Fair Incomes for a Healthy Future: The Sustainable Salaries Act

by Ashfia Khan

Unsustainable salaries lead to unsustainable consumption. (CC0, Roman Boed)

To achieve sustainability in the USA and generally, it is crucial that we narrow the income gap between the highest and lowest earners. An equitable distribution of income is a prerequisite of social and environmental sustainability. It’s not just about sustainability, either—it’s about fairness, too.

People tend to be happier and healthier in societies where there is a more equitable distribution of wealth, as well as more likely to receive higher education and have a longer life expectancy.[i] Among the G7 countries, the USA ranks highest in income inequality, and the wealth gap more than doubled between 1989 and 2016 and continues to widen. The more the income gap widens, the worse it gets for economic mobility.

Sometimes called the “Great Gatsby Curve” by economists, the relationship between income equality and mobility is such that children from lower-income families will be far less likely to improve their economic status compared to their parents. It simply seems unfair that so little of the USA’s population controls so much of its wealth while 20 percent of Americans are unable to even pay their monthly bills and give their children the opportunity for a better future.

Income Inequality and Its Negative Effects

Domestic and international researchers have explored the effects of income inequality through the Gini coefficient. The Gini coefficient ranges from 0 to 1, where 0 represents perfect equality and 1 represents perfect inequality. In other words, when the coefficient is 0, everyone receives an equal share; when the coefficient is at 1, only one group or individual gets everything.

The Gini coefficient is not a perfect indicator, as it depends on every country having reliable income data and doesn’t measure informal economic activity. However, it does provide useful insights for how income inequality effects people’s wellbeing. For example, one researcher compared infant mortality rates in the USA by mapping CDC data against the Gini Index and found that as income inequality increased, so did infant mortality.[ii] Researchers also found that U.S. teenagers living in states with higher levels of inequality are more likely to become pregnant than those living in states with a low level of inequality.[iii]

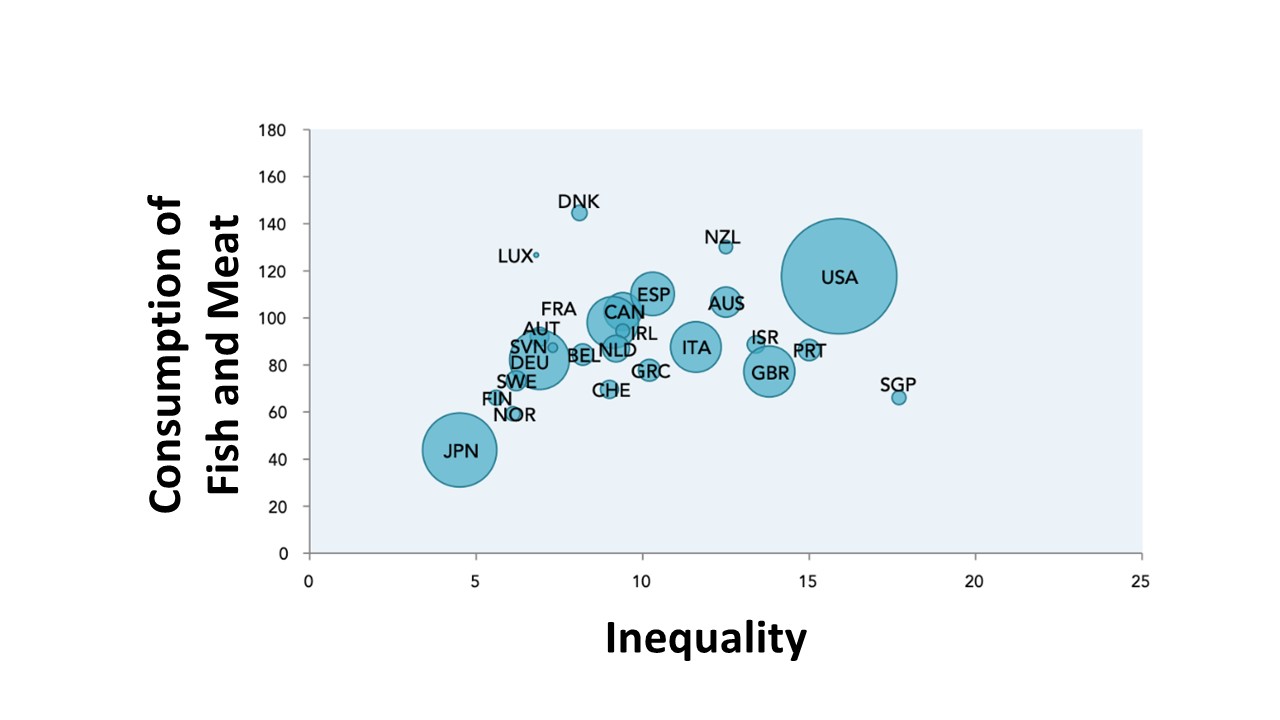

Inequality and consumption of fish and meat across countries, 2002-2007. Note: Circle size corresponds to the size of a country’s population.[ix]

