The Impact of Evolutionary Pressures on Economic Narratives

by Carey King

People use narratives to support their position, and narratives can serve three purposes. First, they tell a story of belonging. If you meet a stranger and realize you are from a common area, you more easily engage in conversation than otherwise. Second, they describe norms that guide our actions. Most people in society follow certain norms such that by doing so, they are accepted as part of the group. Third—and most relevant to advancing the steady state economy—we use narratives to describe and learn about how the world works.

Unfortunately, most narratives don’t serve all three purposes effectively. A narrative around an economic theory can help facilitate conversation by creating a common vocabulary (the first purpose of narratives), but that narrative might inhibit accurate explanation of the natural world around us. Some problems with economic policy derive directly from the fact that our economic narratives, perhaps useful for belonging and norms, are not useful in their ability to describe how the world works.

I decided to write a book about such narratives to explore some of the outcomes that affect our prospects for environmental and economic sustainability. In The Economic Superorganism, I’ve explained how and why people disagree about the role of energy in the economy. I realized that these disagreements weren’t entirely about the characteristics of energy technologies and resources. Far from it. The disagreements are more about why we consume energy in the first place, and how much energy consumption does or does not relate to economic prosperity and social livelihoods.

Energy and Economic Narratives

In Superorganism I break down narratives along the two axes of energy and economics. Because people disagree about the costs, capabilities, and benefits of different energy technologies and resources, proponents of different visions use narratives to convince stakeholders of the validity of their positions. At opposite ends of the energy axis are the fossil fuel and renewable energy narratives.

The fossil fuel narrative is getting old—and dangerous. (CC BY 2.0, Richard Hurd)

The fossil energy narrative starts with the fact that fossil fuels enabled us to achieve what we have today because the physical fundamentals of fossil fuels—most notably high energy-density and portability—ensure high utility and low cost. A proponent could say, “Fossil fuels, and the technologies we have developed to burn them, enable us to shape and control the environment.”

The renewable energy narrative is that we can use renewable energy technologies and resources to sufficiently and cost-effectively substitute for the services currently provided by fossil fuels. A proponent might say: “Thank you, fossil fuels, but we’ve modernized. We don’t need or want you anymore. Fossil fuel production and consumption create environmental harm both locally in the short term and globally over the long term to such a degree that their continued unmitigated use ensures environmental ruin that leads as well to economic ruin.”

We cannot fully understand a proponent (or detractor) of the fossil or renewable energy narratives without also contemplating their position within the economic narratives. At one end of the spectrum is technological optimism and perpetual GDP growth, and at the other end is technological realism and the need for a steady state economy or even degrowth toward a steady state economy.

The techno-optimistic narrative is a story of unbounded substitutability for anything before we run out of it in the faith we can invent our way to a solution for any and all economic, social, and environmental problems. Both the fossil and renewable narratives are usually paired with some degree of techno-optimism, and this year the combined narrative of renewables and techno-optimism was challenged in the film Planet of the Humans.

The techno-realistic economic narrative is the story of biological and physical constraints. Its narrators agree we are inventive, but that we can neither break the laws of nature nor access an infinite supply of natural resources for perpetual physical growth. This narrative underpins the CASSE position on economic growth, the signatories of which comprise a narrative community (or a significant portion thereof).

Which economic narratives, and subsequent mathematical models, should we be following, and are there some unspoken reasons why we might expect one to become more prominent than the other?

Can a System Understand Itself?

To think about this question, consider that in 1977 ecologist Howard T. Odum argued that a system cannot fully understand itself (or its purpose), but by making models of itself the system can achieve some understanding.[1] One extension of this idea is that we humans, in being a part of this system we call “the economy,” cannot fully understand the function or purpose of the economy, but we can try by making our economic models as accurate as possible. Biophysical economic models with realistic dynamics, finite resource constraints, and a direct representation of natural resource flows among parts of the economy (including the original model used within the original Limits to Growth book from 1972) have proven more capable of representing long-term trends of the economy, such as population and energy consumption, than have the conventional economic growth models that rely on equilibrium principles and either exogenous or endogenous “technological change” without directly accounting for flows of biological and physical resources.[2] Given the obvious fact that economic activities involve machines and information processing that in turn require energy consumption to function, and thus that every economic activity is supported by natural resource consumption, why would the predominant economic models fail to account for biophysical resource flows?

