Limits to Wealth = Limits to Growth

by Daniel Wortel-London

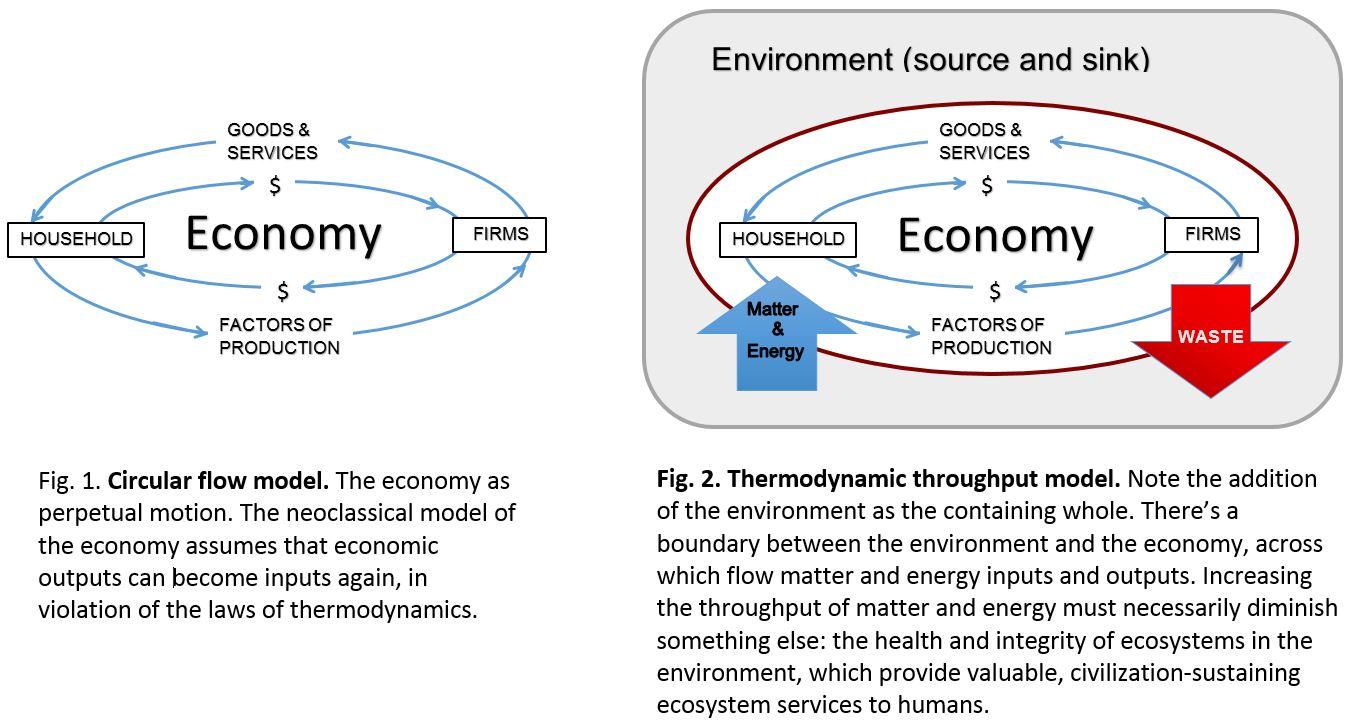

Inequality threatens people and planet alike. Billions struggle to make ends meet while a tiny minority grows fabulously wealthy. At the same time, the conspicuous consumption of the wealthy and the waste they generate takes an enormous environmental toll. The intertwining of social and environmental damage suggests that standard fixes for inequality are inadequate.

Herman Daly thought that waste from the wealthy could not be ended through redistributive taxation alone. Only by “pre-distribution,” that is, by preventing wealth from inordinately accumulating in the first place, can we rein in the pollution and power of the wealthiest one percent.

CASSE has set an ambitious goal of advancing policy in this area as part of its Steady State Economy Act project. The project charts a new legislative path for economic policy in the USA. Its first product is the “Forty-to-One Act,” which is designed to set income boundaries in the USA.