Gini coefficients have also been analyzed with data from the U.N. Human Development Indicators, revealing that Japan has the lowest Gini coefficient (lowest inequality) and the U.S. has the highest, and that there is a significant relationship between inequality and obesity.[iv]

The pervasive reach of income inequality extends beyond societal impacts. Researchers have also discovered strong threats to the environment and sustainability. While many of the causes of biodiversity loss, such as habitat loss and climate change, are more directly causal, some studies have explored the relationship between income inequality and biodiversity loss. Even after controlling for factors like biophysical conditions, human population size, and per capita GDP and income, researchers found that as the Gini coefficient increased, so did the indicators of biodiversity loss.[v] This pattern remained the same whether compared across countries or U.S. states. The researchers noted that correlation does not equate to causality, but they postulated a strong likelihood of causality in this case.

It doesn’t end at biodiversity loss either. One researcher found that there was a consistent trend, at least among wealthy countries, whereby those with higher inequality consumed more resources and generated more waste.[vi] U.S. water consumption per capita is more than twice that of Japan. In Japan, the top 10 percent of the population has an income 4.5 times that of the bottom 10 percent. In the U.S., the top 10 percent earns 16 times that of the lowest. Similarly, in New Zealand, where the top 10 percent earn 12.5 times as much, the per capita annual consumption of fish and meat is close to three times as much as that of Japan.

This same pattern is reflected in how much per capita annual waste countries generate. Sweden, which has a relatively low ratio of income inequality, generates 513kg of waste annually. Switzerland, with an income inequality ratio of 9, generates 728kg, and Singapore, where the top 10% earns 18 times as much as the bottom 10%, generates a whopping 1072kg.[vii]

Salary Caps

One proposed solution to narrow the income gap is to implement a salary cap, which could also be considered a 100 percent tax rate beyond a certain salary. The tax revenue may be repurposed to serve the public good.

Salary caps have been kicked around the policy arena as early as 1933, when members of the House of Representatives were introducing amendments to limit annual incomes to $1 million. In 1942, Franklin Roosevelt proposed that annual incomes should be capped at $25,000 (which would translate to $375,000 today). These proposals were never legislated, but academics and policymakers have explored the concept with increasing interest and support.

The NFL and NBA, among other athletic organizations, have famously adopted salary caps. Since 1994, the NFL has enforced both a salary floor and cap for its athletes and teams. These minima and maxima are readjusted after annual reviews. Sports teams have found that leveling the playing field not only makes for a more egalitarian league, but it also makes the performance more engaging for their audience as well.[viii]

It would hardly make sense, though, to set one overarching salary limit across all industries and occupations. Some industries require higher levels of education and more skilled qualifications. Industries that require specialized education and experience will have less competition than other industries and may garner greater profits. Holding industries with a huge disparity in profit margins to the same salary cap doesn’t seem feasible. If set too low, the political prospects for establishing the cap would be nil. If set too high, it would lose effectiveness.

In Supply Shock: Economic Growth at the Crossroads and the Steady State Solution, Brian Czech proffers “sectoral salary caps” of fifteen times the lowest in-sector salary or wage, calling this a common-sense starting point for feasible policy negotiations. Using the example of a barber in Pulaski, Tennessee versus a barber in New York City, it makes sense that the New York barber could, would, and should charge more for a haircut. For producing what would be a $15 haircut in Pulaski, the New York barber may receive up to $450. A $450 haircut is hardly a glowing example of sustainability, yet it’s not a $1,000 haircut, which would be wantonly wasteful by almost anyone’s standards. The cap, then, would move us in the direction of sustainable consumption.

The Sustainable Salaries Act

The NFL is no paragon of sustainability, but has implemented salary caps since 1994. (In the case of the Green Bay Packers, shown above, the team is community-owned as well). (CC BY-SA 2.0, Mike Morbeck)

Consistent with Czech’s sectoral salary-capping proposal, I propose a “Sustainable Salaries Act.” The legislation may be included in CASSE’s broader Full and Sustainable Employment Act. Alternatively, it may be introduced as an independent bill.

