The Triangular Economy: Behind the Circular Flows

By Brian Czech

The “circular economy” is a response to the environmental problems and resource shortages that arise as the human economy expands. The focus of the circular economy literature is on efficiency which, in terms of economic production, means more output per unit of input. All else equal, increasing efficiency means higher profits, too. That’s real motivation for the corporation.

Efficiency connects to the human propensity to innovate, too. From childhood on, humans enjoy tinkering and improving processes in order to get “more with less.” Plenty of pride is taken in jobs efficiently done.

As the latest model to highlight efficiency, the circular economy is sanctioned by dozens of influential entities ranging from Coca-Cola to the United Nations Environment Programme, all of whom collaborate on the Platform for Accelerating the Circular Economy (PACE). The principals involved in PACE see the circular economy as capable of “decoupling” materials (and even energy in some cases) from the process of economic growth, and thereby keeping the environment intact while growing GDP.

A Primer on Economic Growth

The meaning of economic growth is often taken for granted, leading to misunderstandings about its relationship to the environment and sustainability. Therefore, a brief revisiting of the concept is in order.

Economic growth is simply an increase in the production and consumption of goods and services in the aggregate. It entails an increasing population and/or consumption per person. Economic growth is measured with GDP, or Gross Domestic Product. GDP is the amount of money spent on (and conversely, income gained from) the final goods and services produced annually within the boundaries of a nation (or some other polity such as a state or province).

By definition, then, economic growth is a macroeconomic process. It is not equivalent to the growth of a business, a bank account, or an industry. Nor is it, for example, the appearance of solar panels here and the disappearance of coal-fired plants there. Such trends are sectoral adjustments, which may or may not be concurrent with economic growth.

While we eagerly conceive of certain businesses and sectors approaching a circular model of production—with very little waste and ultra-high efficiency—circularity is not an option for the economy at large. We can view the circular sectors as eddies or whirlpools in the Big River of GDP, a linear river drawing from the “headwaters” of energy and materials and depositing products (and pollutants) in the delta of the marketplace. That’s basic physics and the examples are everywhere. There’s no unburning of fuels, no recycling of rubber particles left on the roadways, and no way to perform any work whatsoever without the flow of energy.

So, in addition to the linear river and the circular eddies, a sufficient vision for sustainability requires us to consider one more geometric shape: the triangle.

The Triangular Economy

In the economy of nature, with its non-human species, nothing makes a living without the “producers” at the base. These producers are the plants; they literally produce their own food (C6H12O6—the basic sugar molecule) in the process of photosynthesis. When producers are sufficiently developed and widespread, a collection of “consumer” species may also be supported.

