. Indeed, headlines about ”Peak Oil” that were common before the Great Recession of 2008-09 soon disappeared as fracking opened up supply.

The last decade, however, has brought new attention to the limits of energy availability and has shown that the shale boom may be short-lived. Because of oil producer obfuscation (particularly on the part of OPEC) we are still unsure of total global oil reserves, and by a terminological sleight of hand (described below), what was once considered oil has changed meaning, adding to confusion about reserve totals.

An Accounting Problem

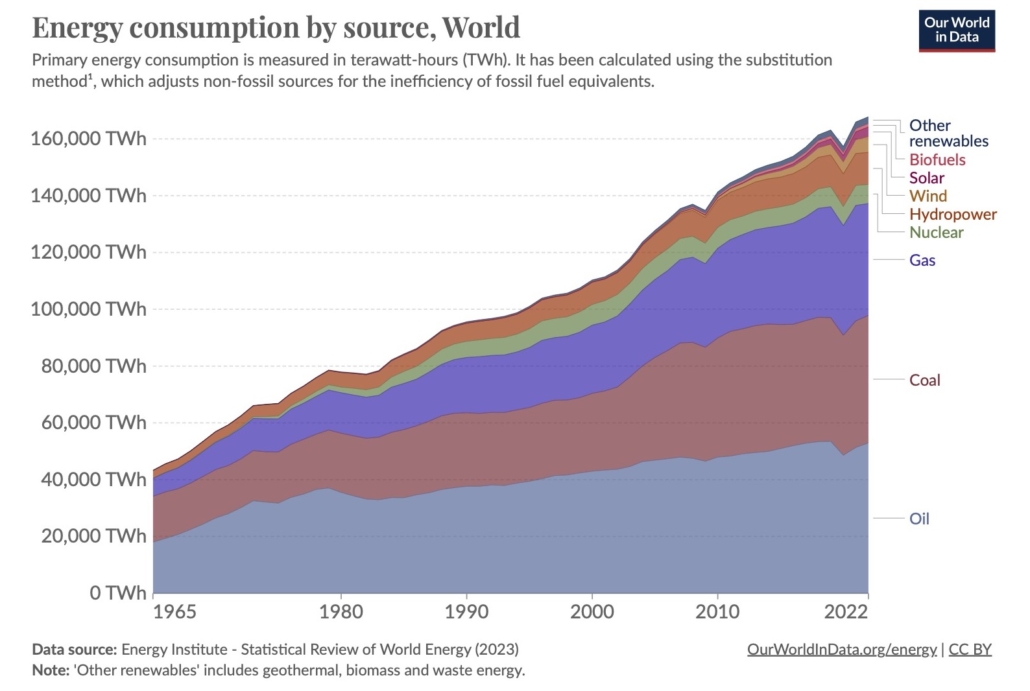

Oil accounts for about 40 percent of total global energy consumption. Given its critical importance to economies worldwide, you’d think estimates of the remaining stocks of oil would be a settled matter. Yet experts have offered a wide range of estimates for decades. Determining the remaining recoverable reserves of countries and of the world is difficult for several reasons.

First is a lack of transparency; producers are reluctant to disclose the extent of their assets, or they wish to exaggerate them for greater global influence. Oil analysts have been suspicious of some producer claims for many years. A recent analysis suggests that OPEC reserves are overstated by 300 Gb (billion barrels), and FSU reserves by 100 Gb. (The reduction in OPEC reserves would align with the long-held theory to explain the “mystery” of sudden reserve additions in the 1980’s—the additions were likely a maneuver to increase export quotas.)

Fossil fuels continue to dwarf renewable sources. (Our World in Data)

Another problem in counting oil reserves results from conflating heavy oils with conventional oil. Heavy oil resources are plentiful, but less economically useful than conventional oil, and extracting them is economically (and environmentally) costly and difficult to scale up. Yet heavy oils are counted in production as though they were equivalent in quality and accessibility to conventional oil. In fact, because they are harder to extract, their “flow rate” is limited and they cannot provide significant spare capacity in times of need.

