Lesson from a Failed Bank: Only One Real Start-Up

by Brian Czech

Banks are macroeconomic mirrors. They reflect the activity of the real economy. If the economy is growing, so are the banks, starting with the Federal Reserve and its regional banks, all the way out to tiny First Michigan Bank, Oakwood Bank (the smallest bank in bank-laden Texas), and the patriotically named Citizens Bank of Americus (Georgia).

Banks reflect the world around them (Pxfuel).

Not only do the banks, taken as a whole, reflect the macroeconomy; each bank may itself choose to do so. Indeed, most banks take this general approach. They seek to attract the savings of—and issue the loans to—all sectors and sizes of business, plus households waiting for finished goods. They strive to be a mini-America, at least in a financial sense, just like, well, Bank of America.

Some banks take a different approach, choosing not to “go macro.” Consider the case of First Bank and Trust. With such a sweeping name, you might expect it to hold accounts from soup to nuts. It’s certainly big enough to do so, as the ninth largest bank in Virginia, a state with tremendous economic diversity. Yet First Bank and Trust is not a “macro bank” reflecting the full-blown economy of Virginia. Rather, it specializes in the agricultural sector, and quite proudly. Presumably the bank’s strategy is molded partly by the fact that it competes with 115 other banks in the state.

Silicon Valley Bank Specialized, Too

Silicon Valley Bank (SVB) was as aptly named for its specialization as Agribank and First Home Mortgage. No place in the world is better known for high-tech innovation than Silicon Valley. Now, especially after SVB’s astounding collapse, no bank is better known for imprudent buy-in to high-tech ambition.

All it takes is a glance at SVB’s most prominent account holders to recognize SVB as a tech sector go-to bank. Technology service providers, in particular, were drawn like flies to SVB, along with providers of medical services, business services, and financial services. Most of SVB’s other depositors were (and are, if they survived the waves of the SVB tsunami) focused on light manufacturing such as medical and technology equipment.

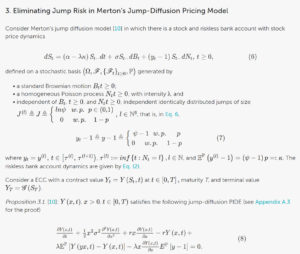

If you grasp these “riskless bank account dynamics” (Shirvani et al. 2020) please work for the SEC!

In the tech sector, especially, the line between goods and services can be fuzzy. BILL Holdings, Inc., one of the biggest depositors at the time of SVB’s collapse, is a “provider of cloud-based software that digitizes and automates financial operations for small and midsize businesses.” Does that make it a provider of goods, services, or both? Probably both.

Similarly, “Roku is a brand of hardware digital media players manufactured by American company Roku, Inc.” You hold a Roku stick in your hand; nothing could be more tangible and therefore a good. Yet Roku is described in its stock profile as being “engaged in the sale of digital advertising and related services.”

SVB also did a berserkly brisk business in “custody services,” in particular for private equity funds and hedge funds. In other words, they apparently took care of “settlement, safekeeping, and reporting” of assets, providing these services for 5,949 funds. One look at the leaked list of funds is enough to warn us that professional financial management has become an arcane, convoluted, inefficient imbroglio, with huge money at stake and probably more than enough wiggle room for significant shenanigans outside the observational powers of the Federal Reserve and the SEC.

Prior to the SVB meltdown, who among us was even aware of “custodial banking”? I spoke with a retired financial professional, a brilliant fellow who worked in the core of the mutual fund industry, and even he was unaware of these widespread custodial services. So was the banker I dealt with yesterday, moving money to protect my non-profit’s assets.

Like so many financial developments—derivatives, hedging, debt/equity swaps—custodial banking is relatively new under the sun. Do we actually have the rapidly evolving army of highly trained bureaucrats required to monitor the financial instruments and activities of these burgeoning combinations and permutations of funds, hedgers, and portfolios? I’ll bet a complexity theorist like Joseph Tainter would promptly reply, “Heck no.”

With a little help from Excel, I calculated the cumulative gross asset value of the funds under the custody of SVB at an outlandish $863 billion, plus about $781 million in change. That’s almost four per cent of U.S. GDP! That’s above and (way) beyond the billions of dollars of “regular” corporate deposits, those of BILL Holdings, Roku, and the like. The regular deposits evidently totaled almost $162 billion, including $151.6 billion beyond the FDIC insurance limits of $250,000 per account.

Despite the enormity of SVB’s coffers, conspicuously absent from its portfolio were the agricultural, extractive, and heavy manufacturing sectors. No Farmers and Miners Bank here! Unlike banks that cater to farmers and other agricultural operations, or even those of a general “commercial” nature, SVB occupied the top shelf of the American economy. That’s a precarious position when the economic foundation starts getting shaky.

The Conventional Wisdom on SVB’s Collapse

Based on the typical news report, the collapse of SVB seems like the result of simple recklessness (including on the part of account holders), coupled with the fecklessness of bank management. As a Georgetown University professor put it, “SVB collapsed because of a stupid rookie mistake with their interest-rate-risk management.” (That’s gotta hurt if you’re the recently unemployed and legally challenged CFO.) “They invested short-term deposits into long-term bonds,” the professor continued. “When interest rates rose, the value of the bonds fell, wiping out the equity of the bank.”

