Sell Your Stocks and Enjoy the Slide

by Brian Czech

I’m sorry if you’re one of the 145 million Americans invested in the stock market, but I actually find it gratifying to see the market sliding. Why shouldn’t I? As a steady stater, I’m firmly against GDP growth in the 21st century. A perpetually growing stock market presupposes a perpetually growing economy. If the market has to decline along with GDP, I’m all for it.

Conversely, it’s safe to say that anyone hoping for an ever-growing stock market is no steady stater. They’re not on the side of people and planet; not really. They’re on the side of their short-term selves, and maybe their immediate families, but not the rest of us, and not the grandkids.

A serious steady stater would probably possess no stocks whatsoever. Yes, arguments get made for “green stocks” such as wind or hydrogen, but ultimately the steady state economy means a stabilized size of economy, whether it’s run on wind, hydrogen, or cow power. If you have disposable income, you can surely think of some steady-state expenditures that don’t reek of pro-growth hypocrisy. Better yet, you can save!

What’s in a Stock Market?

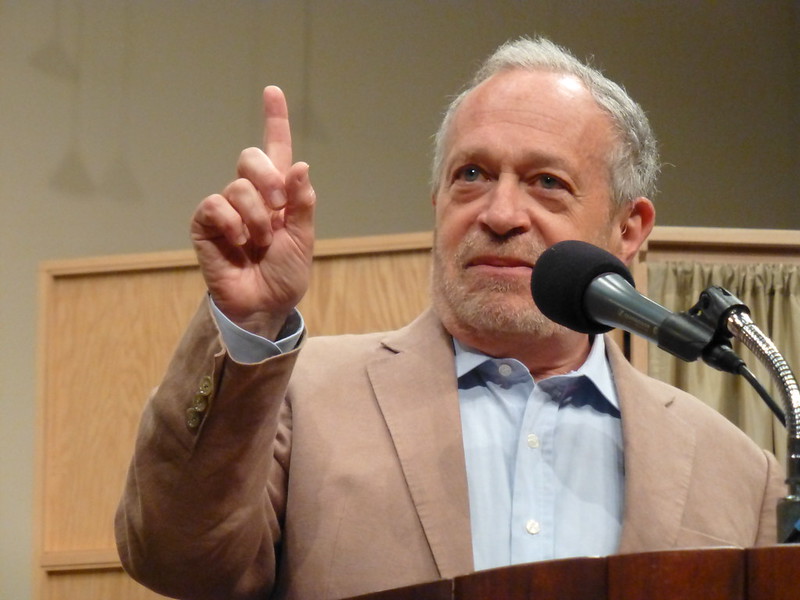

Robert Reich: “Repeat after me, the stock market is not the economy.”

Except it kind of is. (CC BY 2.0, ATIS547)

As Robert Reich would have us repeat, “The stock market is not the economy.” He avers that jobs, wages, and general standards of living have little connection to the market. In terms of its ownership, too, the stock market is hardly representative of the citizenry. While 145 million Americans—56 percent of adults—seems like a lot of investors, most of the “investment” is in the form of retirement accounts containing mutual funds. Only about 14 percent of American families actually invest directly in individual stocks. And, the wealthiest 10 percent own more than 80 percent of the shares.

Shareholding is skewed even more than the general distribution of wealth (including real estate), and far more than the distribution of income. So, Reich’s point is well taken. If the economy is supposed to reflect society at large—rich, poor, and middle-class—then the stock market is not the economy.

On the other hand, let’s not get carried away with nostalgia for Reich or our own wishful thinking. If we’re concerned about people and planet, we have to think twice about the relationship between the stock market and the economy. We’d be way wrong to rationalize, for example, “OK, if the stock market is not the economy, I can invest in it without worrying about my ecological footprint. Limits to growth might apply to the economy, but not to the stock market, which is after all just a measure of expectations, not economic activity per se.”

While the stock market may not be the economy, it certainly represents a lot of our economic activity. Consider the 30 stocks comprising the Dow Jones Industrial Average, the long-serving index of the New York Stock Exchange:

| Dow-Jones Component | Sector (vernacular) | NAICS Best-Fitting Sector* |

| 3M | Chemicals | Manufacturing |

| American Express | Financial services | Finance and Insurance |

| Amgen | Pharmaceutical | Manufacturing |

| Apple | Information | Information |

| Boeing | Aircraft | Manufacturing |

| Caterpillar | Heavy Equipment | Manufacturing |

| Chevron | Energy | Mining, Quarrying, and Oil and Gas Extraction |

| Cisco Systems | Technology | Manufacturing |

| Coca-Cola | Beverage | Manufacturing |

| Disney | Entertainment | Information |

| Dow | Chemicals | Manufacturing |

| Goldman Sachs | Banking | Finance and Insurance |

| Home Depot | Retail | Retail Trade |

| Honeywell | Equipment | Manufacturing |

| IBM | Technology | Information |

| Intelligent | Technology | Manufacturing |

| Johnson & Johnson | Pharmaceutical | Manufacturing |

| JP Morgan Chase | Banking | Finance and Insurance |

| McDonalds | Food services | Accommodation and Food Services |

| Merck | Pharmaceutical | Manufacturing |

| Microsoft | Information | Information |

| Nike | Footwear | Manufacturing |

| Proctor & Gamble | Personal care (products) | Wholesale Trade |

| Salesforce | Software | Information |

| Travelers | Insurance | Finance and Insurance |

| UnitedHealth | Health Insurance | Finance and Insurance |

| Verizon | Telecommunications | Information |

| Visa | Financial services | Finance and Insurance |

| Walgreens | Retail | Retail Trade |

| Walmart | Retail | Retail Trade |

| *NAICS is the North America Industry Classification System, maintained by the U.S. Census Bureau. | ||

Taken one by one or in the aggregate, does anything look sustainable about this who’s who of Wall Street? If anything, it’s a conglomerate with a glaring and growing ecological footprint, with Caterpillar bulldozing the way for the rest of these bellwether corporations. Yet when we study the list, we also find something glaring in its absence.

The absence should be glaring for steady staters, at least, if not for Robert Reich (a progressive but nevertheless neoclassical economist). Can you spot it?

Here’s a hint: How are any of the 30 CEOs, their boards, and their strategists going to eat, and thus continue their plundering growthmanship? Yes, McDonalds is in their midst, but once that last McDouble comes off the McGriddle, they’re in McTrouble, and more than McLittle. They’ve got no farmers, fishers, or growers to keep food on the table!

In this non-Reichian sense, then, the stock market is profoundly not the economy. The real economy starts with agriculture—agriculture and extraction, but most notably agriculture—before anyone goes to work at Apple, Amgen, or American Express. The real economy starts, succeeds, and persists only with enough agricultural surplus to free the people for a division of labor, allowing for the existence of IBM, 3M, and McDonald’s itself. Without that agricultural surplus, the entire economy collapses; real and monetary sectors alike.

So, if we think of “the stock market” as the Dow, it most certainly is not the economy. It’s not the economy for the “Reich reason” (not representing the American public) and it’s not the economy for the structural reason (lacking an agricultural and extractive base). But hang on; there’s more to the story. The verdict isn’t quite in yet on how closely the stock market resembles, reflects, or represents the real economy.

The Dow Is Not the Stock Market

The Dow is not “the” stock market, but rather a stock market index. It’s the leading index, but not the only index. Unless you’re comatose, you can’t get through a week in the USA without hearing about the Nasdaq and S&P 500, too. The Nasdaq represents the technology sector especially, while the S&P 500 is supposed to represent the stock market at large.

All that time and attention spent on mind-numbing, money-grubbing minutiae.

Thank goodness we don’t have to hear about the rest of the approximately 5,000 indices. We have almost as many indices in the USA as there are publicly traded stocks, perhaps even more if we leave out the OTC equities (that is, stocks traded purely over the counter and not via stock exchange).

Globally there are well over 3 million stock indexes, or 70 times the number of publicly traded companies! I’ll opine about the proliferation of such indexes below, but only after we settle this matter of the stock market representing (or not) the real economy.

If we took all the publicly traded corporations in the world—roughly 43,000—and assembled them like pieces of an ecological puzzle, they’d start looking more like the real global economy; that is, the triangular economy building upon the agricultural and extractive sectors at the base. Similarly at the national level, we could use the Wilshire 5000 for a fuller picture of the U.S. economy than we get from the Dow, Nasdaq, or S&P 500. We have agricultural and extractive sectors at the base, heavy manufacturing sectors in the middle, and light manufacturing at the top, with service sectors intertwined throughout, serving the agricultural, extractive, and manufacturing industries in addition to household consumers.

Reich’s particular point about the representation of citizens would still stand, because while Del Monte, Perdue, and Cargill might be there, pumping out the produce and poultry like insults at a political rally, not a single family farm would be in sight, or in mind. Nevertheless, the full suite of NAICS sectors would be represented. In that sense, we might hearken back to another Clintonian confidant, James Carville, and say of the stock market, “It’s the economy, stupid.”

Which brings us back to the incompatibility of stock market investment and serious steady statesmanship.