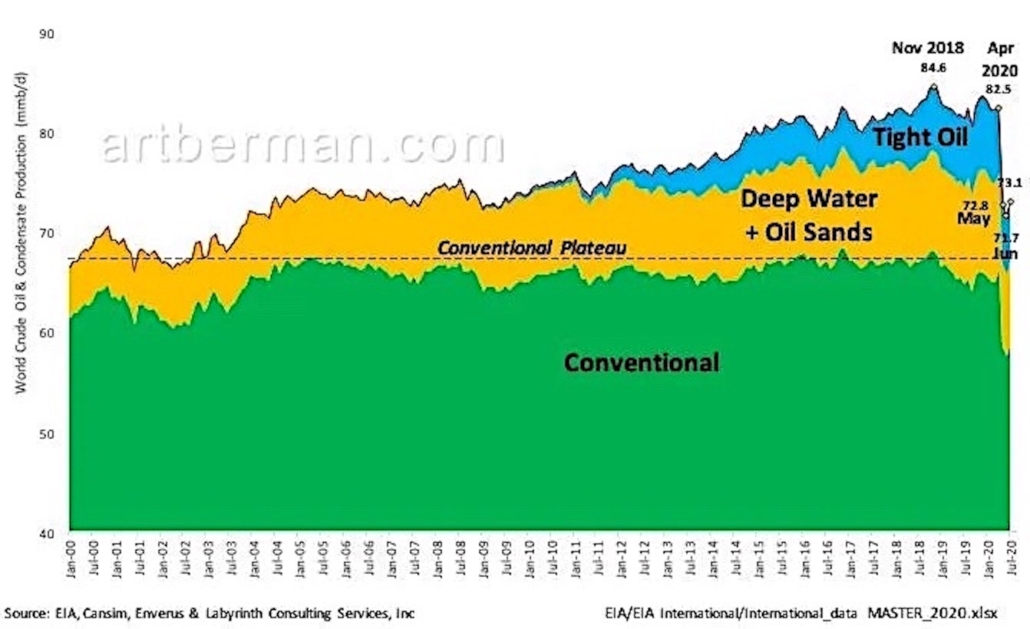

Shale oil also complicates the oil accounting question. The USA is endowed with the best oil shale deposits (for oil production) on the planet and has more than doubled its production over the past ten years. This output has boosted all-liquids fossil fuels production and helps to explain how world demand has been met over the last decade. As seen in the figure, conventional oil has plateaued. Nearly all new additions to consumption have come from U.S. tight (shale) oil.

Shale oil is beset by several problems, however. One is the daunting and capital-intensive nature of the extraction process. Unlike extraction in conventional fields, fracking shale for oil is a constant effort involving drilling down one to three miles, then laterally for miles more before hydraulically fracturing the shale (injecting fluids under tremendous pressure containing large quantities of sand to keep the fractures open), and finally, pumping the liberated oil out of the deposit. This must be done continually to exploit a field.

A second problem with shale is the nature of the “oil” produced. Analysis by petroleum geologist Art Berman indicates that fully 30 percent of reported oil production in the USA, much of it from shale, is natural gas liquids—light hydrocarbons that have significantly less energy content than conventional crude. The light grade of oil is not suitable for heavy transport that relies on diesel. So, much of the fracked shale oil produced by the USA cannot be used in the country and must be exported, so it does not contribute to U.S. energy supplies.

Growth in U.S. oil production since around 2005 has come from hard-to-get sources (blue and yellow). (Art Berman).

The other problem for shale is the spectacular decline rate of a typical well. A conventional well may have a decline rate of 6 percent per year after peaking, but fracked wells plummet dramatically from the start, with a decline rate of 60 percent in the first year and 25 percent the second.