The renewable energy narrative—too often coupled with the techno-optimistic narrative. (CC BY-SA 3.0, AleSpa)

A follow-up question is: “Would an economy that uses a more accurate economic model of itself generally be more fit, in an evolutionary sense, and prevail over an economy with a less accurate economic model of itself?”

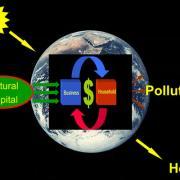

I propose that a biophysical model of the economy is a more accurate construct than the conventional or “neoclassical” models, and we should be working on models that integrate biophysical flows with flows of money, including debt. For example, my “HARMONEY” model helps us understand how the 1970s OPEC oil crisis (and the constraint in energy consumption) could concur with rising GDP, but also with rising income inequality and debt levels, evidence for what Herman Daly calls “uneconomic growth.”[3]

However, I recognize the continued dominance of the neoclassical growth paradigm, even as it’s increasingly challenged due to its failure to anticipate the 2008 Global Financial Crisis, much less the outcomes of the OPEC oil crises. Hence my question as to why a given economic paradigm may be more evolutionarily “fit” than another.

In ecology, the maximum power principle is that, in the sense of natural selection, more “fit” organisms are those that acquire higher rates of energy consumption from their environment. (For non-ecologists, “fitness” redounds to the ability to survive and reproduce.) Now assume that more reproductive economies better propagate their technologies and organizational characteristics just like more fit biological organisms better propagate their genes. Pursuant to the maximum power principle, then, the economy that accesses more energy, and transforms it more efficiently into new structures, is more fit to survive and propagate its narratives.

Do We Want the Truth?

But how do biological organisms or economies know which options enable higher power consumption? Do they know that energy input makes them more fit? Can they actually, consciously “seek” the inputs that increase their reproductive rates? We don’t get any sense that they attempt to model themselves via scientific and economic calculations. Donald Hoffman, a professor of cognitive science, has studied the evolutionary impact of an agent (organism or society) having “truthful” and often complex—versus simple and less accurate—representations of what is really happening in the world around it.

Consider the following excerpt from Hoffman’s 2010 article:

Seeing more data takes more time. So, in the simplest version of this game, simple chooses first when competing against truth. […] Similarly, seeing more data takes more energy, so truth requires more energy than simple. We subtract the cost of energy from the utility that each agent gets. (Emphases added.)[4]

Here, lower utility is the same as lower evolutionary fitness. In addition to the necessity of consuming energy in order to extract energy from the environment, an agent (for example, an economy) must also invest some amount of time to learn more about the environment. Hoffman also emphasizes that it takes energy just to gain more knowledge. His argument is that simpler rules take less time and energy to make a decision.

Thus, in the context of evolution, organisms with simple decision-making rules based on relatively inaccurate descriptions of the environment can be more fit than organisms with more complicated rules based on more accurate descriptions of the environment.

Maximum power principle translated into economic production terms.

What might simple decision-making rules look like for an economy? Prices, the study of which is the summum bonum of neoclassical economics.

Not only do neoclassical economics and neoliberal politics focus on the derivation of prices in the market, but in reality, prices that plague the market lack full and accurate information about the costs (especially the environmental and social costs) of production. Prices can even be determined by reckless whims of buyers and sellers. Even in well-structured markets, where short-term whims play little role, prices often reflect only a portion of the full costs.

Nevertheless, by focusing simplistically on markets and prices, neoclassical economics provides a relatively simple and teachable method to make economic choices in an expedient manner. All else equal, then, neoclassical economics could have an advantage in fitness over steady-state economics.

Thinking About What We Are Doing

The possibility of greater fitness for neoclassical economics (including perpetual growth theory) is a bitter pill to swallow for steady staters. I for one have a hard time thinking that neoclassical economics might have some enhanced usefulness over more biophysically based approaches to economic modeling. But, at this time, neoclassical economics is winning the evolutionary game of self-replication. That won’t necessarily always be the case, though.