The Sustainable Salaries Act would prohibit top employees in most industries from making more than fifteen times as much as the lowest-paid employees. Somewhat lower proportional caps would apply to sectors known for inequitable business practices or the production of non-essential goods and services.

The bureaucracy entailed may not be as onerous as some would suspect. Companies already report their employees’ salaries and wages to the IRS. Pursuant to the Sustainable Salaries Act, the IRS will compile this information and submit it to the U.S. Department of Labor. If a company violates the act, it will face criminal penalties and fines in proportion to excess salaries, and CEOs may even face jail time in egregious cases.

The following is a conceivable Section 3 (Declarations) of the Sustainable Salaries Act. This should give readers a better sense of how the law would function and provide a starting point for conversation on sectoral salary capping. As the act is further developed, some of the subsections may be broken out into full sections.

Enforcing salary caps pursuant to a Sustainable Salaries Act is just one step toward a steady state economy, but a crucial one. By reducing income inequality, we move closer to not only a more equitable society, but a more sustainable one as well.

Footnotes

[i] According to a study in Italy, where the Gini coefficient was mapped against life expectancy at birth, income inequality was shown to have a significant negative correlation with life expectancy. G.A. Cornia, R. Gnesotto, R. Mistry, R. De Vogli. 2005. Has the relation between income inequality and life expectancy disappeared? Evidence from Italy and top industrialised countries. Journal of Epidemiology and Community Health 59(2):158–162.

[ii] Erwin, P., M. K. Jones, and A. Siddiqi. 2015. Does higher income inequality adversely influence infant mortality rates? Reconciling descriptive patterns and recent research findings. Social Science & Medicine 131:82–88.

[iii] Levine, P.B. and Kearney, M. S. 2012. Why is the teen birth rate in the United States so high and why does it matter? Journal of Economic Perspectives 26(2):141-63.

[iv] Brunner, E., Kelly, S., T. Lobstein, K.E. Pickett, K. E. and R. G. Wilkinson. 2005. Wider income gaps, wider waistbands? An ecological study of obesity and income inequality. Journal of Epidemiology and Community Health 59(8):670-674.

[v] Gonzalez, A. G.M. Mikkelson, and G.D. Peterson. 2007. Economic inequality predicts biodiversity loss. PLOS ONE 2(5):e444.

[vi] Islam, S. “Inequality and Environmental Sustainability.” New York: DESA Working Paper No. 45., 2015.

[vii] Ibid.

[viii] Ibid.

[ix] Vassallo, J. The Advantages of Salary Caps. Houston Chronicle, July 31, 2020.

Ashfia Khan is the Policy Specialist at CASSE, and a former CASSE Legal Intern. She is also pursuing a J.D. at George Washington University.

Ashfia Khan is the Policy Specialist at CASSE, and a former CASSE Legal Intern. She is also pursuing a J.D. at George Washington University.

Creative Commons

Creative Commons

Great article. Too bad Occupy Wall Street did not have any concrete demand, such as a Sustainable Salaries Act. To make this happen, we’ll need Occupy II.

I can’t help but see the Sustainable Salaries Act as nothing more than a band-aid policy for addressing income and wealth inequality. Sure, capping salaries will help to reduce disparities in income but do nothing to address the overarching problem – who owns capital wealth and how likely are those with less income able to acquire said capital wealth.

It’s about shared ownership in the means of production and how profits are distributed among workers that make a real difference in people’s lives. Your policy does nothing to address this or work towards a transition to greater worker ownership of businesses and essential basic needs such as energy, food, clean water, etc. Just look at the growing number of employee owned businesses and worker cooperatives that are taking shape now. It is evident their quality of life has improved since before that transition has occurred. Wealth is the answer not an increase or a cap on income which does not always translate to acquisition of wealth for working classes (e.g. land, ownership of supply chain resources, etc.) since, in the case of Great Britain, 10% of the population own 70% of the land. Do you plan on capping land use and ownership too?

If socio-economic elites as you say, do more to destabilize our planetary systems, but are still the ones who own the means of production with a slap on the wrist when they violate policy, how will we ever reach a steady state economy? It will always be in their best interest to align themselves as a class and use their tyranny of merit to strike down laws or policies such as these. Rinse and repeat over and over again and we are back to where we started.

I do wish the unconditional basic income was on CASSE’s radar. Bud Keller’s comments would be fine it the UBI did not exist, but it would be a caralyst for the necessary policy changes http://www.clivelord.wordpress.com

Sorry Clive, but UBI does nothing to address my comments above.

