Behavioral Economics: a Breath of Fresh Air

by Rob Dietz

“Wouldn’t economics make a lot more sense if it were based on how people actually behave, instead of how they should behave?”

-Dan Ariely, in Predictably Irrational (HarperCollins), p. 239.

For anyone who has ever cracked an econ 101 book, behavioral economics is like a breath of fresh air. The approach of behavioral economics differs from that of orthodox economics in essentially one way. Instead of assuming people to be completely rational maximizers of their own self-interest, behavioral economists actually examine how people behave! They accept that (a) our cognitive capabilities may be limited and (b) our decisions are frequently based on something other than pure logic. This difference produces a change in the methods behvioral economists use. Rather than believing a priori that economics is a science that can be reduced to a set of mathematical equations, they actually design scientific experiments to figure out how people make economic decisions.

To understand how good it feels to breathe in the fresh air of behavioral economics, you first have to know what it’s like to be stuck in the stale air of orthodoxy. Economics students have certainly grown tired of gasping and wheezing their way through standard econ courses (see my description of the Econ Scream or take a look at the Post-Autistic Economics Movement). My own troubling experience in the foul air of professional economics taught me quite a lesson.

A few years back I worked for a firm that provided expert testimony in legal cases involving some sort of economic dispute. For example, we were the expert witness in a class action lawsuit that pitted soft drink suppliers (e.g., Coca-Cola and Pepsi) against industrial-sized agricultural firms (e.g., ADM and Cargill). Put aside the fact that this was a battle of “rich/big corporate Team A” versus “rich/big corporate Team B” (do we really care which team wins the lawsuit?). We were hired by the Soft Drink Sellers for obscenely high fees to prove that the Big Ag Boyz were engaged in illegal price fixing – colluding to maintain artificially high prices for artificial sweeteners. We got our hands on all the transaction data, literally millions and millions of records, and our job was to run statistical analyses on price changes to “prove” that the Big Ag Boyz were cheating (if price fixing in agricultural products is a subject that you fancy, there’s a movie you should see).

If the field of economics truly functions like a science, then economic analysis should be able to determine the winner in court cases like this. And our analyses usually did help win cases – we were some of the best economic hired guns around! But something always troubled me (besides the vast amounts of money being contested and wasted). In every case that we ever worked, there was an equally impressive set of expert witnesses on the other side, “proving” the opposite of what we were “proving.” Our economists were mostly affiliated with a prestigious West Coast university, and their economists mostly came from a prestigious East Coast university. I don’t know of too many scientific principles that change based on the longitude where you try to apply them.

A lesson I learned well from my experience as an expert witness, and a lesson the behavioral economists are reinforcing is this: economics in the real world is messy, and economic principles can often be molded to fit one’s purpose.

But along come the behavioral economists! Nobel prize winners like Herbert Simon and Daniel Kahneman helped launch the field by pioneering research on how people and economic institutions make decisions. Recent best-selling books like Nudge by Richard Thaler and Cass Sunstein and Predictably Irrational by Dan Ariely have brought behavioral economics into the mainstream. Ariely’s work, in particular, strikes a chord that is reminiscent of another emergent field – ecological economics.

Ariely does not hesitate to criticize standard or “rational” economics. He recognizes that many economic principles are untested and don’t apply particularly well to experiences in the real world. This passage from his book demonstrates:

…[Standard economics] is incomplete, and accepting all economic principles on faith is ill-advised and even dangerous. If we’re going to try to understand human behavior and use this knowledge to design the world around us – including institutions such as taxes, education systems, and financial markets – we need to use additional tools and other disciplines, including psychology, sociology, and philosophy. Rational economics is useful but it offers just one type of input into our understanding of human behavior, and relying on it alone is unlikely to help us maximize our long-term welfare. (Ariely, p. 328)

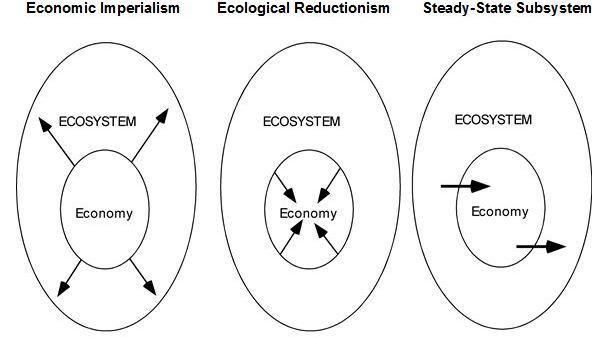

Just as behavioral economists readily appreciate the insights of psychologists, sociologists and philosophers, ecological economists eagerly accept the wisdom of physicists, ecologists and environmental scientists. When Herman Daly, the preeminent ecological economist, analyzes what’s happening in the economy, he starts with the laws of thermodynamics, not unproven assumptions about how people and institutions behave. The idea of perpetual economic growth, although an established tenet to most economists, doesn’t hold water when viewed through the lenses of physics and ecology.