Evolution just occurs; it is not forward-looking and thus involves no long-term planning or design. Similarly, markets focus on short-term profits and consumer utility rather than long-term societal goals. Friedrich Hayek, who perhaps more than anyone promoted markets to establish prices for guiding our choices, believed that we shouldn’t think about what we are doing: “The problem is precisely how to…dispense with the need of conscious control and how to provide inducements [prices] which will make the individuals do the desirable things without anyone having to tell them what to do.”[5]

Of course, Hayek’s “desirable things” aren’t necessarily the same as mine, yours, or anyone else’s.

My point is not that we have no choice but to react in knee-jerk fashion to prices, buy into the rhetoric of perpetual growth, or generally accept ways of economic thinking that overlook biophysical principles. Rather, my point is that those of us who try to explain limits to growth and advance steady-state policies have the additional challenge of using more complicated, comprehensive models and concepts. That—and not the merits of our analysis—helps explain why we don’t always prevail. Yet the more we try, the better our chances of reaching the threshold of success.

Footnotes

[1] Odum, H. 1997. The ecosystem, energy, and human values. Zygon 12(2):109–133.

[2] Meadows, D.H., D.L. Meadows, J. Randers, W.W.I. Behrens. 1972. Limits to Growth: A Report for the Club of Rome’s Project on the Predicament of Mankind. Universe Books, New York; Jackson, T., R. Webster. “Limits revisited: a review of the limits to growth debate.” Limits to Growth. 2016. http://limits2growth.org.uk/revisited/.

[3] King, C.W. 2020. An integrated biophysical and economic modeling framework for long-term sustainability analysis: the harmoney model. Ecological Economics 169:06,464; King, C. ” How Wages are linked to Energy Consumption: Data and Theory.” Carey King Blog. January 2, 2020. http://careyking.com/how-wages-are-linked-to-energy-consumption-data-and-theory/; Daly, H. 1999. : Uneconomic growth in theory and fact. Festa Review 1.

[4] Mark, J.T., B.B. Marion, D.D. Hoffman. 2010. Natural selection and veridical perceptions. Journal of Theoretical Biology 266(4):504–515.

[5] Hayek, F. 1945. The use of knowledge in society. The American Economic Review 35(4):519–530.

Carey King is a research scientist and assistant director of the Energy Institute at the University of Texas at Austin.

Carey King is a research scientist and assistant director of the Energy Institute at the University of Texas at Austin.

I’ve pondered this question for over ten years: why does the neoliberal philosophy (which includes neoclassical econ) persist when the practical implementation of it has resulted in such a disaster? MANY THANKS for your answer to that question. Couple that with the neoliberal use of Edward Bernays style propaganda, and it’s fairly clear why neoliberalism still hangs on… especially in the USA.

Relative to government action, many other Lands have seen through the neoliberal charade. Most of Europe (especially Skandinavia, Germany, Portugal, Ireland, Austria, Denmark, & The Netherlands), significant portions of South America, parts of Asia, & others are all working hard to implement various forms of sustainability. They all are light-years ahead of the USA in that regard.

Thanks again, & Happy Trails

Scott H.

Retired Ecologist

Thanks Scott. I also mention Bernays in Chapter 9 of my book. I separate “neoliberal” from “neoclassical”, perhaps more than you imply here (following Philip Mirowski’s view). And more than “my answer”, this blog is more “my hypothesis” on why something like neoclassical economics can be so pervasive. Neoliberal (per Mirowski) would be using the government to enforce markets and rules that favor incumbents, so not really the textbook attempt at a free market. So to me neoliberal in that sense is at least one step away from a purely market driven society, and no one has a purely market driven society, although the U.S. seems most close to that. This is really a challenge (as Nate Hagens and others say) to see if and how we as conscious beings can resist the tendencies of the economy acting as a superorganism (with no planning or direction, just trying to grow and consume).

