In Commemoration: A Sampling of Herman Daly

by Herman Daly (posthumously) — Introduction by Brian Czech

Given the recent, tragic passing of Herman Daly, we allocate this week’s Steady State Herald to the wise words of Daly himself. From 2010-2018, Herman was a regular contributor to The Daly News, CASSE’s blog before the Herald was launched. (Herman’s modesty almost prevented us from naming the blog after him, but he was outnumbered by CASSE staff and board, and The Daly News it was!)

Daly News articles were shorter—and eminently pithier from the pen of Daly—so we’re able to package a sample of three articles into this commemorative display. These are three of the thirty three articles bound in the book, Best of The Daly News: Selected Essays from the Leading Blog in Steady State Economics, 2010-2018.

Best of The Daly News was the first book published by the Steady State Press, CASSE’s nascent imprint. Herman Daly was happy with the production, which also became the first membership gift. We’re sure you’ll be happy with the distillation below. After all, we might arguably call these articles “the best of the Best of The Daly News.”

Wealth, Illth, and Net Welfare (November 13, 2011)

Well-being should be counted in net terms, that is to say we should consider not only the accumulated stock of wealth but also that of “illth;” and not only the annual flow of goods but also that of “bads.” The fact that we have to stretch English usage to find words like illth and bads to name the negative consequences of production that should be subtracted from the positive consequences is indicative of our having ignored the realities for which these words are the necessary names. Bads and illth consist of things like nuclear wastes, the dead zone in the Gulf of Mexico, biodiversity loss, climate change from excess greenhouse gas emissions, depleted mines, eroded topsoil, dry wells, exhausting and dangerous labor, congestion, etc. We are indebted to John Ruskin for the word “illth,” and to an anonymous economist, perhaps Kenneth Boulding, for the word “bads.”

In the empty world of the past, these concepts and the names for them were not needed because the economy was so small relative to the containing natural world that our production did not incur any significant opportunity cost of displaced nature. We now live in a full world, full of us and our stuff, and such costs must be counted and netted out against the benefits of growth. Otherwise we might end up with extra bads outweighing extra goods and increases in illth greater than the increases in wealth. What used to be economic growth could become uneconomic growth—that is, growth in production for which marginal costs are greater than marginal benefits, growth that in reality makes us poorer, not richer. No one is against being richer. The question is, does more growth really make us richer, or has it started to make us poorer?

Wealth and illth: which the greater? (CC BY 2.0, Michael Caven)

I suspect it is now making us poorer, at least in some high-GDP countries, and we have not recognized it. Indeed, how could we when our national accounting measures only “economic activity”? Activity is not separated into costs and benefits. Everything is added in GDP, nothing subtracted. The reason that bads and illth, inevitable joint products with goods and wealth, are not counted, even when no longer negligible in the full world, is that obviously no one wants to buy them, so there is no market for them, hence no price by which to value them. But it is worse: These bads are real and people are very willing to buy the anti-bads that protect them from the bads. For example, pollution is an unpriced, uncounted bad, but pollution cleanup is an anti-bad which is accounted as a good. Pollution cleanup has a price, and we willingly pay it up to a point and add it to GDP—but without having subtracted the negative value of the pollution itself that made the cleanup necessary. Such asymmetric accounting hides more than it reveals.

In addition to asymmetric accounting of anti-bads, we count natural capital depletion as if it were income, further misleading ourselves. If we cut down all the trees this year, catch all the fish, burn all the oil and coal, etc., then GDP counts all that as this year’s income. But true income is defined (after the British economist Sir John Hicks) as the maximum that a community can consume this year and still produce and consume the same amount next year. In other words, it entails maximizing production while maintaining intact future capacity to produce. Nor is it only depletion of natural capital that is falsely counted as income; failure to maintain and replace depreciation of man-made capital, such as roads and bridges, has the same effect. Much of what we count in GDP is capital consumption and anti-bads.

