Introducing the Salary Cap Act

by Daniel Wortel-London

Obscene salaries are no longer sustainable and should be illegal. (Justin Pacheco, Wikimedia)

The daily news regularly features commentary about the outrageous and growing income inequality in the USA. The data support the outrage:

- In 1965, the CEO-to-worker salary ratio at the average U.S. company was 21-to-1. Today that ratio is 344-to-1.

- In 2022, CEO pay at 100 S&P 500 companies averaged $15.3 million, while median worker pay averaged only $31, 672, according to an Institute of Policy Studies analysis.

- Since 1978, CEO pay has increased 1,460 percent.

Many reasons can be cited for opposing large discrepancies in pay, including depressed morale of employees, diminished firm productivity, and widened gender and racial disparities. Another reason is their effect on the environment. High salaries tend to increase environmental impacts. And high pay, particularly high CEO pay, is dependent on—but also drives—the economic growth that is creating today’s societal and environmental crises.

To counter inequality in the USA, CASSE proposes adoption of a Salary Cap Act (SCA). The Act would create salary caps by major occupational sector, as Brian Czech proposed in Supply Shock. Almost no expansion of the Tax Code is entailed. The SCA would simply prohibit the issuance of salaries beyond the prescribed proportions (described below), making it a crime for employers to issue exorbitant salaries.

Exorbitant Salaries and Environmental Degradation

Generating money entails agricultural and extractive activity at the trophic base of the economy. Therefore, the need to pay exorbitant salaries results in more environmental degradation than paying for lesser salaries. Imagine, for example, the ecological footprint required to pay Elon Musk compared to a minimum-wage worker.

Highly paid individuals are more likely to purchase resource-intensive luxury goods, too. This is one reason why the USA’s top one percent of income earners was responsible for 23 percent of the growth in global carbon emissions between 1990 and 2019. And income inequality leads to inequality in political power, which helps CEOs lobby for policies that promote unsustainable growth.

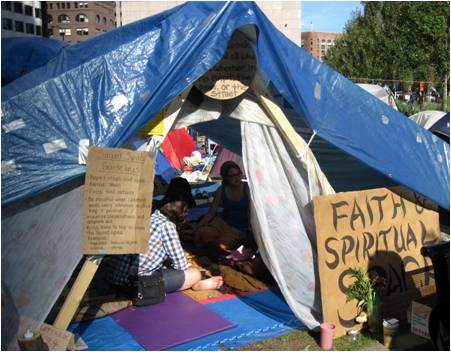

Limiting the environmental impact of the economy entails limits on high salaries. (Richard Hurd, Creative Commons 3.0)

High salaries drive growth in less obvious ways as well. At many corporations, CEO compensation includes a generous grant of stock and stock options. These sweeteners motivate CEOs to strive for company growth, then use profits to buy back company stock, which raises its price and enriches the CEO even further.

For example, the compensation of oil company executives is intimately linked to exploring for new fields, extracting fossil fuels, and promoting consumption of their fuels and services, activities that contribute to the growth of the firm. As Richard Heede of the Climate Accountability Institute observes, “executives have personal ownership of tens or hundreds of thousands of shares, which creates an unacknowledged personal desire to explore, extract and sell fossil fuels.”

Moreover, high CEO compensation through stock options and bonuses encourages companies to take a short-term perspective that can involve boosting stock prices quickly through shortsighted sales or risky investments. The Enron scandal, for example, involved CEOs trying to quickly raise stock prices in pursuit of bonuses. Selfish and short-sighted decisions like these can take a serious environmental toll, and are disastrous at a time when companies should be committed to the long-term health of our planet.

Drivers of Unequal Pay

CEO pay has increased extensively in part because companies have grown larger and wealthier, which allows them to offer fatter salaries. It’s also because CEOs have increased their leverage over corporate boards and can therefore set their own pay more easily. But the greatest reason is because CEOs are compensated differently than ordinary workers: Some 80 percent of CEO compensation in 2021, for example, derived from vested stock awards and exercised stock options rather than “ordinary” salaries. CEOs are thus able to negotiate salaries that are orders of magnitude higher than the salaries of workers paid through more conventional means.

Policymakers have a deep toolbox for addressing pay inequality. They can, for example, ban or tax stock buybacks or deny public contracts to companies with excessively high pay inequalities. Measures like these are now law. The Inflation Reduction Act placed a 1 percent excise tax on stock buybacks, while San Francisco and Portland, Oregon have taxed companies with large CEO-worker pay gaps. Inspiration comes from outside the USA as well. The European Union will assist in bailing out failed banks only when their pay ratios are 10-to-1 or less.