What Happens When You Purchase Stock

When you purchase stock through an initial public offering, you’re either helping yet another corporation take root, or an existing one expand its operations. It’s that simple. That might have been fine in the early 20th century, but by now, any addition to the bloated economy is like feeding Fat Albert French fries. It’s not healthy—literally—for people or planet.

While the effect isn’t as direct, you encourage the corporation to expand its operations when you purchase “seasoned” (non-initial) shares at the stock exchange, too. Corporations view their share price as a barometer for when to initiate more capital outlay. On the ground, that means more factory floor, offices, utilities, energy consumption, and pollution. Less green space, quietude, biodiversity, resources, clean air, climate stability…all the things we need most at this point in history.

Please don’t cop a plea with the lukewarm alibi, “I’ll do good with my money by investing in sustainable industries.” Steady staters know that sustainability is first and foremost about the size of the economy. The hydrogen French fries may not be as fattening, but Fat Albert needs less fries, period.

Furthermore, the economy grows as an integrated whole, and so does the stock market. If you’re helping one sector, you’re essentially helping them all. You may not be assisting every business competitor when you purchase a particular stock, but you are helping to expand a sector, and therefore the economy at large.

Every stock purchase is an opportunity cost, too. Think of all the bona fide good that could have been done with the trillion dollars poured into stock markets in 2021. Things like infrastructure repair, debt relief, healthcare coverage, and education. It almost makes you want higher taxes—especially capital gains taxes. That’s assuming our elected politicians have meritorious priorities. And there you go: meritorious political campaigns could have been supported instead of more pipelines, power plants, and parking lots.

Stock Market Indices Are Social Indicators, Too

In 1975, global market capitalization (the market value of publicly traded shares) comprised roughly 27 percent of global GDP. It first exceeded GDP in 1999, and by 2020 was 135 percent of GDP, or almost $94 trillion. In the USA alone it was nearly $41 trillion; well over double the American GDP. What does that tell us about American priorities?

Sell your stocks and enjoy the slide! (CC BY-NC-SA 2.0, blanchardjeremy)

Revisiting the proliferation of stock indices and funds, one gets the impression that just about any combination or permutation of stocks could constitute this or that “index,” with more of them arising by the business day. Many if not most of these indices double as investment vehicles in their own right, scarcely distinguishable from mutual funds and exchange-traded funds (ETFs). These “index funds” can only be purchased outside of trading hours though, so in today’s hyperactive markets, ETFs have become all the rage, as they can be traded throughout the day. In the first quarter of 2022, 73 more were added to the New York Stock Exchange alone (one of 60 stock exchanges in the world).

This proliferation of funds, indices, and market cap speaks to the salesmanship and ambition of financial operators, brokerage firms, and (most likely) second comings of Bernie Madoff. It’s also an embarrassment for Homo sapiens, with so many of its members occupying their precious time on such mind-numbing money-grubbing.

Don’t we have better things to do with our time and money than analyzing the markets to death and trying to suck even more money out of an inflated market and money supply?

If you own stock, why not sell it now? Use it to help an ailing loved one, or even an ailing stranger. Boost the campaign of a steady stater. Put it in a trust fund for your kids’ tuition. Protect some land, help Ukraine, and put some smiles on poor kids’ faces. Who knows the benefits you might impart?

One thing is certain: When you sell your stocks, you’ll be helping us all—people and planet—with desperately needed degrowth toward a steady state economy. Then you can stop worrying about the Dow, the Nasdaq, and the rest of the 5,000 boring indices.

Brian Czech is the executive director of CASSE.

Brian Czech is the executive director of CASSE.

Brian needs to caution as well against putting the money you don’t invest in the stock market into savings, if Mr. McKibbin is right ( https://www.newyorker.com/news/daily-comment/could-googles-carbon-emissions-have-effectively-doubled-overnight? ): namely, the bank is just going to invest your savings in… oil companies, etc. The same concern holds for other financial instruments. So lobby for higher taxes, donate to worthy abortion-providing services and environmental groups like CASSE– but not if they pay their top two executives two million dollars (the last time I checked) like the AAAS; check with the Charity Navigator for salaries and administrative expenses.

I agree about the banks and in fact I wrote about that in Supply Shock. A steady-state saver faces logical and ethical challenges, and often with imperfect information. Clearly charity is best if the money is truly disposable. If you need to protect a financial position, certain bonds are better than bank deposits. For example, if you’re a USAID fan you can purchase AID agency bonds. (Most steady staters support some level of growth for poverty-stricken countries; see the CASSE position at https://www.steadystate.org/act/sign-the-position/read-the-position-statement/ ). If you have a substantial chunk and little need for liquidity, land conservation is great. Buy the land and sit on it, and/or grow food.