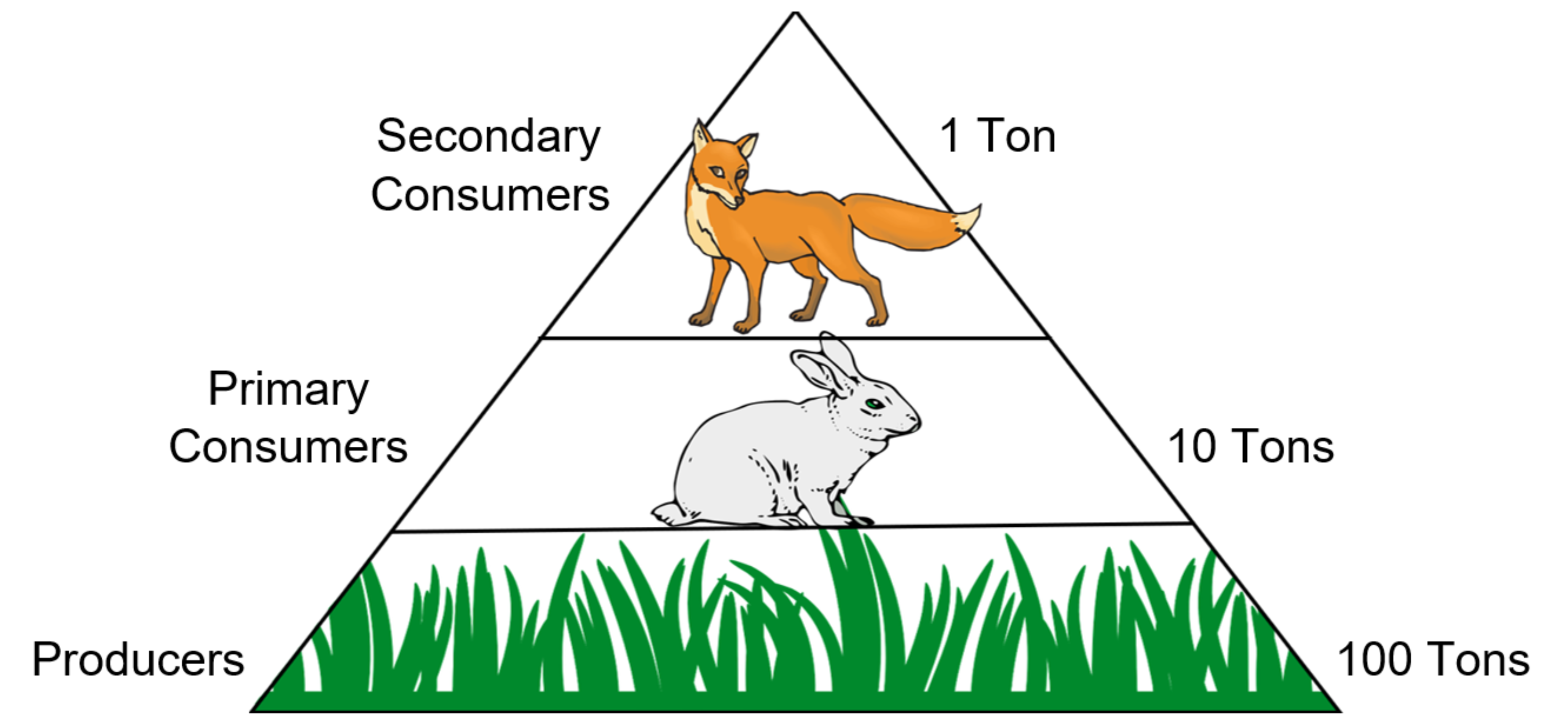

The “primary consumers” consume plants directly. When primary consumers are likewise sufficiently developed, “secondary consumers” may also evolve. They eat the primary consumers. A simple example of this fundamental food chain in the economy of nature is grass → rabbits → foxes (Figure 1).

Figure 1. Producers, primary consumers, and secondary consumers comprise “trophic levels” in the economy of nature. (In ecology, “trophic” refers to flows of energy, nutrition, and body mass.)

Of course, it’s not as if we can support one fox with merely one rabbit. Nor can we support one rabbit with one blade of grass. Rather, a great deal of grass is required to produce a large number of rabbits, which in turn is needed to support a viable population of foxes. These proportions are what give our triangle its shape, with its broad base of producers.

It’s hard to beat billions of years of evolution for developing efficient practices and eliminating wasteful activities. Therefore, circular economy entrepreneurs look to nature for examples of highly efficient processes. In fact, “biomimicry” is a buzzword among the circular economy crowd. For better or worse, though, humans never really escaped nature. As classic omnivores (somewhat similar to bears) they occupy primary and secondary consumer levels, consuming a great variety of plants and animals.

Meanwhile in the human economy proper, some aspects of nature are built in as surely as gravity. One such aspect is the trophic structure comprising producers and consumers. The base of producers centers around agriculture and other food-producing activities such as commercial fishing and livestock production. Only when the producers supply sufficient food can there be any division of labor; otherwise everyone is busy growing or gathering their own food!

