Next Big Thing or Next Big Mistake?

by Brian Snyder

In 1965, the SNAPSHOT program decided to launch a nuclear power plant into space. Hindsight 20-20, right?

In a 2021 landmark of ludicrousness, Jeff Bezos launched himself, cowboy hat and all, into space aboard a phallus-shaped rocket. But Bezos’ fruitless attempt to fill that gaping hole in his life was only the latest stupid reason to send something to space. Spaceship stupidity goes back to the SNAPSHOT program which, in 1965, sent a working nuclear reactor into space. Not surprisingly, the reactor shut down after a month when a voltage regulator failed, but it still remains in orbit where it will stay for 4,000 years or happens to get hit with debris and plunges back to Earth, whichever comes first. The ironic thing about the SNAPSHOT program is that humans are so incredibly brilliant as to discover fission, build a working nuclear reactor, miniaturize it so that it can fit in a satellite, build a rocket, and send that satellite into orbit for four millennia, yet we can simultaneously be so foolish as not to question whether that is a good idea.

So, let’s imagine that we have some new industry or industrial process that’s proposed as the “Next Big Thing.” Maybe it’s a new technology like social media or carbon dioxide removal, or perhaps a new market like Amazon, or a new currency like Bitcoin. Perhaps it’s just a new way of doing something we already do, like conferencing with Zoom instead of Skype. The question is, when is this change useful and when is it a waste of time, or even harmful? Can we identify when the Next Big Thing is beneficial as opposed to erosive of human wellbeing over the long term? Even in the steadiest of steady states, market economies will be dynamic with winners and losers and creative destruction, so how do we creatively destruct towards a more sustainable economy?

Uneconomic Growth

In the 1970s, Herman Daly used the concept of uneconomic growth to mean growth in which the costs outweigh the benefits. By contrast, economic growth is growth in which the benefits outweigh the costs. I don’t know how easy uneconomic growth was to spot in the 1970s, but today it’s pretty clear. Growth which allows a man to become so rich that he can ride a rocket into space purely to enlarge his ego is unquestionably uneconomic growth. Also, growth generated by creating a platform for people to spread disinformation about vaccines and elections is uneconomic growth.

But it’s one thing for me to write that in a blog post, and another thing entirely to try to quantify it. How could we test the hypothesis that Amazon, Facebook, or any other growing industry, represents uneconomic growth? How do we know when we should pass on the Next Big Thing versus when it represents an opportunity for creating a more just and sustainable economy?

The Benefits of Economic Activity

The problem with understanding the benefits of economic growth is that modern economics—including steady state economics—is utilitarian. In mainstream economics, humans are assumed to behave rationally to maximize their utility, which is akin to saying maximizing their pleasure and minimizing pain. This is only a problem because humans do not actually behave this way, nor do most humans believe that they should behave this way. Instead, humans are complex social creatures with ethical ideals that conflict with utilitarianism. Humans’ poor ability to predict what will and won’t maximize their utility, coupled with a tendency to fail to follow through when we do know what’s good for us, further complicates this system.

Thus, while an economist may argue that the benefits of an industry—say Amazon—are proxied by what people are willing to pay for their products, anyone who has actually interacted with humans would find this laughable. I have a house full of junk—some of it purchased from Amazon—that I do not use, that does not increase my utility, yet I paid for nonetheless. In some cases, people have purchased things I don’t want for me, yet because they are gifts I feel too guilty to discard them, so I’m left owning products that lower my utility.

Instead, what we call the benefits of economic production are often costs, albeit costs difficult to quantify. The brilliant 19th century Swiss economist Jean Charles Leonard Simonde de Sismondi understood this. Writing about the role of the factory and industrialization in his magnum opus in 1819, he wrote:

It is not the improvement of machines which is the true calamity, it is the improper distribution we make of their products. The more we can produce with a given quantity of labor, the more we must increase either our enjoyments, or our leisure; the worker who is his own master, when he would have produced in two hours with the help of a machine what he had before in twelve, would have stopped after two hours… it is the dependency of the worker that brings him to work, not less but more hours per day for the same wages, while the machine enhances his powers of production.

To Sismondi, the benefit of industrialization—the increase in the productivity of labor—was a cost in disguise because it did not result in more enjoyment or leisure for the worker; rather, it resulted in more work, less economic security, and less freedom. Thus, metrics like revenues and production are generally poor indicators of the real, societal value of an enterprise.