As argued above, one reason that growth may be uneconomic is that we discover that its neglected costs are greater than we thought. Another reason is that we discover that the extra benefits of growth are less than we thought. This second reason has been emphasized in the studies of self-evaluated happiness, which show that beyond a threshold annual income of some $20-25,000, further growth does not increase happiness. Happiness, beyond this threshold, is overwhelmingly a function of the quality of our relationships in community by which our very identity is constituted, rather than the quantity of goods consumed. A relative increase in one’s income still yields extra individual happiness, but aggregate growth is powerless to increase everyone’s relative income. Growth in pursuit of relative income is like an arms race in which one party’s advance cancels that of the other. It’s like everyone standing and craning their neck in a football stadium while having no better view than if everyone had remained comfortably seated.

As aggregate growth beyond sufficiency loses its power to increase welfare, it increases its power to produce illth. This is because to maintain the same rate of growth, ever more matter and energy has to be mined and processed through the economy, resulting in more depletion, more waste, and requiring the use of ever more powerful and violent technologies to mine the ever leaner and less accessible deposits. Petroleum from an easily accessible well in East Texas costs less labor and capital to extract, and, therefore, directly adds less to GDP, than petroleum from an inaccessible well a mile under the Gulf of Mexico. The extra labor and capital spent to extract a barrel in the Gulf of Mexico is not a good or an addition to wealth—it is more like an anti-bad made necessary by the bad of depletion, the loss of a natural subsidy to the economy. In a full-employment economy, the extra labor and capital going to petroleum extraction would be taken from other sectors, so aggregate real GDP would likely fall. But the petroleum sector would increase its contribution to GDP as nature’s subsidy to it diminished. We would be tempted to regard it as more, rather than less, productive.

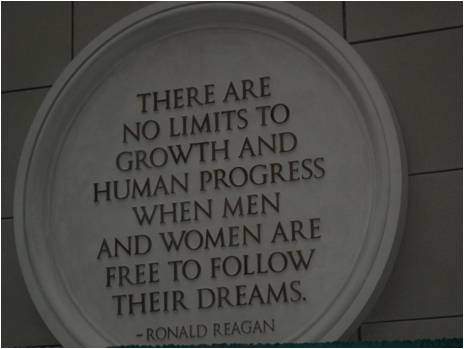

The next time some economist or politician tells you we must do everything we can to grow (in order to fight poverty, win wars, colonize space, cure cancer, whatever…), remind him or her that when something grows it gets bigger! Ask him how big he thinks the economy is now, relative to the ecosphere, and how big he thinks it should be. And what makes him think that growth is still causing wealth to increase faster than illth? How does he know that we have not already entered the era of uneconomic growth? And if we have, then is not the solution to poverty to be found in sharing now, rather than in the empty promise of growth in the future?

Fitting the Name to the Named (March 28, 2011)

There may well be a better name than “steady state economy,” but both the classical economists (especially John Stuart Mill) and the past few decades of discussion, not to mention CASSE’s good work, have given considerable currency to “steady state economy” both as concept and name. Also, both the name and concept of a “steady state” are independently familiar to demographers, population biologists, and physicists. The classical economists used the term “stationary state” but meant by it exactly what we mean by steady state economy; briefly, a constant population and stock of physical wealth. We have added the condition that these stocks should be maintained constant by a low rate of throughput (of matter and energy), one that is well within the regenerative and assimilative capacities of the ecosystem. Any new name for this idea should be sufficiently better to compensate for losing the advantages of historical continuity and interdisciplinary familiarity. Also, “steady state economy” conveys the recognition of biophysical constraints and the intention to live within them economically, which is exactly why it can’t help evoking some initial negative reaction in a growth-dominated world. There is an honesty and forthright clarity about the term “steady state economy” that should not be sacrificed to the short-term political appeal of vagueness.

Fitting the name (and a logo) to the named.

A confusion arises with neoclassical growth economists’ use of the term “steady-state growth” to refer to the case where labor and capital grow at the same rate, thus maintaining a constant ratio of labor to capital, even though both absolute magnitudes are growing. This should have been called “proportional growth,” or perhaps “steady growth.” The term “steady-state growth” is inept because growth is a process, not a state, not even a state of dynamic equilibrium.

