A Doughnut Economy Please, but Hold the Agnostic Frosting

by Brian Czech

Author of Doughnut Economics, Kate Raworth. (CC BY 2.0, Arbeid and Milieu)

Doughnut Economics by Kate Raworth, which I gobbled up last week, was tentatively in my top five economics pastries before I bit down on Chapter 7. Now it’s “merely” in the baker’s dozen—top ten even—along with classics such as Small is Beautiful, the Diseconomics of Growth, and more than one Herman Daly title on the pantry shelf.[i] I know you’re hungry for the answer to what grated my teeth at Chapter 7, so grab a cup and pull up your chair.

Chapter 7 is called “Be Agnostic about Growth,” with a small-lettered subtitle, “from growth-addicted to growth agnostic.” What a surprise it was—all this agnosticism—given the warnings about overgrowth baked into the preceding pages! For steady staters who advocate striving for the right-sized economy, Chapter 7 is hard to swallow.

Why, then, would Doughnut Economics still be in the top 10? Let’s start with that, because we definitely don’t want to push the doughnut away with the dirty dishes. (And yes, we can leave the pantry puns with the day-old buns.)

A Picture is Worth a Thousand Words

People brainstorm and come up with brilliant ideas, some more than others (must I add, in terms of the people and the ideas). Kate Raworth came up with a winner in the doughnut, and I’m not surprised. Interviewing her for a Steady Stater episode, I sometimes felt like a woodchuck running with a blue heeler. Alert as could be, she darted into every nook and cranny of relevance, always on the right track, always finding persuasive answers. As a bonus, she even asked questions back; the sign of an open mind, and great for a podcast.

Unlike many authors who take a while (forever in some cases) to convince the reader that their reading time will be worth it, Raworth has you realizing from page one that Doughnut Economics is a book you’ll be finishing, and gratefully. In the introduction alone, “Who Wants to Be an Economist,” she shows you she’s done her homework aplenty. She’s dug deeper into stories we’ve scratched only the surface of; she’s found other stories we knew not at all. Just as importantly, she’s picked out the key points keenly, and now she relays them to you with the mastery of an Olympic sprinter. You can grab them and run yourself now; if still a woodchuck, a chuck on fresh clover.

Believe me, you’ll benefit from many such passings of the baton, but the highlight, of course, is the doughnut. It is at once a meaningful model and metaphor (and fit for puns, but we’ve eschewed those buns). Before describing the doughnut model, let me list a few adjectives for it:

- Clear

- Cogent

- Resonant

- Friendly (It’s a doughnut, for God’s sake.)

- Scientifically sound, yet…

- Simple (not simplistic)

- Holistic (I know what you’re thinking.)

Now that’s quite a list! Anyone who can develop a model—of an economy no less—with such traits is bound for the bestseller list, and possibly even sainthood. And that’s just the doughnut model; the book at large is all those things plus flowing (exceptionally so), enlightening, and motivating.

As for the doughnut, and as Raworth describes in terms more artful than the old adage, a picture is worth a thousand words. If there’s anyone left out there who doesn’t believe it, they haven’t read Doughnut Economics.