Yachts like this emit as much carbon as the daily activities of thousands of the world’s poorest people. (Petr Kratochvil, Public Domain)

In Beyond Growth, Herman Daly observed that because there is “a limit to the total material production that the ecosystem can support,” it would be “unjust for 99 percent of the limited total product to go to only one person.”[1] Between 1990 and 2015 the richest one percent of the world’s population was responsible for more than twice as much carbon pollution as the poorest half. Such excesses threaten the regenerative and assimilative capacities of ecosystems. Moreover, the investments and consumption patterns of the rich have ripple effects, as polluting industries cater to the wealthy’s whims and ordinary people mirror the wasteful habits of the one percent.

Excessive CEO compensation further fuels this inequality. While the typical worker’s compensation grew by about 10 percent between 1978 and 2015, CEO compensation increased more than 940 percent during the same period. Exorbitant executive pay not only fuels (literally) the consumption habits of the wealthy; it gives them the incentives and financial power to prevent the reforms needed to transition to a steady state economy.

New Approaches Needed

The traditional remedy for inequality—skimming the surface off accumulated wealth via taxation—isn’t up to the task of reining in the excesses of the one percent. The reason is simple: Progressive taxation is applied only after wealth has accumulated. By the time tax season creeps around, the damage to the environment wrought by the wasteful investments and spending of the wealthiest has been done.

Moreover, building a revenue system around concentrations of wealth makes the country fiscally—and hence, politically—dependent on the rich. Leaving individuals “too rich to fail” gives them outsized political influence and leaves the revenue system vulnerable to reductions in tax rates when the political moment is right. This is exactly what happened in the 20th century: Through ceaseless lobbying by the wealthy, the tax rate of the top income tax bracket in the USA fell from 91 percent in 1963 to 39.6 percent today.[2]

A more efficient solution is to prevent grotesque wealth accumulation in the first place. In Beyond Growth, Herman Daly called for a “maximum personal income” ratio of 10 to 1 between the highest and lowest income earners, and a growing number of policymakers are taking up the cause today. In 2013, Swiss progressives succeeded in placing before the public a bill to cap executive incomes. Major candidates in France and England have endorsed similar salary caps.

Salary caps already exist in professional sports.

Campaigns for income caps have a long history in the USA, too. Huey Long’s “Share our Wealth” campaign won millions of supporters in the 1930s. Franklin Roosevelt’s called for a 100 percent marginal tax on high incomes during World War II. More recently, Bernie Sanders has called to tax billionaires out of existence. (“People can make it on $999 million,” he quipped.) And salary caps have a long history in professional sports.

Capping income on a national level, however, is easier said than done. There is a question of what instruments to use. Should salaries over a certain limit be taxed away or simply prohibited? Should caps be placed on individuals, or on firms—and which ones? What about sectoral specificity (as Brian Czech proposed in Supply Shock), with different caps for barbers and doctors?

And how do we define “wage?” Should the term include only paychecks, or other income streams from rents and royalties? What about wealth from investments and assets? And perhaps most vexing, how do we define “maximum”?

Designing the Instrument

To start, we should recognize that defining “maximum” is a somewhat arbitrary exercise. A highway speed limit of 64 or 66, after all, would be generally as effective as a limit of 65. Nonetheless, we have evidence that speeds set too high or low are dangerous. In the same way, we can set our income limit at a certain level and adjust it as the evidence warrants.

For the “Forty-to-One Act” I define “maximum” as a multiple of a smaller unit of income. While some scholars call for calculating the maximum level as a multiple of the nation’s median household income, I define it as a multiple of the federal minimum wage: $15,000. In this way we can set clear minimum and maximum levels of income based on existing income-related statutes.

The threshold level to enter the top one percent today is around $597,815, so that is the maximum income in my plan. Given the minimum wage of $15,000, the ratio of the wealthiest one percent’s income to that of the poorest is about 40 to 1. Hence, the “Forty-to-One Act,” in reference to the legislation’s purpose of capping wealth inequality at this ratio.

Franklin Roosevelt called for a 100% marginal tax on high incomes for the sake of national defense.(DVIDS)

How should an income cap be designed? A variety of approaches are at our disposal. Some call for a cap on executive pay in all publicly traded companies. Others seek an end to all subsidies and tax exemptions for businesses that have dramatically unequal pay ratios. Yet others, like Marxists and Georgists, seek community ownership of land and enterprises to prevent profits and rents from flowing only to a few wealthy owners. And still others propose taxes on wealth itself—stocks, yachts, paintings, and other assets—rather than on incomes alone.