Having made my terminological preference clear, I should add that there is nothing wrong with other people using various preferred synonyms, as long as we all mean basically the same thing. Steady state, stationary state, dynamic equilibrium, microdynamic-macrostatic economy, development without growth, degrowth, post-growth economy, economy of permanence, “new” economy, “mature” economy…these are all in use already, including by me at times. I have learned that English usage evolves quite independently of me, although like others I keep trying to “improve” it for both clarity and rhetorical advantage. If some other term catches on and becomes dominant then so be it, as long as it denotes the reality we agree on. Let a thousand synonyms bloom and linguistic natural selection will go to work. Also, it is good to remind sister organizations that their favorite term, when actually defined, is usually a close synonym to steady state economy. If it is not, then we have a difference of substance rather than of terminology.

Out of France now comes the “degrowth” (décroissance) movement. This arises from the recognition that the present scale of the economy is too large to be maintained in a steady state—its required throughput exceeds the regenerative and assimilative capacities of the ecosystem of which it is a part. This is almost certainly true. Nevertheless “degrowth,” just like growth, is a temporary process for reaching an optimal or at least sustainable scale that we then should strive to maintain in a steady state.

Some say it is senseless to advocate a steady state unless we first have attained, or can at least specify, the optimal level at which to remain stationary. On the contrary, it is useless to know the optimum unless we first know how to live in a steady state. Otherwise knowing the optimum level will just allow us to wave goodbye to it as we grow beyond it, or as we “degrow” below it.

Optimal level is one thing; optimal growth rate is something else. Once we have reached the optimal level then the optimal growth rate is zero. If we are below the optimal level the temporary optimal growth rate is at least known to be positive; if we are above the optimal level we at least know that the temporary growth rate should be negative. But the first order of business is to recognize the long-run necessity of the steady state and to stop positive growth. Once we have done that, then we can worry about how to “degrow” to a more sustainable level, and how fast.

There is really no conflict between the steady state economy and “degrowth” because no one advocates negative growth as a permanent process; and no one advocates trying to maintain a steady state at the unsustainable present scale of population and consumption. But many people do advocate continuing positive growth beyond the present excessive scale, and they are the ones in control and who need to be confronted by a united opposition!

War and Peace and the Steady State Economy (April 29, 2015)

My parents were children during World War I, the so-called “war to end all wars.” I was a child during WWII, an adolescent during the Korean War, and except for a physical disability would likely have been drafted to fight in the Vietnam War. Then came Afghanistan, Iraq, the continuous Arab-Israeli conflict, ISIS, Ukraine, Syria, etc. Now as a senior citizen, I see that war has metastasized into terrorism. It is hard to conceive of a country at war, or threatened by terrorism, moving to a steady state economy.

Peace is necessary for real progress, including progress toward a steady state economy. While peace should be our priority, might it nevertheless be the case that working toward a steady state economy would further the goal of peace? Might growth be a major cause of war, and the steady state a necessity for eliminating that cause? I think this is so.

Growth goals beyond the optimum march inevitably toward death and destruction. (CC BY 2.0, manhhai)

More people require more space (lebensraum) and more resources. More things per person also require more space and more resources. Recently I learned that the word “rival” derives from the same root as “river.” People who get their water from the same river are rivals, at least when there are too many of them, each drawing too much.

For a while, the resource demands of growth can be met from within national borders. Then there is pressure to exploit or appropriate the global commons. Then comes the peaceful penetration of other nations’ ecological space by trade. The uneven geographic distribution of resources (petroleum, fertile soil, water) causes specialization among nations and interdependence along with trade. Are interdependent nations more or less likely to go to war? That has been argued both ways, but when one growing nation has what another thinks it absolutely needs for its growth, conflict easily displaces trade. As interdependence becomes more acute, then trade becomes less voluntary and more like an offer you can’t refuse. Unless trade is voluntary, it is not likely to be mutually beneficial. Top-down global economic integration replaces trade among interdependent national economies. We have been told on highest authority that because the American way of life requires foreign oil, we will have it one way or another.