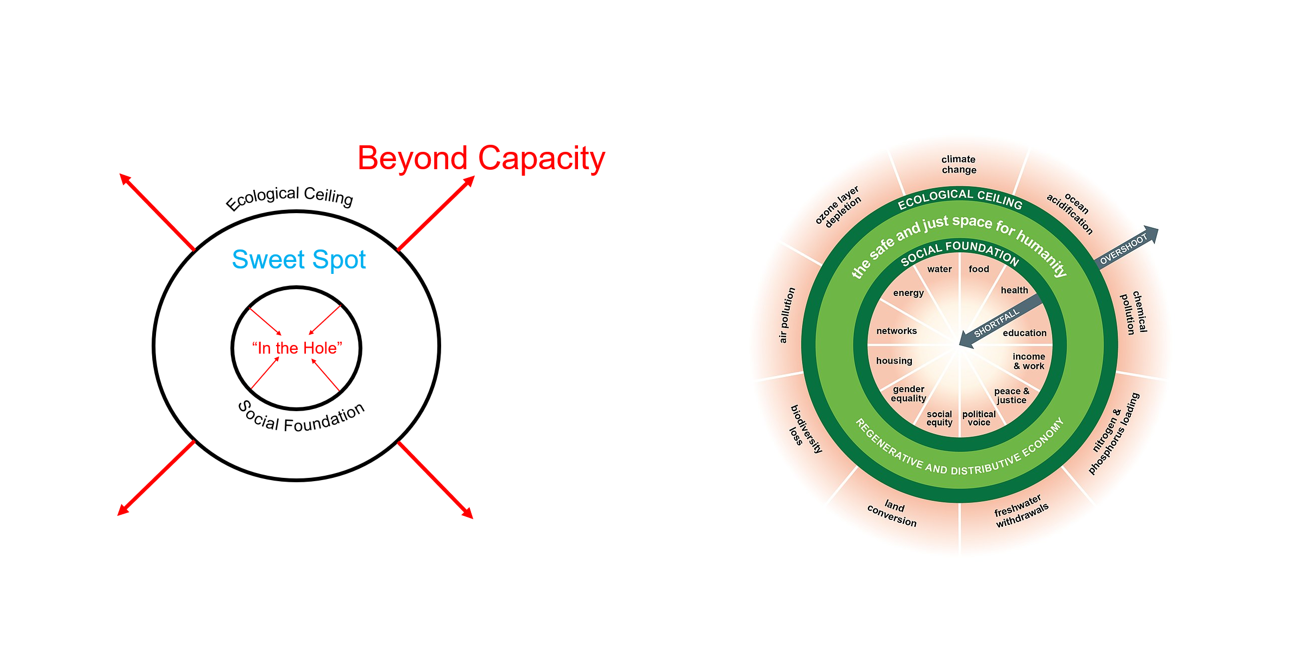

Yet there are the rare folks whose brains work better with words, or at least with words included, so I’ll translate the doughnut thusly: The inner circle is the “social foundation” (Raworth’s term). If you’re stuck in the hole you’re financially poor and, if your community is likewise, chances are you’re not healthy or happy either. You’re not advantaged in many ways at all; you’re hungry, stressed out, politically marginalized, and your opportunities are few. You and your neighbors need economic growth, among other things.

The outer circle is the “ecological ceiling.” Limits to growth, in other words.

In between, of course, is that sustainable sweet spot.

This would have been enough for a handy model, but Raworth adeptly adopted the timely (for doughnut purposes) and prestigious publication by Rockstrom, Steffen, and others on “planetary boundaries.”[ii] I believe this made a huge difference for conferencing and policy circles, as it instantly gave the doughnut a nicely baked crust of scientific credibility.

The doughnut economy: model and metaphor. Basic doughnut (left, by CASSE); full model (right, CC BY-SA 4.0).

After introducing the doughnut, Raworth moved onto describing the “7 Ways to Think Like a 21st Century Economist,” pursuant to the subtitle of the book:

- Change the Goal: from GDP to the doughnut.

- See the Big Picture: from self-contained market to embedded economy.

- Nurture Human Nature: from rational economic man to social adaptable humans.

- Get Savvy with Systems: from mechanical equilibrium to dynamic complexity.

- Design to Distribute: from growth will even it up again to distributive by design.

- Create to Regenerate: from growth will clean it up again to regenerative by design.

- Be Agnostic about Growth: from growth-addicted to growth-agnostic.

The seven ways comprise the seven chapters of the book. Chapters 1-6 range from outstanding to excellent. Unless you are God, you’ll learn something from at least one of these chapters. If you’re 99.9 percent of citizens, you’ll learn plenty from all chapters. But, be careful with Chapter 7. It’s not the healthiest part of the doughnut model. If you partake of this mysteriously soggy portion, it’s bound to cause some dizziness. If you’re a steady stater, it might cause high blood pressure and heartburn to boot!