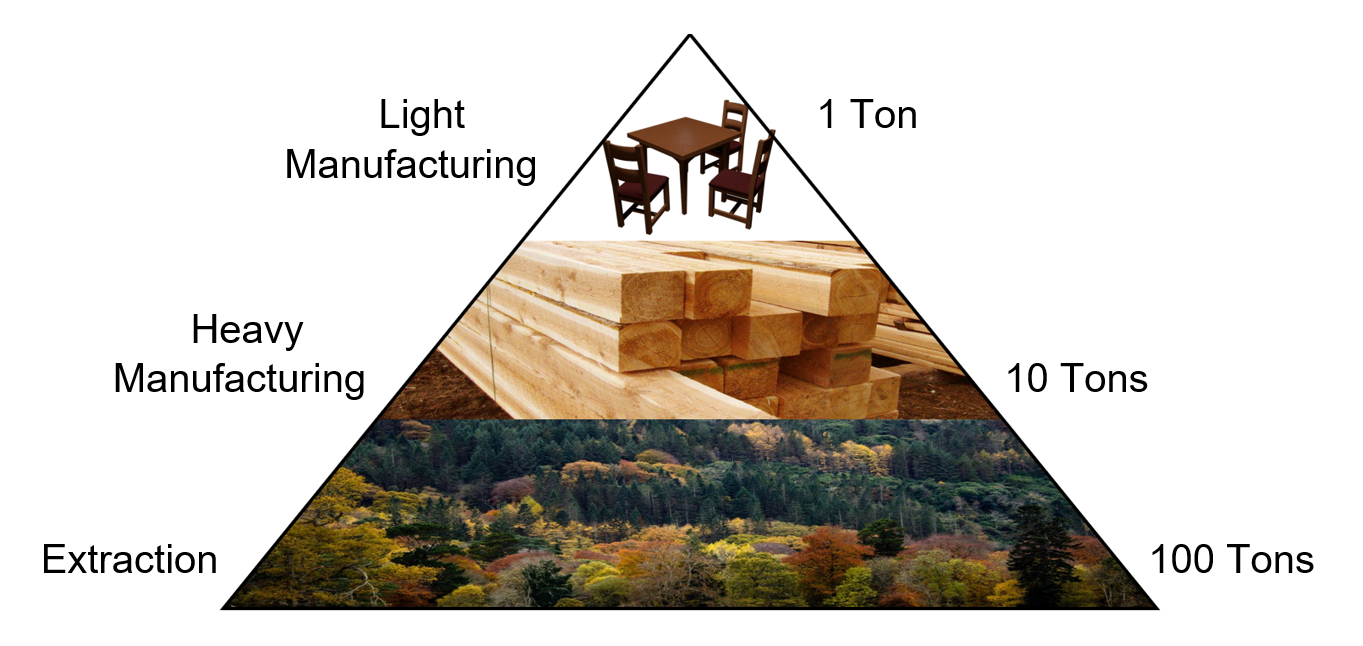

The extractive sectors such as logging, mining, and energy extraction fill out the producer base of the economy. Each of these sectors takes the rawest materials from nature, which may then “feed” the heavy manufacturing sectors such as lumber milling, steel smelting, etc. Moving up the trophic structure ultimately allows for the lightest manufacturing of cans, cameras, and computer chips.

What is the significance of this triangular structure? It provides crucial context for sustainability thinking. Imagine the manufacturing of aluminum cans becoming so efficient that each can is recycled. That certainly makes the can manufacturing sector more sustainable, vis-à-vis aluminum, but each act of recycling takes energy, and each can must be filled with something. The can, the energy to produce or recycle it, and the foods to fill it (and the fuels to ship it to market) all come ultimately from the producers at the base of the economy. So, here we have a circular flow of aluminum—an eddy in the Big River of GDP—helping to alleviate aluminum shortages while still requiring surplus production at the trophic base of the economy.

The Trophic Theory of Money: Simpler Than it Sounds

The triangle is the sturdiest shape in architecture and a veritable workhorse in geometry. From the ancient pyramids to the Pythagorean theorem, triangles have powerful properties. Perhaps it shouldn’t be so surprising, then, that the triangular economy comes complete with…a theory of money!

Figure 2. Trophic levels in the human economy consist of agricultural/extractive sectors (producers), heavy manufacturing (primary consumers), and light manufacturing (secondary consumers).

The “trophic theory of money” is that money originates via the agricultural and extractive surplus that frees the hands for the division of labor into manufacturing and service sectors. Prior to agricultural surplus there was no money; indeed money would have been a meaningless concept. This seems like a no-brainer, yet it deserves close attention because it means that the money supply (a stock) and GDP (a flow) are invariably indicators of environmental impact.

Circular eddies in the manufacturing sectors may help prevent, for example, litter from aluminum cans. We can’t discount, however, the indelible holes and “forever” pollutants left by the original aluminum mining. Meanwhile the ongoing agriculture to fill the cans and energy extraction to recycle the cans has direct and inevitable impacts on the landscapes and ecosystems of the planet.

This is not to pick on the aluminum industry. Every manufacturing sector—and every service sector—exists only as part of the broader trophic structure; i.e., “the economy” at large. The structure cannot grow without more surplus coming from the producer base, which is essentially nature or the environment. This helps to explain why many scientific organizations have described a “fundamental conflict” between economic growth and environmental protection.

Great Expectations Meet the Maximum Power Principle

The ideal of circularity in the production process is a bit like the ideal of civility in electoral politics. It is commendable, everybody wants it, and many profess to pursue it. Yet harsh realities systematically diminish the odds of achieving the ideal.

All else equal, efficiency is more profitable, so it would seem that all businesses in all sectors would do their best to maximize it. The key phrase, though, is “all else equal” (the notorious ceteris paribus in economic jargon). One of the unequal variables, when we compare economic processes, is the speed of production.

The most rigorous approach to considering all these variables is the “maximum power principle” described by the great systems ecologist H.T. Odum (1924-2002). Odum was a master of physics and used the Atwood machine to demonstrate the principles. Fortunately, most of the formulae aren’t relevant or required for the current purposes, so I’m going to channel Odum’s principle and Atwood’s machine with a simpler device known to nearly all; namely, the teeter-totter (aka “seesaw”).

Imagine a tin can on the teeter seat, which sits on the ground. Your job is to lift the can to a head-high shelf. If you can manage to place a one-ton rock on the totter seat, and let it drop, the can will shoot up to shelf level in an instant! The job was performed, but nearly a ton’s worth of kinetic energy was wasted as the rock smashed—totter seat and all—to the ground.