For now, the “Forty-to-One Act” is centered around the government’s most powerful existing tools for limiting incomes: the personal income tax and government procurement powers.

The Bill

The “Forty-to-One Act” will amend the Internal Revenue Code by taxing at 100 percent incomes in excess of $600,000—roughly the income threshold for the one percent, remember—of married individuals filing joint returns, heads of households, and unmarried individuals. Married individuals filing separate returns would each be taxed at 100 percent on incomes over $300,000.

One benefit of the bill is to link the fortunes of the wealthy and the poorest people in a positive rather than oppositional way. Once signed into law, the new policy would give the one percent an incentive to persuade policymakers to raise the minimum wage because it would raise the maximum ceiling. In this way, rising living standards for the poor would create rising living standards for the wealthy—the opposite outcome of today. To prevent these rising standards from transgressing earth’s carrying capacity, of course, the “Forty-to-One Act” must be complemented by other Steady State policies.

No excuse for poverty in a wealthy nation. (Wallpaperflare.com)

The “Forty-to-One Act” also amends the Fair Labor Standards Act of 1938 by adding a new section, “Maximum Wage on Federal Contracts.” Any employer providing services to the U.S. government, or any subcontract thereunder, would be required to limit compensation of its highest-paid executive to no more than 40 times the salary of its lowest-paid employee, the same maximum-minimum ratio described above in the revision of 26 U.S.C. 1 et seq. Such a bill helps leverage Federal purchasing power towards ensuring a broader salary cap in the USA. It also has the added benefit of giving cooperatives and social enterprises a leg up when competing for government contracts.

In the future CASSE will expand on this bill by exploring further instruments to tax large corporations, excessive executive severance and bonus packages, and other forms of wealth. For now, we look forward to hearing from you on how the “Forty-to-One Act” can be further developed and refined.

Back from the Brink

To be clear, this bill will not establish a steady state economy single-handedly. Social equity alone is no guarantee humanity will stay within the earth’s carrying capacity. Without reform of other elements of our economy (as intended in the broader Full and Sustainable Employment Act, aka Steady State Economy Act),”uneconomic” growth will continue even after a wealth cap is adopted. Still, capping wealth will slow our rush to the ecological cliff. If the conspicuous consumption of the one percent helped lead us to the brink, perhaps their conscribed consumption can help edge us back.

Daniel Wortel-London is CASSE’s Policy Specialist.

Notes:

[1] Herman E. Daly, Beyond Growth : The Economics of Sustainable Development. (Boston: Beacon Press, 1996), 202-203.

[2] Sam Pizzigati, The Case for a Minimum Wage (Cambridge: Polity Press, 2018), 38.

How about several means for “leveling”: 1) progressive income taxes–they worked well as levelers until the trillion dollar cuts by Reagan, Bush, and Trump. 2) Wealth taxes–we have real estate property taxes. A Tobin tax on stock transactions? Other wealth taxes.3) Maybe a cap related to the lowest pay could work. And leveling comes importantly on the spending side–free college educations, government single payer health insurance.

I love the 40 to 1 act. Even alone, it would be a formidable change and there’s a lot to be said for keeping it simple. But Max’s additions all make sense. I mention just two of them because I have direct experience. In my writing I have argued that single-payer is a Steady State policy. I live in a mainly single-payer system where the incentive is to degrow. My doctor does not even have a medical secretary. He just swipes my card. An entire medical growth industry is thus eliminated. And the system pays for itself by practicing more prevention and less intervention, a type of degrowth. Max also mentions the Tobin tax. Much wealth is in the financial markets. A two penny tax on all financial market transactions (there are billions of them) would fairly redistribute wealth. The organization I work with in France was founded on this concept, though Mr Tobin disavowed us. At one point we had so much support that the right-wing Sarkozy government supported it, but it got shot down by the European Union.

Hi Max,

Thank you for your comment! I definitely hope to build on progressive income taxes by developing legislation around wealth taxes, universal basic income, and universal basic services like free college education and health insurance. Stay tuned!