This means that companies need to drill new wells continually just to maintain production at a constant level. This is “The Red Queen” predicament, after Lewis Carroll’s “Through the Looking Glass,” in which the Queen advises Alice to run as fast as possible just to stay in place. It’s a very apt metaphor for fracking.

If world oil demand continues to increase as expected by energy advisory bodies such as the International Energy Agency and the U.S. Energy Information Agency, fracked deposits will have to perform increasingly well in the years to come. Yet production at two of the major oil shale plays—the Eagle Ford in 2013 and the Bakken in 2020—has apparently peaked, leaving only the Permian Basin as a prospect for expansion.

In sum, given the plateauing of conventional oil, the likely exaggeration of some countries’ reserve levels, and the rapid decline of fracking as a strategy for boosting conventional output, a peak in total liquids should be of urgent concern to policymakers and the public.

The Net Energy Cliff

The lengths humans will go to extract oil illustrates its value as an energy source. Gone are the days when an explorer could stick a pipe in the ground and hit a “gusher.” Today we drill miles deep in the ocean, mine dirty oil sands, and crack open deep rock (fracking) to find oil. But these increasingly extreme measures themselves require increasing inputs of energy.

This raises a key question: How much energy is being expended to get various forms of energy? What is the energy cost of energy production? Analysts studying the question developed the concept of “energy return on energy invested,” or EROEI, to answer this question. The measure expresses the energy in the extracted resource compared to the energy cost of its exploration and development.

The Net Energy Cliff. (Adapted from Wikipedia)

For example, extraction of 50 units of energy in oil (as in historic oil and gas fields) may require one unit of energy, for an EROEI of 50 to 1. But over time, as oil extraction requires increasing effort, oil’s EROEI might fall to 30 to 1, then 15 to 1. Declining EROI is precisely what characterizes the current state of fossil hydrocarbon extraction, as the graphic shows.

The implications are staggering. A declining EROEI reveals that extraction of energy will be increasingly expensive and eventually, cost-prohibitive. Hydrocarbons will still be in the ground, but the costs of their extraction will continue to climb. This also means that, barring the development of some new type of energy source, society will have to adapt to a much lower energy future. And it suggests that the monetary costs of extraction will erode GDP growth and eventually cap economic expansion.

Action is Needed Now

In 2005, just a few years before the rising price of oil triggered the 2008 economic crisis, the U.S. Department of Energy commissioned a report from the think tank SAIC titled “Peaking of World Oil Production: Impacts, Mitigation and Risk Management.” It’s clear from interviews that the authors were shocked by the implications of soon-to-arrive global Peak Oil, which they termed “an unprecedented risk management problem.” Analyzing the supply and demand side of the oil scarcity challenge, they concluded that at least a decade, and more likely two, would be needed to prepare for Peak Oil and prevent social and economic upheaval.

The report garnered a great deal of attention at the time, as did other warnings of energy limits. But the subsequent “shale revolution” changed everything. Instead of being recognized as a last domain of exploration and recovery, the media framed shale and fracking as an energy elixir. The intervening years have not produced the preparatory planning that Hirsch warned should occur.

Perhaps a peak visible on the horizon will draw attention to the predicament we are in: Perpetual economic growth cannot be reconciled with energy limits. The longer we wait to act, the higher the cliff, the more painful the landing, and the more difficult the transition to a steady state economy. Some local communities have been planning for energy scarcity, and I will share their work of conservation and adaptation in a future post.

Dave Rollo is a Policy Specialist at CASSE.

The world oil clock says we have 47 years of oil left.

I want to meet just one actual working politician who will tell their constituents this.

Hi John!

It’s a controversial message, especially for politicians who are just looking to the next election. But, as a city council member I found support for a resolution, and the creation of a task force that examined the problem back in 2008 (https://bloomington.in.gov/boards/peak-oil). We were wrong on determining the date, as were many of those warning of the impending peak at that time. Better to understand that, regardless of the date of maximum QUANTITY extracted per unit time (that will come, as any finite resource that isn’t replenished does), it is necessary to understand that energy QUALITY determines net energy availability, as represented by the net energy cliff..