The Fed and SVB: Dumb and Dumber? (Tom McKinnon, CC BY-SA 2.0)

The political peanut gallery proffered partisan explanations, too. The dust had hardly settled from SVB’s cave-in when the GOP portrayed the bank as some “woke” bastion of environmental and social pandering at the expense of depositors who put their money in SVB’s trust. Meanwhile, Democrats argued that Donald Trump had set the stage for SVB’s collapse by weakening banking regulations.

Still others put the onus on the Fed. Aaron Klein of the Brookings Institution counted “at least four classic red flags of the bank’s conduct that should have sent the alarm bells ringing, which the Fed appears to have slept through.” One red flag was noted above: interest-rate risk. Another flag, “hyper reliance on uninsured deposits,” was alluded to in the previous section. In addition, Klein pointed to SVB’s “explosive asset growth” (assets quadrupled in four years) and a “dash for cash to the Federal Home Loan Bank,” considered the “lender of next-to-last resort” by the Fed itself! Klein’s point is that the Fed should have seen the warning signs and exerted the available regulatory pressure to keep SVB—and its largely uninsured depositors—from the brink.

The Fed also gets blamed for hiking interest rates when it darn sure knew that doing so could threaten a bank heavily invested in Treasury bonds. Any bank that must resort, for whatever reason—such as a sudden need for cash by major depositors—to prematurely selling Treasury bonds is jeopardized when the Fed raises interest rates, because these Treasuries invariably lose value when the Fed raises rates. Enough loss of value causes insolvency and panic among depositors, causing a run on the bank at precisely its most vulnerable moment.

Based purely on the interest-rate risk criterion, it’s hard to tell who was most to blame for the collapse of SVB: the Fed or SVB management. It seems like a case of dumb and dumber. Either way, it’s “the bank.” And if SVB made a “rookie mistake,” it was the experienced Fed—the head coach of sorts—that sent them straight into the cloud of dust.

Finally, much has been said about the prevalence of start-ups banking at SVB. It’s true that SVB loaned aplenty to start-ups, including aspiring “green” innovators. That probably didn’t help; start-ups are obviously riskier businesses than well-established ones. The fact is, though, that the huge uninsured depositors at SVB weren’t the newest kids on the block (nor particularly green), and the start-up story only distracts from the underlying, fundamental weaknesses of SVB’s banking model.

That basically covers the conventional explanations for the demise of SVB. It’s unfortunate that we steady staters weren’t in on the conventional “wisdom.” We’d have planted another red flag, and maybe one more would have done the trick.

The Real Fundamentals for Economists and Bankers

The prophet Isaiah said, “All flesh is grass.” Theologians have gravitated toward various interpretations and implications of this deceptively nuanced statement. I’d like to think the prophet was delivering, among other things, an early lesson in ecological macroeconomics. If “all flesh is grass,” we might as well say, “No grass, no flesh.” No process of photosynthesis, no process of ingestion. No plants, no animals. No farmers, no butchers, bakers, candle-stick makers, or bankers.

Now those are some fundamentals, straight from the economy of nature. Yet when economists, Fed governors, or politicians talk about “the fundamentals” of the economy, they’re inevitably talking about levels and trends of GDP, inflation, and interest rates, plus a few economic indicators like unemployment and “consumer confidence” (a pet peeve of yours truly). The assumption is, if GDP is growing and the rest of the indicators seem conducive to growth, all is well.

If your bank reflects the economy like this, find another bank. (Lynn Friedman, CC BY-NC-ND 2.0)

Despite the apparent consensus on the desirability of growth, the term “fundamentals” is hardly well defined and gets tossed about bogusly. After all, what is “fundamental” about any of the indicators noted above? Do they reflect any laws of thermodynamics or principles of ecology? Perhaps if you’re a creative physicist or ecologist, you can come up with an abstruse, indirect, philosophical reply in the affirmative. But such a strained approach is not required to recognize the trophic structure of the economy as a truly fundamental aspect of economic activity. It is based precisely on laws of thermodynamics and principles of ecology. At the base of the economy we have agricultural and extractive activity. In ecological terms, this is the “trophic” base because all other economic activity—all the manufacturing and services sectors—depend upon the energy and materials flowing from the base.

Given that the trophic base—the foundation of the economy—is agriculture, it’s easy to see why we cannot have perpetual growth on a finite planet. That’s why these basic principles from ecology resonate so loudly with our common sense. What’s astounding, though, is how rarely this common sense flows into discussions of money and banking. Is not the monetary sector supposed to reflect what is happening in the real economy? Is not inflation “too much money chasing too few goods?” Isn’t it a primary role of the Federal Reserve to keep the monetary sector in balance with real economic activity?

Yes to all, in spades and of course. So, then, why isn’t monetary theory tied more clearly to the trophic structure of the economy? In particular, why do we never hear the money supply discussed in terms of agricultural activity and, more generally, food surplus? Why does the Federal Reserve ignore the most fundamental of the fundamentals? How can it allow a “rookie” bank to load up on top-shelf, tech services without a trophic base of producers that allow such services to flourish?