Sincerely,

Daniel Wortel-London

Max, the concept and policy to cap incomes has merit. However, the opposition would be almost if not impossible to counter. Money, in the form of income is considered the very means to gain freedom. Financial empowerment is literally the game that we are all playing, not only the uber-rich. I’ve tried to not to play too aggressively or competitively, but, nonetheless, I was and am still forced to play it. We need to change that game and this means we need to understand the ethos behind it. And, no, it is not greed that so many people, otherwise thoughtful folks like to use.

That said, the very first thing we need to understand is that money is not wealth and so taxing money as income distracts us from the real source of wealth, human labor and natural resources plus energy. Brian proposes that money is founded and ultimately backed by land. I agree. But, I would define this “land” and flesh it out. Land comes in two basic forms: geo-mass and biomass; what integrates them is energy flow. Human wealth is the combination of land and human labor which includes all the various skills, knowledge, creative imagination and so forth applied to produce products and services that we then consume. Money is the not simple medium of exchange used by so-called “free”, rational human beings( homo economicus). Rather, I’ve discovered that it’s use in commodity markets embodies the, de facto, political system we have or what we could call late stage “capitalism”; in other words a “radical plutocracy” where everyone is invited to participate in competitive and at odd times a co-operative manner.

What we need are viable policies that we would reawaken our social, communal instincts. It is not technological reform, consumption reform, monetary or financial reform that we need, but rather the way more difficult, political reform. The “40-to-One-Act” I would support, it has the merit of being more palatable than the “10-one” proposal. But these are ways to transition on the way.

I feel the “taking away” of money from the wealthy will always lead to failure as it can be considered an act of aggression, which will be responded to in like manner. A more appropriate mechanism to prevent overconsumption and inequality I feel is to redefine the actual power of money itself via regulation. This would require more global economic integration and reduction of corruption around the globe. Just a thought, but I’m loving the comments here, even more so than the article. I also feel the inequality we see may be a symptom of a larger problem, and not the problem itself, I think it’s important to focus on the bigger issue of having an economy that is actually connected to our ecological system.

Hi Saam,

Thank you for your comment!

I certainly believe that the actual power of money needs to be redefined though that will probably run afoul of certain interests as well. Out of curiosity, how do you see economic integration redefining that power?

Also, as I say in the piece, inequality is not the whole story: but addressing it is an important means of getting us to a steady state economy. But I’m interested in how you see inequality as a symptom of something else: what do you see inequality as a symptom of?

I like the 40 to one idea. It’s way out generous enough for any ambitious starter outer, it also will flatten out the top of the desire mountain. People strive to get what they see others having. Less private jets and superyachts. Above a certain level wealth adds little marginal luxury, Wealth gathering then more a power and status building game. Alternative power and status plays can then come in to effect, as the talented switch their objectives

eg, The ceos of commonly owned cooperatives, competing to provide a sustainable planet will hold the ultimate status.

Great article, I am in general agreement with steady-state economics, using real value for biological assets, and for using a rate between lowest and highest wage earners. However, I see a couple of issues in your 40-1 proposal immediately. I agree with Herman Daly, to be fair I think it should be closer to 10-1. In your example, a family max annual income is $597,815, which if you divide by 40 is a max family income of $14,945, which is $1,245/month. I’m assuming you are referring to the US. Where in the US can a family live on an income like this? For a single earner max would be $7,500 annually in your scheme. Over time this would simply perpetuate and exacerbate the current wealth disparity. I would think the 10-1 scheme proposed by Daly would be more fair, but starting at the bottom of say $25/hr, or $52,000/yr for an individual in the US, which would make the cap $520,000.

But there is a much greater issue, accumulated wealth will stop any such idea (the 40-1 as proposed would be more likely to pass but wouldn’t help much if not make things worse). I know our capitalism ingrained brains probably can’t handle this, but unless and until the wealth gap is reduced, the majority of us will never have the power to change the status quo, unless we start and finish successful revolutions in all of our countries, then what? We must have a wealth cap, I’m suggesting in the range of $5-10 million per person or family. I just retired after a 50 year career and am living on my savings. I am not rich, but nor am I desperately poor (although I have been during parts of my life). With $2mil in real estate and $3mil in savings at 5% interest I could have a nice tidy $150k/yr income and still leave all $5 mil to my wife and son upon my death. This is not my situation, but the point is $5mil is more than enough to handle our retirements and why would anyone need more than this?