Voilá, a Breadstick!

Inspired by Raworth to think graphically as well as metaphorically, and motivated to atone for any fleeting flirtation with agnosticism, let us roll away the stone! I mean the doughnut. (Please don’t call it the “stoughnut.”)

We don’t need to roll it out of the picture, but rather unto its transfiguration into a breadstick. Instead of two concentric circles denoting the social foundation and ecological ceiling, we now have two parallel lines denoting the same. And what’s in between these crusts? The same, safe, happy space for humanity. Still the sweet spot; perhaps less metaphorically (as doughnuts are sweeter than breadsticks) but just as figuratively. (See figures below.)

These horizontal, parallel lines suddenly imposed upon our tabula rasa also beg the question: What’s on the Y-axis? Anyone worth their steady-state salt will know almost instantly. It’s got to be GDP! Below the social foundation, the economy is too small. Above the ecological ceiling, too big. In between, sustainable (with an optimal size somewhere toward the middle). For any country, and globally.

And how do we measure the economy? With GDP, or population × per capita consumption. And yes, while GDP is technically the market value of final goods and services, it reliably indicates the amount of production and consumption in the aggregate, primary and secondary, from the trophic base up.

If there’s one thing economists of all ilks can agree upon—and “we are all economists now,” as Raworth exhorts—it’s that GDP is the best estimate we have of the size of the economy. Not of healthiness, not of happiness, but of pure, unadorned size. Envision the planetary economy stepping onto the scale and exclaiming in alarm, “What?! I am now up to $85 trillion—I have got to lose some weight! Well, at least I know what to do now.”

But if we go “agnostic” on GDP, we fail to see the scale. Or we get on the scale, note the unprecedented GDP, and go our agnostic way, still unhappy and looking for remedies such as alternative currencies, minimum incomes, and solar panels. All these are helpful and important, akin to meds for the obese patient. They buy some time and make us feel a little better about things. They’d fit with a program of long-term maintenance, too, but none of these meds get to the root cause of the crisis: obesity.

Food for Policy Thought—Balanced Diet Required

A balanced diet is good, but we don’t have to get ridiculous. We don’t all have to have amaranth, chia seeds, and wheatgrass in our breadsticks. We need not all (although some Spartans will) partake of The Entropy Law and the Economic Process, A Prosperous Way Down, or even The General Theory of Employment, Interest, and Money. But we all need breadsticks as well as doughnuts. If we are to be taken seriously about changing the goal “from GDP [growth] to the doughnut,” we better understand how that doughnut translates to GDP terms. Taking a “growth-agnostic” pill won’t cut it.

If you’re wondering what caused Kate Raworth—brilliant beyond a doubt—to express this most ironic form of agnosticism, you’re not the only one. I’m guessing it’s a common question among steady staters and degrowthers alike; I’ve certainly heard it broached by some. After reading her book and interviewing her, as well as reflecting upon my own life experience (including gag orders during my civil service career), I can’t help but hone in on Raworth’s resonating words:

Back in 2011, I was tasked by Oxfam to write a policy paper to help the organisation decide whether, in high-income countries, it should promote the concept of “green growth” or side with those advocating “degrowth.” I jumped at the chance because it took me back to the heart of macroeconomic thinking. But my excitement soon turned to paralysis as I dug into the debate and found that while both sides had some strong arguments, both too quickly dismissed the opposition’s case, and neither had a singularly compelling answer. As I attempted to come up with a clear policy position for Oxfam despite my own deepening uncertainty, my stomach tied itself in knots, and my throat became so tight that I could barely breathe. I had been immobilised by one of the most existential economic questions of our age. So I called my project manager and explained the situation. “OK,” she said. “What do you need—two more weeks?” What I needed was to stop trying to answer that question head-on. (page 208)

Does anyone out there enjoy feeling paralyzed, knotted up, or choked for air? Only the most masochistic maniac would want more of that, and Raworth is no maniac. Perhaps that explains the disconnect between Chapters 1-6 and Chapter 7.

