Distinguishing Capitalism from Growth

by James Magnus-Johnston

Capitalism and growth might have similar connotations, but they have important distinctions, too. “Capitalism” has become a clumsy catch-all for any number of value-laden projections—greed, big business, innovation, accumulation, complexity, workaholism. “Growth,” meanwhile, is a landmine of technical and cultural connotations, and I’ll explore just a couple of them here.

Private property: the essence of capitalism.

Technically speaking, their differences seem straightforward. Growth is a material increase in economic production and consumption. Capitalism is a highly complex term, but for our purposes can be distilled down to an economic system of private property in a competitive market. And to put them together: a capitalist economic system drives growth and wealth accumulation.

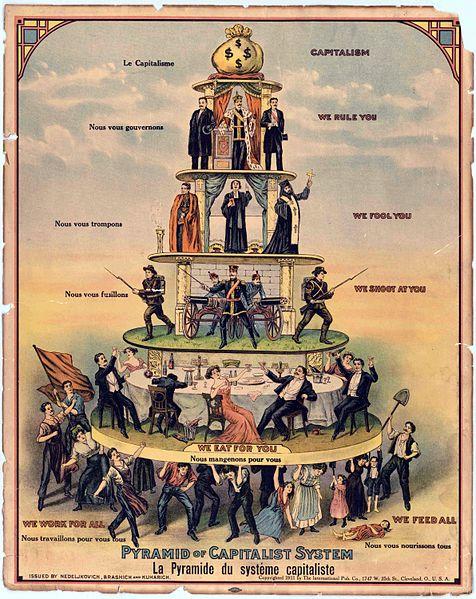

Critics articulate how each phenomenon eventually limits its own effectiveness. The economy is subject to the dynamics of any expanding complex system: it cannibalizes its foundation as it expands, leading to disorder and change. 20th century theorists like John Stuart Mill and John Maynard Keynes assumed that growth would eventually reach the limits of its effectiveness; they’re now echoed by a contemporary chorus of ecological economists. Critics of capitalism, embodying Marx, likewise argue that capitalism subverts its own effectiveness with its characteristic crises. The accumulation of wealth fosters social and financial crises. In contemporary parlance, money flows to the top one percent, where it accumulates as “capital” without benefiting society at large. All these trends are part of a complex we might call “uneconomic growth.”

Fundamentally, if capitalism drives growth and accumulation, it would be spurious to claim that a steady state economy could be referred to as “capitalist,” as we understand the term today. Neither growth nor wealth accumulation are synchronous with the idea of a post-growth economy. There are no hard prescriptions, however, for a steady state economy to dispense with all private property or (regulated) trade in a competitive market. Some ecological economists (for example, Peter Victor) have argued for an increase in public investment for socially desirable ends, and there is room for a diversity of views on this.

No one’s vision of a steady state economy.

More importantly, however, capitalism’s cultural considerations don’t suit a steady state economy. Peter Ghosh writes in Aeon that Max Weber used the term capitalism to refer to a “modern Kultur” centered around a code of values for the 20th-century West. In a capitalist Kultur, the ethic includes “cool, reserved, hard and sober” public behavior governed by strict rational and impersonal procedures for the professional life of a market economy. In this new economy, the highest virtue became “the making of money and ever more money, without any limit.” Growth-as-prosperity then became virtuous, but remained distinct from greed, which retained its grotesque connotations. The outputs of mass consumption, technology, and legality, he argues, replaced the inherent virtues of “the human ideal of warmth.”

A post-growth society may not include a hard shift away from private property or a competitive market, though it most certainly needs a shift away from capitalism’s present ethic. While there isn’t yet a well-established ethical code for such a new Kultur, it is emerging: a reduced emphasis on productivism; greater emphasis on self-reliance; a stronger connection to land and place (including Indigenous knowledge); dispensing with the virtue of growth-as-prosperity; and, a reclamation of warmth and care among people living in community. I’ll argue, too, that we need a new political language for whatever comes next, because whatever it is, it can’t look or sound like what we’ve done to the planet for the last few hundred years.

My take on the realities of capitalism and growth:

I think IF OUR NATION IS EVER TO COME TOGETHER, it will be OVER TWO OVERARCHING ISSUES:

1. Special Interests controlling our government and the media, which makes it impossible to pass any meaningful legislation. Good government must be able to create strategy for where our society should be heading and plans to get there for the common good of the people, future people, and the planet. Private companies may fill a role to provide goods and services to fulfill that strategy within the plans.

… and

2. Our culture of looking to (eternal) growth is the SOURCE of most of our problems, NOT the solution. The USA doubles its GDP every 40 years and doubles its population every 60 years (mostly immigration). Growth overwhelms all else we try to do to help the environment and our society and to achieve true sustainability. Climate Change is one of the many symptoms, as is crowding, overfishing, pollution, the need for franken foods and the anthropocene. So is income inequality, loss of quality-of-life, and always more revenue needed to accommodate quantity rather than quality.

Sign onto CASSE at https://steadystate.org/, or better have your organization sign on; see also http://www.growthbusters.org/.

To me, these two overarching issues should get way more attention than they do get – by both individuals and organizations.

All else, IMHO, is to a large extent a symptom of these two overarching issues. Is your organization including these overarching issues in its program? Probably not – unless you put on the pressure!

My understanding of capitalism is that is inextricably part of a growth economy. A new name is needed. Maybe to do with the economy of the household?

I might be late to leave a reply, but I wil do so anyway :)

I usually use the very simple definition of capitalism used by distinguished economic anthropologist Keith Hart.

“Capitalism is making money with money”.

Making money with money, in a debt driven economy, could also be basically described as betting on future growth.

Are there some other things that allow capitalists to accumulate wealth (i.e. exploiting natural resources)? Of course there are. But as they are also driven by the growing demands of production, I would say that my simple definition holds up.

Therefore I say: Capitalism is betting on future growth.

This is the simple reason why capitalism and a postgrowth economy do not go together at all.

With the end of growth, capitalism dies. Trump and the other fascists are simply capitalisms undertakers.

Capitalism and growth are not synonymous. Growth is driven by investment, not by some essential part of the system, and if we eliminated the growth incentive, capitalism would still function properly. Also, it most definitely isn’t dying, it’s just being mismanaged. People look forward to each new “crisis” because it’s become an easy way to make money, and to redistribute wealth.