Now imagine an identical set-up but, instead of using a one-ton rock, you place an identical tin can—plus a pebble—onto the totter seat. Assuming it’s a well-greased teeter-totter (and given a little boost of start-up energy) you’ll get the job done, but progress will be agonizingly slow. In purely physical terms, you were far more efficient, but you were hardly competitive in the market.

To maximize profits, you’d use a weight that moves the can quickly, but without wanton waste of energy or the likelihood of a disastrous wreck! In other words, you’d strive to perform the job with an intermediate level of efficiency, in order to get it done in a timely fashion for success in the can market. The tension between maximizing production (at market speed) and maximizing efficiency is another overlooked reality, even in those sectors where we hope for circular flows.

The Sustainable Solution

“The ultimate solution is truth.” Was it Plato, Copernicus, or Abraham Lincoln who spoke thus? Evidently none of them, if Google be our guide, yet doesn’t it sound like each? Perhaps they didn’t utter the words because the logic seemed too obvious. After all, if a proposed solution isn’t based on the truth, the whole truth, and nothing but the truth, is it ultimately a “solution” at all?

Similarly, a big-picture solution cannot be arrived at without considering the entire picture. The entirety of the picture amounts to the wholeness of the truth. Wholeness, in the case of big-picture sustainability, is a triangular economy.

We should encourage as much circularity as can truly be achieved, especially in the manufacturing sectors where circular eddies can most readily form in the river of GDP. In all sectors, too, we should strive for as much efficiency as comports with a relatively free market (as opposed to dictatorial planning). Without a doubt, circular economies and efficiency in general will buy us some time for avoiding supply shocks and environmental calamities.

Yet if we are truly concerned with sustainability—natural resource conservation, maintenance of biodiversity, and a stable climate for starters—we must confront the truth that perpetual growth is impossible, much less reconcilable with environmental protection. Real sustainability boils down to a steady state economy with a stabilized population and per capita consumption. That’s the big-picture solution.

We live, after all, in a triangular economy.

Brian Czech is the Executive Director of the Center for the Advancement of the Steady State Economy.

I have heard and seen a bunch of people espousing the circular economy as the way to save our planet and make it sustainable and you did a great job at articulating very simply its fallacy. Thank you.

And thank you as well. Terry. Your 8 Billion Angels documentary makes an outstanding contribution to the discussion on limits to growth.

I enjoyed reading ‘the triangle economy’ and greatly appreciate your ecological approach. I absolutely agree that agriculture is the critical base of the economy which is why I think Parity Pricing of Ag produce should be a no-brainer. When I got to the ‘Trophic Theory of Money’ I was reminded of this Frederick Soddy quote:

“It is this underlying confusion between wealth and debt which has made such a tragedy of the scientific era.”

As a student of money I agree that the Sun powered Earth provides agriculture with extractive surplus which is the origin of our wealth, not money which is a human innovation. As Professor Daly wrote; “Money ranks with the wheel and fire among ancient inventions without which the modern world could not have come into being. But it is much more mysterious.” I think that is because it is an abstraction and that the system is privately controlled for profit and wants facts about money hidden. As Marshall McLuhan said, “Only the small secrets need to be protected. The big ones are kept secret by public incredulity.” The incredulity is supplied by the social management system of schools and mass media.

I would define money as ‘an abstract social power embodied in law as an unconditional means of payment.’ The problem now is we have a private for-profit system creating all our money as debt, which is usury, a grave sin that Dante’ called “…an extraordinarily efficient form of violence by which one does the most damage with the least amount of effort.” It has hugely negative psychological consequences that we can and should reverse.

I don’t know that we need another theory of money so much as we need to get money right and do it as soon as possible. As Soddy said, “10 centuries before Christ the ancient Greeks recognized that the most vital prerogative of democratic self-governance was to create the money.” Right now that is not the way it works, we live in a plutocracy that rules via the privately controlled money system that is now engaged in a mass robbery of us ALL. It should be stopped and there is legislation already written that would do that; the NEED Act HR 2990 introduced to the 112th Congress by Dennis Kucinich. Government would be the exclusive creator of money issued not as a debt but as a permanently circulating asset for the security and general welfare of society as its first use. With money going to where the need is it would create an economics of care to replace the economics of greed and reverse the negative consequences.

This is the reform that AMI, AFJM and IMMR supports.

One more thing, this article written by Umair Haque uses the analogy of how glaciers and ecosystems collapse from the bottom up to describe our circumstances. I thought it fit well with your explaining how our economy, our civilization depends on the broad bottom of the triangle to remain viable. https://eand.co/the-age-of-collapse-1b7082b75f04

Great post!