Don’t get me wrong or take anything out of context. To me, Kate Raworth is borderline heroic. She’s no wilting wallflower. Aside from the intellectual talent, she is clearly a brave, strong, and highly effective person. But, no one (perhaps aside from a handful of narcissists) is entirely free of fear, angst, and stress. Furthermore, everyone has their psychological limiting factors, many of which are engaged in particular settings and in the context of particular norms. As social psychologist Rui Gaspar put it:

Given the presence of unconscious components in norm activation…people may not be conscious of these processes taking place and influencing their behavior. These in turn are determined by limiting factors (psychological and non-psychological) resulting from both individual and situational variables.[iii]

Clearly Raworth came into a psychological buzzsaw at Oxfam. However, while the debate over “green growth” may have “paralyzed” her, that’s less a weakness of hers and more of a rap on those who refuse to acknowledge limits to growth and stick, as Greta Thunberg put it, to their “fairy tales of eternal economic growth.” The onus is on the intellectually lazy and arrogant neoclassical economists who willfully ignore the ecological sciences. It’s on the environmental organizations that refuse to do their homework in ecological macroeconomics and leave the post-growth heavy lifting to others. It’s especially on those who, already knowing better, muffle others from speaking truth to power. These entities—individuals and organizations and corrupted agency cultures—have been like the bystanders to bullying, letting the pro-growth bullies have their way in the city parks of public policy.

Now, if there had to be avoidance, evasion, or refusal to even acknowledge growth as a variable to manage, then Raworth’s “agnostic” approach would probably be the least damaging way to go about it. With this approach, we start by talking all about the problems caused by overgrowth, and even during the “agnostic” phase we insist upon not pursuing growth any further, even while supposedly ignoring it. Such a vision of agnosticism leaves me agnostic about whether it’s agnosticism at all. If it is, then avowed steady staters must be the Vatican of non-growth economics.

No matter what you call her brand of “agnosticism,” Kate Raworth is just getting started in doughnut economics and steady statesmanship. Her paralysis at Oxfam, circa 2010, is way back in the rear-view mirror now. Chapters 1-6 of Doughnut Economics, as well as our conversation on the Steady Stater, make it clear enough to me that she gets it about the importance of addressing—not avoiding—growth as measured with GDP. Yes, there are moments of doubt, but overall the clarity is there. Listen for yourself.

Oh yes, and there’s this: In 2017—the same year Doughnut Economics was published—Raworth signed the CASSE position on economic growth, along with most prominent thinkers in post-growth circles. As the author of that position, I’ll take my turn with the baton and translate for current purposes:

- The size of the economy is what pushes us past the upper line of the breadstick, or that outer ring of the doughnut.

- Any hope for staying “in the dough” redounds to a steady state economy with stabilized population and per capita consumption.

- The steady state economy is, all else equal, indicated by stabilized (mildly fluctuating) GDP.

That’s the reality—faith metaphors can’t quite capture it—and Oxfam will learn to live with it. So will the World Bank, Big Green, Dark Money, the USA, EU, and Wall Street. The sooner they read Doughnut Economics, especially chapters 1-6, the sooner they’ll start accepting it.

Now pass me a breadstick please. Or a doughnut. Just hold the agnostic frosting.

[i] Above all would be: Daly, H. E., and J. Farley. 2010. Ecological economics: principles and applications. Second edition. Island Press, Washington, DC. 544pp.