The journey to degrowth requires a viral mindset shift, its not just dumping shares. Incomes need to be reduced also. Having an income above your needs implies that your economic contribution is surplus to your economic needs. This surplus, like the agricultural surplus, is fuel for economic growth. A move towards more part time working, more time for life and less demand for unfulfilling consumer items needs to be central to a new economic paradigm.

Thank you Conor Desmond for saying so much with so few words: narrative degrowth. I agree with and have abided by the philosophy of your comment. However, what about agricultural surplus? Is it really surplus ;;; that is, can’t it be part of a system that distributes food to regions in need, for example where drought has crushed farmers?

If one has a retirement account with minimum withdrawal restrictions or else pay much higher taxes on total withdrawal, how does one avoid contributing to growth? Does the money market option also contribute to growth?

As usual, Brian, right on the mark. In addition to your piece here, I’ve also posted a link to your journal article, “The Trophic Theory of Money”, on my blog:

https://individualsovereignty.blogspot.com/2022/05/stock-market-101-steady-state-economy.html

Keep on with CASSE’s important work.

Interesting article, Brian. Thanks. I’m in total agreement with the Steady State economic model and the need for radical degrowth. I also agree with the view that agriculture and extractive activity form the basis of any complex social system as you repeatedly and rightly point out. But, I need to point out once again, money is not just a neutral piece of paper, metal, or electronically designated credit or something represented by a stock “index” on some stock exchange. It is THE political organizing instrument that allows us to make decisions giving us, as individuals and small groups perhaps, access to what we need as to products and services. Our economy is structured backwards: it uses our need for those services and products in order to concentrate financial capital to give us power to do and to have access. If we want a workable and sustainable economy, it needs to be Steady State balanced with specific given ecological limitations and also to be politically just. This means we need to construct non-competitive, not for profit, non-commodity market means to give us access to what we all produce co-operatively. We need community based non-competitive credit systems that account for the cooperative effort involved what we produce and as a means to access what we produce equitably. That’s the meaning of Steady State and socially just politics. Otherwise, we will continue to need to generate money competitively and to distribute it competitively which forces us to “grow” the economy and to fight for just access based on whatever criterion fits your fancy.

And likewise, interesting comment Nicholas. Please consider expanding and expounding for the Herald: https://steadystate.org/learn/steady-state-herald-submission-guidelines/ .

I’ll just say here and for now that I’ve never noticed any incongruence between the trophic theory of money and justice-based critiques of our monetary system. (And I don’t think you implied such incongruence.) In my opinion the TTOM and many of the justice-based critiques are entirely complementary, and can readily build off each other, and should.

Plus the policy wonk in me concurs with Herman Daly that the goals of sustainable scale and fair distribution entail distinct policies. Those distinct policies can, however, be bundled in a package such as the Full and Sustainable Employment Act, our primary policy project at CASSE.

Thanks, Brian.

The Steady State economic model along with Herman Daly’s ecological economic model are fundamental to a transitioned economy which is both ecologically sustainable and socially just. All I’m trying to point and, as you rightly say, need to expand and expound upon, is the necessity of looking at and addressing the underlying dominant political structure that we call capitalism. It’s how we organize socially that will determine the extent to which we are capable of reaching balance with the natural world; but this can’t be done without fundamentally addressing the meaning and the praxis of economic/political equity. Our current market system will not allow us to do this, I’m afraid, and tinkering with it won’t work in the long run. But, political activism aim at overthrowing it won’t work either.

What we need is to go to the very roots of our how we provision ourselves and build economic-political structures at the local levels that use non-competitive, commodity, for profit market mechanisms. One idea that I have been working on is a CSC( community service credit) system at the local level organized democratically in the way basic needed goods and services are produced and then using a sound accounting system to equitably distribute or better allow for the requisitioning of this communally produced wealth without using conventional financial instruments based on money.

In fact, this idea puts into practice your idea of the trophic grounding of money, but expands upon it in political/ social terms. Our market system can’t do this. We can not escape our political realities nor our existential need for one another AND the greater ecological/ solar-lunar matrix upon which we radically depend upon that CASSE, you and Herman Daly so tirelessly and cogently have been working to show us.

Hi again Brian,

I need to clarify something I wrote: I meant to say that we cannot use competitive, commodity, for profit market systems to address the issue of economic equity simply because access to needed services and goods don’t get fully addressed for ALL members of society and is this fundamentally a political problem, not a purely economic one. Some form of UBI or “social credit”, for example, could be a sound beginning to help transition to a socially and ecologically sustainable world community of communities.