But if benefits of economic activity are not proxied by willingness to pay or aggregate utility, how might we measure them? Sismondi provides a clue here too. Sismondi founded what became known as humanist or social economics, a reaction to the in vogue classical economics of the early 19th century. Social economics assumes that humans have certain needs that must be met (ironic link to Mark Lutz’s excellent book on Amazon), and that the meeting of these needs is an objective good that all humans are equally entitled to. These needs include material things like food, water, and shelter, but also include non-material things like security, purpose, and belonging. Thus, the benefits of economic activity might be proxied by the number of people provided these basic needs. Does a dollar spent in a given industry provide employees with safe jobs, the money to meet their needs, and the intangible benefits that make for a meaningful life? If so, that dollar of economic activity may have high benefits.

To return to the case of Amazon, we might view its benefits not in terms of the willingness of customers to pay for its products, but in terms of the pay, security, and sense of purpose it provides its employees. Of course, most industries also contribute to the basic needs of society, and so the way an industry or enterprise treats its employees cannot be the only mechanism by which we separate sustainable from uneconomic activity, but it is a critical and generally overlooked factor. In sum, the benefits of any economic activity are not in terms of products or profits, but are determined by the number of humans provided with a decent standard of living by that economic activity, as well as the number of individuals who derive their intangible but invaluable meaning from that economic activity.

The Costs of Economic Activity

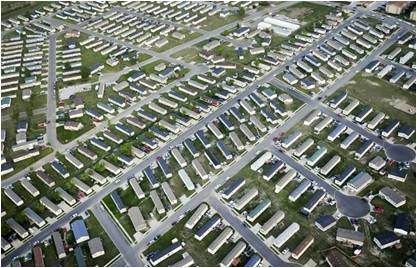

When will we learn to distinguish the “Next Big Thing” from the next big mistake? (CC-BY-NC-SA 2.0, darthdowney)

The costs of economic activity are typically enumerated in terms of eutrophication, global warming potential, air pollution, and other environmental metrics in life cycle analyses. However, this only tells half of the story. Some economic activity has additional impacts on society that might be difficult to predict, yet are especially malignant. Take Facebook, for example. When it emerged in the late aughts, I don’t think anyone predicted that it would help elect Donald Trump or be used to convince people to take horse dewormer. Yet scarcely more than a decade later, here we are. Thus, in addition to asking questions about the environmental impacts of the Next Big Thing, we also need to ask questions about the societal impacts of new economic activity.

What to do when the costs outweigh the benefits?

In sum, the costs and benefits of economic growth are not easily quantifiable. The benefits aren’t in terms of dollars and the costs aren’t entirely in terms of environmental damages. As a result, any kind of rigid weighting of costs and benefits of the Next Big Thing is destined to be incomplete. So how can we decide what Next Big Things are good and which are like Amazon or Facebook?

We need to become comfortable with the idea that we, as a society, have made a mistake. That what we thought was the Next Big Thing was really the Most Recent Big Mistake, and then respond appropriately. Facebook has become a malignancy to American democracy; Amazon exploits workers across its supply chain to sell us junk we don’t need and promotes consumerism. Like the SNAPSHOT program in the 1960’s, we might have seen their costs more clearly ahead of time if we had bothered to look, but unlike the SNAPSHOT program, it is not too late.

Brian Snyder is an assistant professor in the Department of Environmental Sciences at Louisiana State University and a CASSE chapter director.

Happy to see recognition that “Even in the steadiest of steady states, market economies will be dynamic with winners and losers and creative destruction, so how do we creatively destruct towards a more sustainable economy?” It’s a reality that easy talk about steady-state economics tends to avoid. Unfortunately, the article offers few clues on how to identify “uneconomic growth” before the innovation has taken hold.

I recently moved from Montana to San Jose, Ca. Montana is just beginning the dive into urban sprawl. I’m culture shocked to the core by San Jose’s success in paving a huge paradise in favor of a few parking lots and an ever-growing mess of multi-lane freeways.

This is so true: The sheer pointlessness of owning more and more stuff!

I must clear my garage out soon, we might even get the car in there one day.

For me the underlying problem is the systemic pursuit of profit by the corporates. Its the chase for profit that enables their survival so it must be pursued or companies and countries [which rely on taxes] for our health services etc collapse. Life quality and environmental quality are set aside in this focused race. We need to evolve towards a market dominated by cooperatives supported by ethical consumers. This system can then widen beyond the pursuit of profit to the pursuit of benefit.