Franklin Roosevelt called for a 100 percent tax on annual incomes above $1.2 million (in 2022 dollars). (Elias Goldensky, Public Domain).

But another, more direct remedy for pay inequality is salary caps. We’ve seen such caps in professional sports leagues for decades, including every major league in the USA except Major League Baseball. These caps are much higher than those prescribed in the Salary Cap Act presented below, but they achieve analogous purposes. Leagues use caps to keep overall costs down and ensure a competitive balance among teams. The USA would use salary caps to for purposes of social equity, but also to keep environmental impact at a lower, more sustainable level.

Salary caps, along with caps on wealth and other forms of income, have been proposed by various economists and progressive policymakers, occasionally with public success. A referendum was held in Switzerland in 2013 to cap executive incomes; while unsuccessful, it emboldened major candidates in France and England to endorse similar salary caps. And campaigns for wealth and income caps have taken various forms in U.S. history, from Huey Long’s “Share our Wealth” campaign to Franklin Roosevelt’s call for a 100 percent tax on high incomes during World War II.

In the spirit of these efforts, CASSE proposes the Salary Cap Act.

The Salary Cap Act

The Salary Cap Act is designed to curb exorbitant salaries for purposes of social equity and environmental health. Salary caps are set and enforced by the Department of Labor. A separate provision addresses pay for self-employed workers.

The SCA defines “salaries” as wages, bonuses, tips, and other forms of compensation specified under Section 3401(a) of the Internal Revenue Code. This broad definition is meant to encompass forms of compensation, such as corporate stock options, which are not traditionally classified as “salaries.”

Section 4 describes the target and structure of the salary caps. The Secretary of Labor sets the caps for each of the 23 major occupational groupings in the Standard Occupational Classification (SOC) Codes maintained by the Bureau of Labor Statistics. The caps are set, and updated annually, to correspond to 1.8 times the salary of the 90th percentile of employees for each occupational grouping. (In other words, maximum salaries in each occupational grouping are 80 percent higher than the salary at which 90 percent of salaries in the grouping are lower and ten percent are higher.)

For example, the annual salary cap for managerial occupations would be set at $400,000, while the cap for food preparation occupations would be set at $81,270. Salary disparities would remain, but they would be far lower than the disparity today. The average CEO-to-worker pay gap across occupational categories is currently 344-to-1. Under the SCA, the ratio would be roughly 7-to-1.

We can respect planetary boundaries, or we can have billionaires, but not both. (Adrian Cadiz, Wikimedia)

Meanwhile, traditional and reasonable salary discrepancies among professions are still respected. For example, licensable occupations that require extensive training or years of graduate school warrant a higher range of salaries than those for occupations requiring little training or education.

The value of 1.8 in the maximum salary formula is chosen because the salary of the President of the United States is currently 1.8 times the 90th percentile of CEO salaries. We do not believe a CEO deserves to be paid more than the president. Still, the SCA’s maximum salary formula offers plenty of room to reward superior performance while curbing the social and environmental distortions of exorbitant salaries.

Section 5 describes how the Office of Labor-Management Studies in the Department of Labor will enforce the SCA. The Office will have the power to petition a court if it believes the Act has been violated. Companies found guilty will face criminal penalties of up to $100,000,000, imprisonment not exceeding 10 years, or both.

A concluding section requires net earnings from self-employment or employee ownership in excess of $400,000 be taxed at 100 percent. Salaries derived from self-employment are not included in the NAICS SOC codes, so it is necessary to “cap” these earnings through taxation rather than salary caps.

The SCA is designed to be both a stand-alone bill and a component of the larger Steady State Economy Act. It will not, by itself, end wealth inequality or ecological overshoot. But it will help apply brakes on incentives that drive economic firms to grow the economy beyond our planet’s carrying capacity.

We also encourage the voluntary adoption of salary caps prior to passage of the SCA. In addition to contributing to the social and environmental purposes of the SCA, such voluntary caps provide a boost to employee morale and cut costs for small businesses and nonprofit organizations.

The Salary Cap Act may be revised pursuant to reader responses and the input of CASSE allies.

Daniel Wortel-London is a CASSE Policy Specialist focused on steady-state policy development.

Some of these CEOs with exhorbitant salaries use some of their illicit wealth to take trips into space, resulting in obcene CO2 emissions.

Their space travel should be one way only.

Thanks for pointing out this obscenity. And let’s make passengers in to space illegal while we are at it—at the UN level!!