[ii] Rockström, J., W. Steffen, K. Noone, Å. Persson, F. S. Chapin, III, E. Lambin, T. M. Lenton, M. Scheffer, C. Folke, H. Schellnhuber, B. Nykvist, C. A. De Wit, T. Hughes, S. van der Leeuw, H. Rodhe, S. Sörlin, P. K. Snyder, R. Costanza, U. Svedin, M. Falkenmark, L. Karlberg, R. W. Corell, V. J. Fabry, J. Hansen, B. Walker, D. Liverman, K. Richardson, P. Crutzen, and J. Foley. 2009. Planetary boundaries:exploring the safe operating space for humanity. Ecology and Society 14(2): 32. [online] URL: http://www.ecologyandsociety.org/vol14/iss2/art32/

[iii] Gaspar, R. 2013. Understanding the Reasons for Behavioral Failure: A Process View of Psychosocial Barriers and Constraints to Pro-Ecological Behavior. Sustainability 5(7), 2960-2975; https://doi.org/10.3390/su5072960

"General Audience with Pope Francis" by Catholic Church (England and Wales) is licensed under CC BY-NC-SA 2.0

"General Audience with Pope Francis" by Catholic Church (England and Wales) is licensed under CC BY-NC-SA 2.0

Hi Brian, excellent, thankyou for the clarity on GDP. I think regarding the Oxfam question, that it was “both and” not “either or.” Not economic growth but Green Growth, growth in green prosperous small self-reliant communities, fertile soil, happy people, and degrowth in capitalist economy, debt, inequity, war etc. Need a public money system for government to do this as banks have a whole other idea on what is right and fair and it is not fit for the people. Also the alienating psychological consequences of usury keep the parasite on the back of free-enterprise. Change the money from private to public and we change the psychology from personal gain to care..

Having only listened to the podcast interview, my interpretation on the GDP debate was perhaps twofold:

1) Global GDP already exceeds some (or most?) planetary boundaries, but perhaps individual countries are in the hole, in the sweet spot or beyond the doughnut. So, some need de-growth to steady state, some need to transition to steady state but are in the sweet spot, and others do actually need to grow to steady state to get out of the hole.

2) The second point made was more about GDP being a reasonable proxy for environmental impact now but may not always be a reasonable measure as we move to steady state. The use of more direct and complimentary indicators may be beneficial like footprint metrics to track along side GDP. Maybe decoupling hasn’t happened to this point, but has it been proven to be impossible? If so, I’d love to hear that podcast.

Anyway, just some thoughts from an interested reader that is definitely not an economist.

Brian,

Have you read “A New Framework for Macroeconomics: Achieving Full Employment by Increasing Capital Turnover” by Mason Gaffney? In it he suggests that:

“It is not a question of stopping growth. There is no need to divide into factions for and against growth. We can grow by combining more labor with the same land and capital. It is simply a matter of modifying processes and products and consumption. Each time capital recycles it can embody new techniques as well. Growth of capital is not needed for progress; turnover is. Since one way to substitute labor for capital is to turn over capital faster, this also accelerates embodiment of new knowledge in real capital.”

https://www.jstor.org/stable/27739802?seq=19

I’m not sure one way or the other to be honest, but it seems to me that we’ve never really tried it because we’ve lived by the reality of enclosure and horizontal expansion for centuries. But it doesn’t seem like this is an inevitable way to ‘grow’ the economy.

Thanks for that recommendation Justin. The concept of capital turnover and labor substitution of capital sounds interesting. I just happened to start reading a book by Chris Smaje titled “A Small Farm Future” where he gives a good quick history of capital and how it has morphed over the centuries. He certainly advocates for labor substitution of capital. Regardless, it’s pretty obvious that the current global capital system will end itself either through the impact on planetary boundaries or human inequities, or probably both.

Excellent Brian!. I bet you were creative with PlayDough in your early years, too!

I had the same feeling when I read over the material on doughnut economics. Summarized I would say:

– the doughnut concept is a nice, intuitive way to get more people to think holistically about the problem humanity faces. It works :)

– it overlaps heavily with Steady State Economics .. we’re basically describing the same problems and solutions

– alas, the concept of growth uber alles has a powerful hold over economists’ minds, even now.

On balance, to be fair, I don’t blame Raworth a bit for not *quite* making the leap (at least publicly) about economic growth. For a recovering conventional economist, she’s made simply amazing progress. A powerful intellectual ally, and a welcome one!