Thank you for a very informative article. As the extraction costs dramatically increase, I imagine that the oil company lobbies will probably get the government to subsidize those costs, at our expense.

As cynical as this sounds, it is also alas probably the most likely outcome, at least in part. I think we can expect extreme levels of lobbying. I am crossing my fingers and hoping that enough of the younger generation is in power by then to hold off these efforts. One thing I am struck by among my 20-something daughter’s social circle is that even nominally “conservative” individuals seem to have accepted that we have to transition away from fossil fuels.

Thank you, Mark. I fear that you are correct. And there are many subsidies already occurring.

These include direct subsidies, hidden “subsidies” of granting leases, and externalization of costs of environmental damage. There were also advantages of ultra-low interest rates, which helped the fracking companies in the very capital-intensive phases of their operations.

As we proceed down the energy slope, a likely outcome is greater direct subsidies to try to offset the costs. But public investment would be better spent in adaptation to a lower energy world and ultimately to a world of limits.

Is that not already happening John? I suspect that heavy subsidies have already been in play since the fracking boom started post financial crisis. Oil companies consolidating too, in buy outs in recent months. I think its all linked. The debt bubble has continued to grow telling me that surplus energy is at an end and has been for a while. Plus energy concentrates have swayed to different economies too, India, China, so that only deepens the competition for cheap fuels and resources around the world, also takes shares away right. With that in mind, recent middle eastern and Russian border issues seem likely to be linked to securing resources in the future for waning western economies. There is only one plan for governments, economic growth, no plan B, other than to secure what is left. What’s next isn’t going to be pretty.

Back about 2006, (a) on an extracurricular basis aside from my (Texas Legislature) job while the ASPO-USA organization was in existence, (b) before fracking really got going, and (c) and while I was more active on the peak oil issue (e.g., an online webliography on the 50th anniversary of M. King Hubbert’s 1956 presentation in San Antonio), I came up with a mental numeracy exercise which at least to my own mind had value in distilling the 21st century U.S. and civilizational situation as regards the origin, trending, and destiny of the substantial oil portion of our homo sapiens energy supply.

At the time, if not also now, a rather high figure for the original bounty of estimated ultimately recoverable (EUR) world oil was about 3 trillion barrels. So 3 X 10 to the 12th. The preponderance of this was laid down, bio-geologically in certain spurts, over a ballpark (to be imprecise but to simplify the math) of 300 million years. So 3 X 10 to the 8th. Dividing, this averaged out at 1 X 10 to the 4th, or about 10,000 barrels of creation per year. Yet in 2006, the world was extracting and consuming about 30 billion barrels per year. So 3 X 10 to the 10th. Again dividing produced 3 X 10 to the 6th, such that we were extracting and consuming it 3 million times (3 X 10 to the 6th) faster than the average rate at which it was created. Hopefully, I have that correct within an order of magnitude or two, but, even if off somewhat, it pretty much nails down that this particular energy bonanza cannot last at the level it’s been lasting so far. Yet few Americans, or their talking heads or pols, have appropriate appreciation. Rather, a preference is to be (and think) wordy, rather than numbery. And then wordiness is a Tinker Bell dust sprinkle by which to fly off pseudo-easily, unsophisticatedly, into imaginary futures of coping with the inevitable depletion. Such imagination is filled with a lot of “will” and “can” words that have a poor match to plausibility or likelihood.

Oh man, so true – “wordy” and not “numbery”. It’s a disease at epidemic levels in public discourse in the US and even elsewhere.

The only (partial) cure I’ve found for this is to encourage or politely ask for talking points to be written down, such as on a whiteboard. When one asks someone who’s waving their hands and using crude rhetorical devices such as a loud voice, facial gestures, etc. to capture their input as a brief phrase that can be written down, that seems to help steer a discussion toward reality. I wish I could say it always works – it can’t – but it can help.