I recently came across an article about Fernand Braudel that discussed his writings on capitalism. I was pleased to see his making a distinction between “market economy” and capitalism. In particular, he saw capitalism as actually “anti-market.” I have recently been thinking of capitalism as a market failures, but I like his formulation better. I think our analyses of what’s wrong with our economy and the inequality it creates would be improved if we were to make that distinction. It’s one thing to “earn” income through a market system (e.g., rewards of hard work, risk taking, innovation, exceptional management talent, etc.) and another to extract (through “unearned rents and financial system manipulation”) vast wealth that results in oligarchy and that corrupts democracy. Just a thought.

There’s a good reason to believe this would work just fine.

The monthly pay of a private, first class, in the US Army is $2,261. The pay for a four-star general (highest possible today) is $14,975.

That’s a multiple of only 6.6.

And the stresses and scope of responsibility for a top general are hard for most CEO’s to even comprehend. Yet, there’s no shortage of fellows waiting to be promoted to that highest rank.

Money is a hugely important motivator for executive effort, but it is not the *only* motivator.

Market demand creates stratospheric salaries for talented individuals that make the difference on the bottom line, the best F1 race driver or a winning CEO of a global Corp. Supply and demand set the salary, and put the talent in its most efficient profit maximising role. Its important that talent ends up in the role where it can deliver the most benefit, even in a steady state. Alternative to salary capping, high salaries need to be fairly taxed, lets say 70% incemental tax on salary earned over 1M,the market driven high salary can still be utilised to place talent where it can deliver the most benefit and society can benefit from the fair tax.

The prohibitive approach, vs. taxation, is quite intentional on the part of CASSE, and for at least two reasons.

First, the issuance of exorbitant salaries at this point in history needs to be recognized as so bad for society as to be criminal, increasingly so. It truly undermines the lives of a growing number of citizens — today’s and tomorrow’s — because of the huge ecological footprint required to generate the money to pay such salaries. The market doesn’t deal with that; public policy to manage the scale issue does.

Second, we prefer not to further complicate the imbroglio known as the U.S. Tax Code, except as necessary. (So you’ll note that the Salary Cap Act does prescribe taxation in the relatively rare case of massive, self-employment “salaries.)

My sense of it is that restrictive caps imposed on the cutrent growth economy, hobbling it so it can do less harm is a bit like the old fable where the cold wind trys to blow the mans the coat off and he holds on to it more tightly. With gentle warm sunshine and no force needed he removed his coat without any forcing. Consumers can drive the change we all need by supporting the growth of social businesses. Previous generations cooperated to survive, their reputations were built on helping one another within their close communitie and this reputation based assisting enabled them to share assistance to survive hardship. We now have hardship on the global horizon and are not cooperating so well because we live anonymously. Repuation building and protecting that valued reputation by continued cooperation has not been required for survival. When we embrace sharing and scoring our environmental reputations our problems are solved with our collective responsibility. Consumers may strive to be seen to be living sustainably on the demand side. On the supply side suppliers also protecting their reputations, mindfully of consumer loyalty, will strive to supply sustainably (and pay reasonable salaries). Can this reputation governed supply and demand deliver a steady state when in equilibrium?

Thais is a timely proposal. I believe the ancient Greeks had similar guidelines: the wealth/ income of the most well off was not to exceed ten times the income/wealth of the poorest citizen. ( of course, women and slaves were not citizens!)

This proposal, was it implemented , also a t to curb the hideous efforts that the citizenry makes to emulate the wealthy and famous – also a big driver of ecological impact!

Try and play this one out in professional sports.

This is a good start, and I hope if enacted would make a significant improvement as stated. How does this differentiate for salaries vs. stock? Stock awards are an incentive at many levels. Will stocks be ignored, or did I miss that part? Also, what about the C-Suite’s legal tie to bring maximum profits to the shareholders? This is motivational at the least – to heck with the environment. Maybe this issue should not be included in this policy, but hopefully this would get addressed as well. Finally, I don’t think this goes far enough. The ultra-wealthy already have so much political power, they could continue to operate as now for generations based on accumulated wealth alone. Thanks for all you do.

A thought that I’ve had for a while vis-a-vis stock options, recognizing how the concept plays to human weakness.

If stock options remain in play (I’m not saying they should or shouldn’t, and this is quite apart from taxation), one way to ameliorate short-term, pump-and-dump executive behaviour is to push out exercising dates on a large percentage of options held well beyond the executive’s departure date. The objective being to incentivize the executive to, upon departure, leave the firm in good shape for the benefit of the firm, the next manager, and their own remaining options.

Lots of great insight here. Are there society’s that did implement this? If so what was the long term benefit? I think it would be helpful to sit down with many executives to find out how they might choose to respond to this, so that the solution takes them, other employees, the companies, stockholders, stakeholders and society into consideration. The more I look at system change the more I believe any change needs to be examined in many ways before implemented to arrive at the best outcome for the greatest good for society as a whole. Sorely lacking in executive pay now.