Again, a band-aid response to quell dissent to real wealth disparity with respect to land, stock, or business ownership, etc. i.e. the means of production. When 84% of stock ownership belongs to the wealthiest 10% of American households, UBI is irrelevant in mitigating the wealth gap. If these very few businesses were structured to share in the net profits through worker ownership, instead of divvied up among shareholders that do no real work, we could really begin to tackle the wealth gap since roughly 39% of American workers work at these enterprises.

But, even a transition to worker ownership of privately held businesses (which is admittedly where most transitions are already taking place) would do even more to reduce the wealth gap since private businesses employ close to 50% of the US workforce.

And, finally, on the topic of racial wealth disparity, where 98% of land in the US is owned by white Americans, UBI is irrelevant in mitigating the wealth gap for people of color.

Yes wealth inequality is the greater inequality, due to accumulation of surplus profits as capital over time. Rather than decide whether to address salary income vs. capital income, both are equally important. Limit only one and the other increases to fill the gap.

Yes, Mike I agree both are important , but not equally.

When businesses are worker owned and democratically controlled (big picture – not day-to-day) the issue of income for various positions in the company are decided by BOD or another body elected by all workers, not by a top down command structure which places decidedly more value on the role of management in the workplace – some of this is justified by the nature of the work, but in some cases not, as seen in nearly all companies today. If an executive at a company can be seen playing golf more than actually working it is hard to justify their need for up to 300% more income than their average worker. And, if we are to cap executive salaries at no more than 15 times that of the lowest paid worker as suggested in the policy, I think this cap on income is better determined at the local level within individual businesses that are worker owned not by federal, state, or local government. It provides people with agency to determine the outcomes of their work, not being regulated from above, which in turn improves their quality of life.

I think a better overall quality of life is what we are after here. I’m in no way stating that worker owned companies are w/o internal struggles. But, they can establish a grievance process they can claim on their own, and not passed down on them from public officials in many cases they did not vote for in a two party system that does not represent their interests. Worker owned companies are “values-driven” and have shown to have more stability, higher survival rates, and less layoffs in the times of recession whereby reducing unemployment over time. I think these facts have been shown to be far more meaningful to people than income caps or higher incomes – while still important but not equally.

Yes, there are many success stories around worker-owned companies, and that is one of the best ways to address inequality issues. I would love to see a calculation of how much money is “wasted” on the wealthy. For example, choose an income threshold at the top of the middle class, sum up all excess income beyond that, then subtract from that any “widely beneficial” uses of that money like charity and some investments (need to exclude hedge funds, stock buy-backs, any expenditures that only benefit the top group). Getting that money back into the “economy for all” would set us on a sustainable path. I wonder what percent of GDP is wasted.

Yes, Mike I would like to know that as well. I welcome exercising that approach. Unfortunately, there is so much opposition in this country to meaningful redistributive income strategies. Both political parties shirk the idea. A trojan horse for socialism we are told. As long as socio-economic elites control the purse strings of government and can influence elections with insurmountable sums of money, we will never get on a sustainable path. Nice dialogue. Thank you.

I think I get the gist of Bud Keller’s point, and can agree. To the extent that *ownership* of income producing assets is equitable, a lot of things tend to fall into place.

The only thing I’ll add is that it’s striking to me to what degree our Western system of laws and governance is optimized to reward ownership over work and creative effort. I guess the landed gentry of past centuries still has a thumb on the scale of justice, even today.

Yes, Cole you are right to question or be speculative about the ownership of income producing assets being equitable across society – they won’t be. But, in the case of worker ownership of said assets, it is far more equitable than what we have today and one of the best ways to make our economy more equitable while improving overall quality of life. It is a system that is likely the most desirable within the context of the competitive market economy – with an emphasis on the accumulation of capital assets for maximizing self interest – we have to operate within.

Further, to your point about emphasis on ownership over work and the laws which protect a landed gentry. Our US constitution protects a right of property not a right to property. I don’t have to remind folks such as yourselves about the finite nature of land or the necessary resources in order to do meaningful work – there is only so much arable, workable land to go around. And, the finite resources we have come to rely on to fuel our way of life, are becoming less accessible or attainable due to a host of ecological limits we are faced with.

Lastly, as I stated in a previous comment, 98% of land in the US is owned by these landed gentry – white, affluent Americans. Where does that leave the millions of people of color or less affluent white folks in our country? How will we ever achieve an equitable society when far fewer people own all the land and most other capital assets, and the sizeable majority does not? What mechanisms will we have to put in place for a more equitable distribution of land, property or other capital assets that is within constitutional law? What if these landed gentry don’t want to sell even if someone has the ability to pay? I think you get my point. No need to beat a dead horse here. Sorry for the cliche’.

Ciao