Thanks for your comment. Yes, I figured your “answer” (your original post here) was your hypothesis. As to neoliberal and neoclassical, I only have time to say the following (which isn’t much).

Having read Mirowski’s paper, “The Political Movement that Dared not Speak its own Name…” and his article, “This is Water, or Is It the Neoliberal Thought Collective?”, I find much with which to agree. Especially on the mark is his description of how many on the Left mischaracterize capitalism. Nevertheless, also having read Vernengo’s “Who is afraid of Neoliberalism? A comment on Mirowski” (while considering Mirowski’s views on Vernengo’s stance), basically I have to agree with Vernengo. Neoliberalism is intrinsically connected to neoclassical economics.

Neoclassical economics may have started out not embracing Crony Capitalism, but that isn’t true any longer, and hasn’t been for a long time. The whole “free market” concept appears to me to be a myth. Government always is involved with legitimate markets.

I agree that, unlike neoclassical econ, neoliberalism is a political movement. It’s much more encompassing than simply economics. In my opinion, though, it utilizes neoclassical economics to the hilt and beyond. In other words, the econ is subordinate to the overall neoliberal ideology. So, we agree to disagree re “neoliberal” & “neoclassical” being separate. :)

Having said that, I’ll conclude with two thoughts:

a) in a certain sense, this discussion is a bit like trying to determine how many pixies dance on the head of a pin; and

b) what matters most is that neoliberalism (& its economics, by whatever name) is an utter disaster, and STILL dominates politics, economics, and ethics throughout the world.

That must change, and soon.

https://ecologicalliberalism.blogspot.com/

Happy Trails,

Scott H.

I can agree that this discussion can easily lead to nowhere. I certainly don’t claim to have the last word (or the first word) on the linkages between neoclassical economic techniques and neoliberal thinking. I’ve not read Vernengo’s piece you mention, so will put it on my list. I’ll continue to work on consistent non-equilibrium methods and theories to explain energy/resources and economic interactions and historical patterns, and I don’t think I need to prescribe to a specific view on “neoclassical vs. neoliberal” in order to do that. Thanks again!

KUDOS, & Happy Trails

Interesting post. The idea that false stories can sometimes outcompete true stories is quite important. I put the God religions (Judaism, Christianity and Islam) into the category of useful, self-replicating stories. They are related to the growth is good story because they are so human centric, do not see humans a species in a community of interdependent life. Science has much more sophisticated and detailed and true stories. But they don’t replicate as easily. Science offers material benefits but fails to think in systems terms and has unintended consequences and lacks moral guidance. So by trying to tell us how to get along with each other, religious folktales have great utility and survival value. Thinking about a new, more easy to sell story is something to work on..

Yes. I’m all ears Max. My book is my effort at a long-winded story, but perhaps the short version is “The economy operates as a system that metabolizes energy to grow and process information, and if you don’t realize this while pursuing human-centric outcomes from the economy, you’ll misdiagnose the problem and make inappropriate policies.” That’s already longer than “make another market for it”.

Dear Carey,

This is great! I don’t think I could agree more. Here is a paper I wrote that I think is along the same lines, albeit from a slightly different perspective. I will look forward to reading your book, it arrives on Sunday! Thanks

https://link.springer.com/article/10.1007%2Fs11625-020-00803-z

Thanks Brian. I will read your paper!

Carey King makes the point that simple (even simplistic) narratives have an evolutionary advantage over complex (but more truthful) ones – but to pin the simplicity of the neoclassical paradigm on ‘the summum bonum of prices’ misses the larger picture. Three other factors explain the persistence of the growth narrative – political expedience, moral convenience, and a distorted conception of the Enlightenment ideal of freedom.

Political rulers who preside over prosperous economies enjoy power, social stability and electoral success, and those who are ruled anticipate steadily increasing opportunities for improved standards of living. Growth is expedient because it strengthens government’s hold on power even as it serves the will of the people.

Additionally, neoclassical growth is morally convenient because it relieves the tensions of inequality and competing claims on limited resources. All contending parties, public or private, employer or employee, rich or poor, agree on growth as a policy objective because it benefits them all – by promising more of everything for everybody – without the imposition of a redistributive burden on anybody.