International “free trade pacts” (NAFTA, TPP, TAFTA) are supposed to increase global GDP, thereby making us all richer and effectively expanding the size of the earth and easing conflict. These secretly negotiated agreements among the elites are designed to benefit private global corporations, often at the expense of the public good of nations. Some think that strengthening global corporations by erasing national boundaries will reduce the likelihood of war. More likely we will just shift to feudal corporate wars in a post-national global commons, with corporate fiefdoms effectively buying national governments and their armies, supplemented by already existing private mercenaries.

It is hard to imagine a steady state economy without peace; it is hard to imagine peace in a full world without a steady state economy. Those who work for peace are promoting the steady state, and those who work for a steady state are promoting peace. This implicit alliance needs to be made explicit. Contrary to popular belief, growth in a finite and full world is not the path to peace, but to further conflict. It is an illusion to think that we can buy peace with growth. The growth economy and warfare are now natural allies. It is time for peacemakers and steady staters to recognize their natural alliance.

It would be naïve, however, to think that growth in the face of environmental limits is the only cause of war. Evil ideologies, religious conflict, and “clash of civilizations” also cause wars. National defense is necessary, but uneconomic growth does not make our country stronger. The secular West has a hard time understanding that religious conviction can motivate people to kill and die for their beliefs. Modern devotion to the Secular God of Growth, who promises heaven on earth, has itself become a fanatical religion that inspires violence as much as any ancient Moloch. The Second Commandment, forbidding the worship of false gods (idolatry) is not outdated. Our modern idols are new versions of Mammon and Mars.

Brian Czech is CASSE’s executive director. Herman Daly (1938-2022) was a long-time CASSE board member and economist emeritus.

I’ve missed countless opportunities to advance the steady state by failing to connect the work for peace with the steady state. What a valuable lesson: “This implicit alliance needs to be made explicit.”

Working with Herman and the other writers on the Daly News (Brian Czech and Brent Blackwelder) was a career highlight for me — and an honor too! Brian is 100% correct. Herman didn’t really want us to use the “Daly News” title, but we were able to get him to relent — it was too good of a name to pass up!

I can’t remember if it was Herman Daly or Brian Czech who made this observation (very true):

In microeconomics, there has been for ages the notion of an optimum size of the firm. Beyond that, the marginal (incremental) costs to the firm rise faster then the marginal revenue – so it’s just good sense to not do that, and try to stay at the firm’s optimum size. The microecon notion of optimum size is tried and true, and easily proven (because there are fewer variables to understand in micro) …shouldn’t we apply that notion to *macro*economics too?

I think that everything needed for steady state economics would inevitably flow from that.

In biology, most variables have optimum levels. Blood sugar, body temperature, food intake, pituitary hormones, and on and on. Population also has an optimum level (fuzzier because it depends on lifestyle and other choices–do future generations matter, for example, what will happen with future uninvented technologies). But the scale of the earth being limited, means the size of the human enterprise cannot get too big. We need feedback controls, like a thermostat, to push population and output down if too big for the planet, and up if too small for humans to thrive. Pretty clearly the control should be pushing output and population down now. Herman Daly was a great economist for swimming against the growth mania.

Thank you for this valuable and timely reminder of Herman Daly’s work, which has never been more relevant than today. I had the pleasure of getting to know Herman when he was at the World Bank in the late 1980s. While at the Bank, his early advice to the Government of Brazil to pursue priorities other than economic growth was literally a show stopper. Unfortunately, senior Bank management and the Brazilian Government refused to stop, listen and think, even for a moment.

I have been advocating for the linkages between ecology, economy, peace, and justice forever, well since the 1980’s. I have worked to take this knowledge to the halls where economic development is discussed and acted upon in my community. The powers that be are still obsessed with growth, but I think more and more people are getting it. I think the climate Justice movement is a big part of that.