Until the Fed, Bank of America, and all the other banks of America grasp the primacy of agricultural and extractive surplus as the real “authority” for determining the money supply, we’ll be courting bank failure (and inflation). All else equal, the failures will strike those banks which have specialized toward the top of the trophic structure, because those are the farthest removed from the most essential economic activities. They’re the highest and least stable shelves in the oikos.

You might say there’s only one real start-up for the economy and the monetary sector reflecting it: agriculture. It all starts there; all of the other thousands of economic activities, as catalogued for example in the North America Industry Classification System. None of them are solvent—and certainly no banks are— without the agricultural surplus that authorizes their existence.

You can bank on that.

Literature Cited

Shirvani, A., S.V. Stoyanov, S.T. Rachev, and F.J. Fabozzi. 2020. A new set of financial instruments. Frontiers in Applied Mathematics and Statistics 6:1-13.

Brian Czech is CASSE’s Executive Director.

Brian Czech is CASSE’s Executive Director.

The irony here is that the Silicon Valley (where I grew up 60 years ago) was once called the Valley of Heart’s Delight because it had topsoil 25 feet deep and was the best farmland in California. My dad was a farm advisor for over 30 years, but when he retired there was no need to replace him because the farmland was gone.

Wow, that IS ironic. And sad.

With spring arriving, imagine it pre-farmland, even.

I had to work to understand the article, and there’s a good feeling of revelation for having reflected on each word and sentence. I come away thinking that SVB might be the tip of the iceberg. Here in France, where it used to be that nearly every city dweller had some family roots in agriculture, today only 2.5% of the inhabitants actually work in agriculture. This sounds like an overall “economy” that is relying much too heavily on the top shelves, to use Brian’s term, though I’m not considering investments in agriculture. Nor am I considering the amount of produce that sprouts and grows outside the money economy.

Thanks for taking the time to work your way through it. I had to work my way through it as well, lol. And I think you’re right. The real economy itself is trophically filled to the brim – breaching limits to growth – and the monetary sector tends to drive it ever more top-heavy. (Tried to represent that with the funhouse-mirror image.)

Yesterday, after we published this article, an article came out in Fortune with the title “U.S. Banks are sitting on $1.7 trillion in unrealized losses, research says. That’s not a problem—until it is.” Haven’t had a chance to read it just yet, but you can bet we have banks left and right with the same service sector/light manufacturing “assets” with nowhere near enough agricultural/extractive surplus to warrant the speculation/investment in such activity. Not to mention (as we have a million times in previous articles) that all that economic activity, bottom to top, is already causing disastrous environmental decay with long-term economic ramifications.

To be continued, I’m sure, in the Steady State Herald…

In Irelands recent economic history banks overlent into a property bubble and needed rescuing by tax payers. Fighting for survival banks were accused by disgruntled borrowers of calling in loans on performing property schemes where underlyong assets of value could be sold releasing liquidity to prop up the struggling bank. I expect tech companies have borrowed securing on tech asset values, future income streams, which will have fallen in value as interest rates rise. Strength lies in a diverse loan book and specialist tech lenders in difficulty may turn on their strong well secured borrower for liquidity while leaving the real cans of worms unopened for now…

On banking I recollect the grammen bank microfinancers in Bangladesh as an inspirational. I imagine ladies there borrowing a little maybe to buy a Honda scooter so they can ride to work in a clothes factory, gaining independence, greater equality, empowering their lives. The problem then arises when they get bigger loans maybe with a different lender for a family suv, enslaving them to work and pay for it, disempowering their lives. Steady state financing is a balancing act.

Why is this stated as a given, a truism?: “Given that the trophic base—the foundation of the economy—is agriculture, it’s easy to see why we cannot have perpetual growth on a finite planet.” I would agree that, the “primary role of the Federal Reserve to keep the monetary sector in balance with real economic activity.” There are too many artificial, created-out-of-whole-cloths banking and financial vehicle simply so people can manipulate them like a real-world board game to make money that is totally divorced from reality. But it does seem to me that our economy is made up of myriad sectors of actually created genuine goods and services. And whether something is a good or service seems like a red herring, intended or not. It just seems to me that too much of our financial and banking economy — an ecosystem unto itself — is so laissez faire (what I always think of as the unregulated Wild, Wild West) that there is no way the Fed or any regulators could possibly keep up. It’s quite depressing, actually.

The fundamental problem is in the Ponzi-scheme of interest-bearing currency. That will always lead to boom and bust cycles, whether one has a full reserve banking system or a fiat system. the problem is the inherent growth-drive and wealth and power concentration by interest on credit and it has been for millennia. It is genocidal, sociocidal and ecocidal. I have a peer reviewed paper on this: http://jocrise.unida.gontor.ac.id/index.php/JOCRISE/article/view/3/3

What we need to do, is to correct money’s misrepresentation and organize a passive mutual credit system, that does not need to grow, but can fluctuate: https://www.moneytransparency.com/