Finally growth has always included the Enlightenment ideal of freedom – freedom from oppression and exploitation, and freedom to pursue desirable goals and a better life. Today, however, freedom has been reimagined to mean freedom to pursue a limitless and cornucopian image of the future. This false freedom and the moral laxity it engenders are the poison pills of the story of neoclassical economics, beyond the technical consideration of prices.

I should also say that I question King’s assertion that ‘evolution just occurs; it is not forward-looking and thus involves no long-term planning or design.’ The increasing complexity of biological development (and of the Universe as a whole) speak to an inherent teleology more conducive to the evolution of a more truthful story than a meaningless, directionless reality.

Thanks Stephen. I guess I don’t associate neoclassical thinking with an inherent assumption of growth (e.g., neoclassicals can imagine situations with no growth) … if that is what you mean (maybe it is not what you mean). I do agree that growth in general is more politically expedient. I don’t quite follow your comment of “an inherent teleology more conducive to the evolution of a more truthful story”.

Carey – I’d be surprised if neoclassical economics could be dissociated from growth – after all, the neoclassical move to mathematics in general, and prices in particular, was all about abstracting the economy from biophysical constraints on growth.

My teleology comment was probably more obscure than I intended. I was referring to the belief shared by many (including Herman Daly, I think) that evolution is not blind – that the Universe is both meaningful and purposeful, that people are here as part of the Universe becoming aware of itself.

If there really is a teleological impulse inherent to the Universe, then aligning the ‘new story’ with that impulse (however you may interpret that) could make it more saleable. What I’m really getting at here is that the global environmental crisis is a moral problem as much as it is a technical one, so we need something more than just ‘trying harder’ to tackle it. A strategic shift to the humanities might help with that.

Stephen — I’ll agree that neoclassical thinking is nearly always associated with promoting growth, but I guess I was just trying to say that the neoclassical mathematics does not have to assume growth.

Per your teleological statement of “that people are here as part of the Universe becoming aware of itself”. OK, I see what you mean now. While I can imagine that a logical consequence of evolution is to end up with beings that can contemplate their own existence (i.e., humans and some other animals), at the moment, my thinking does not let me conclude that (1) this is inevitable (e.g., resources or conditions might not allow this advance being to develop long enough through evolution and (2) the end point of this process is Homo sapiens, or even biological. It is the second point that prevents me from assigning too much morality to how we treat the planet.

WITH THAT SAID … I’m FOR treating other humans, living creatures, and the planet generally more environmentally sustainably than we (humans) are at the moment because I also don’t see a moral argument for simply increasing the quantity of people and man-made stuff (capital) until we eventually can’t. One could make the argument that more people and stuff gives us a better chance to go to other parts of the galaxy (Star Trek scenario), but to me that still could occur without a necessity for a moral argument (e.g., could maybe just be based on statistics or thermodynamics).

Kudos, Stephen. Right on the mark.

Humanity is in a socio-ecological-economic Crisis because we need a paradigm shift in both ethics & spirituality (not religion).

I’m reading Zachary Carter’s book The Price of Peace, a biography of J.M. Keynes and therefore a view of the history of 20th century economic thought. One thing is abundantly clear: There has been a thumb on the scale to distort thinking about economics. In a chapter called “the aristocracy fights back” Carter tells how, ironically after Keynesian policies saved capitalism, leftish “pinko” professors were fired after WWII for modest ideas like national health insurance or international management of the world economy. Economics could have developed on a different foundation: Malthus (population growth makes for starving children), Mill (population and economic growth makes for an ugly world), Keynes (ending population growth and technological progress will make it possible to stop growth and concentrate on culture and ethics), Boulding (spaceship earth) and Daly (economy as subset of ecosystems). Instead the oligarchy installed professors whose theories recommended that the rich get richer via growth and “free” markets. (A concept Keynes found was nonsense. And Joe Stiglitz and the Behavioral Economists have elaborated.) Econ 101 is a pack of lies.