Thank you, Chris, for offering your estimation of the rate of use relative to oil creation. Numeracy is essential for appreciating our situation. Magical thinking is dangerous, especially when it determines the future of humanity.

Oil is incredibly energy dense; a single barrel yields the energy equivalency of over 12 years of human labor. And, of course, it is finite in quantity. A growing economy relies on more energy, and there is a peak of extraction on the horizon, in terms of both volume of oil and its net energy. If just those fundamentals were understood by our leaders then there would be a sea-change in policy.

Spot on, Dave. The same thing (more or less) is happening with minerals. The low-hanging fruit is pretty much gone. See Simon Michaux’s “Minerals and Materials Blindness”, an interview by Nate Hagens on YouTube. The shortfall of affordable fossil energy and minerals for renewables is fast approaching. Plus, as William E. Rees and many others have stated: we’re already in eco-overshoot.

It’s obvious what must be done: plan for transition to a low-energy use society. Economic throughput has to be reduced. The death of infinite economic growth is a 99.999% certainty. Politicians must take their heads out of the sand. If they don’t (which is likely), then Nature will teach us a hard lesson.

Finally, we’re facing other crises as well: soil degradation & loss, fresh water availability, biodiversity loss, toxic pollution, overpopulation, ecosystem damage/destruction, social atomization, and more. It’s time for all of us to step up to the plate. If we don’t, my grandkids are facing a tough row to hoe.

Thanks for your timely article. Great job.

p.s. As well as with Simon Michaux, Nate Hagens also has an interview with Art Berman on YouTube.

Thank you, Scott. Yes, to all you have said! And, much of the extraction and damage of finite resources grows – and is “demanded” to grow every year in a growth economy.

Dave, that’s a great article. It will be interesting to watch how oil use pans out when it becomes more scarce and expensive. Private jets and superyachts will undoubtedly still afford that price while the hard landing for growth impacts the less fortunate. My fear is that without systemic economic change growth will find a way. Alternative energy sources may come online with green growth maybe protecting the climate while continuous growth erodes the environment in all the other ways https://www.independent.co.uk/tech/nuclear-fusion-breakthrough-clean-energy-b2467638.html

In a scenario whereby individuals can build, and display their personal reputations to one another (when they consume responsibly while supporting systemic change onto a not for profit business economy) – the plant and its people can relax.

As you note, other sources of energy may appear, but scaling and commercial application are problems to reckon with. But, in any case, we would arrive at other limits, and they will not permit infinite growth on a finite world.

Recognizing limits certainly has implications for fair distribution of finite resources. The disparity between the top 1% and those that can barely afford the means to eat is unsustainable as well as immoral. Recognizing limits brings into focus this disparity, as the rising tide of growth is no longer available to lift all boats.

A modest lifestyle with low material consumption may well be popularly regarded as ideal, and I think achievable, as long as basic needs are met.

planet, lol

Love you all , regardless our sinking ship .

Hi Erika.

I am certain that the growth economy is doomed. But there are no inherent reasons why humans cannot make a shift in their thinking regarding earth’s limits, and plan accordingly. It would be naïve to think that it would occur without difficulty, but change can come quickly, and the sooner our assumptions about endless growth change, the better the outcome will be.

I think this post is incomplete because it does not include renewable energy, particularly solar and wind, for which the resource itself is virtually inexhaustible. The transition to a primarily renewable-supported economy is well underway, with major investments now occurring in technologies that promise to replace the last bastions of oil and gas use (by, say, 2050). However, I recall from Peak Oil discussions 15-20 years ago, the EREOI of solar and wind is relatively low. At the very least, this narrative must incorporate the potential for renewables to maintain the economy. I wholeheartedly agree that sustainability demands abandonment of a perpetually growing economy. Decarbonizing the economy (and dematerializing it–i.e., the circular economy) are necessary to address the climate change and biodiversity crises, but as long as we insist that growing the economy in already wealthy countries, they will be insufficient.