Thank goodness for the Arielys and Dalys in the world of economics. We need people willing to apply both the scientific method and lessons from scientists to the mostly non-scientific field of economics. But we need many more of them. Another quote by Ariely makes this point clear:

…[E]conomists have been very successful in convincing the world, including politicians, businesspeople, and everyday Joes not only that economics has something important to say about how the world around us functions (which it does), but that economics is a sufficient explanation of everything around us (which it is not). (Ariely, p. 326)

Now is the time to make people aware of what the behavioral and ecological economists are saying. Politicians, businesspeople, and everyday Joes can’t go on abiding by the conventional economic wisdom. There is nothing conventional or wise about growing our economy beyond the capacity of natural systems to support it.

Rob Dietz brings a fresh perspective to the discussion of economics and environmental sustainability. His diverse background in economics, environmental science and engineering, and conservation biology (plus his work in the public, private, and nonprofit sectors) has given him an unusual ability to connect the dots when it comes to the topic of sustainability. Rob is the author, with Dan O’Neill, of Enough Is Enough: Building a Sustainable Economy in a World of Finite Resources.

Rob Dietz brings a fresh perspective to the discussion of economics and environmental sustainability. His diverse background in economics, environmental science and engineering, and conservation biology (plus his work in the public, private, and nonprofit sectors) has given him an unusual ability to connect the dots when it comes to the topic of sustainability. Rob is the author, with Dan O’Neill, of Enough Is Enough: Building a Sustainable Economy in a World of Finite Resources.

I think Joseph Stiglitz talk on Green GDP at Asia Society complements the ideas of Behavioral Economics. He talked about how We grow what we measure (GDP), and because we are measuring the wrong stuff, we are growing wrong.

It seems to be in our DNA to want to “grow,” but like a garden, don’t we have a choice about what we grow? Are there ways we can grow our economy that restore abundance rather than consume it? What are the essential things to measure so that we are growing good things?

For more on the Stiglitz Asia Society talk, see:

http://8020vision.com/2009/06/22/nobel-laureate-joseph-stiglitz-on-sustainability-and-growth/

Another great blog entry, but is there any good reason for the use of the phrase and spelling “Big Ag Boyz”? Is it something to do with your name ending in Z? Or is it just an attempt to sound more “urban” or “street” or something?

I’d like to think it’s a comment on the Cokes of this world appropriating culture to make huge wads of cash, but there’s nothing else in the article to indicate that. If there’s not a good reason then I kindly suggest that this is not the way to raise broad support for the campaign. And it could well be easier to reach those people who have gotten little benefit from growth, if we can avoid silly mistakes.

I think there are definitely variables in Economics, but there are also solid foundations of Economics, pillars at which most answers come from. Now, I do agree that these pillars are not like pillars in Math – in math, everything is proven 100%, where as Economics has a lot of assumptions. But certain assumptions, such as people are maximizers, the theory of marginal costs, etc, these COULD change over the course of our species, but they will only change as we evolve. For example, the trate of maximizing is an evolutionary trate, where the ones who did not maximize did not survive, and thus this is a common train that you can apply to practically all humans, common enough that I think you could declare it a pillar.

But what do I know, I have only taken 1 Economics course! I really really enjoyed it though :)

I expect studying the economic behavior of nation-size groups will always be incomplete.

An posting article, but I am wondering why you felt free to name the companies that were parties to the lawsuit you discussed, but coyly did not see fit to mention the names of the east-coast and west-coast universities who contributed economists to the law firms?

Do you feel that industrial and commercial institutions should be held to closer scrutiny or higher accountability than academic institutions? Were you thinking to take advantage of a supposed bias on the part of your academic readers, believing they would enjoy a feeling of lofty superiority to the business world, but that they would see universities as sacred cows? Did you fear some sort of repercussions if you named the universities whose scions were “hired guns” for those big companies?

I’m not saying any of the above are true, but those are the sort of questions that may run through a reader’s mind when he/she spots what appears to be reportorial bias.

Not to get too detracted by what is only a small point of your post, but I think the fact that “there was an equally impressive set of expert witnesses on the other side, “proving” the opposite of what we were “proving.” ” says a lot about one of the major problems with our legal system. This very fault has sent countless (deserving?) people to jail, as someone comes on the stand, talks the talk, and provides the answers the lawyers want and the juries listen too.

Such disciplines as behavioural and ecological economics (and the other variants) make so much more sense that I cannot see why people do not instantly see their superiority. It should be a light bulb slap-head moment but I have introduced the principles to quite a few significant types and they, at best, think the subject is interesting but mostly they just carry on regardless, unscathed by what is far closer to “the answer” than mainstream economics.

I suspect that many people have reached their level of incompetence (the Peter principle) and, being fully versed in the conventional wisdom, have no room, talent or time left to consider anything that might change their cherished beliefs and established behaviour patterns.

Very nice read, thanks!

I appreciate the topic, but I wish your article had a bit more meat in it. I learned from the article that you like the new forms of economics, and you don’t like the traditional form, but I didn’t learn anything substantive about how they differ from each other. What new insights do behavioral economics provide about how we should approach our current situation? How would we change our response to the economic crisis, if our choices were informed by behavioral or ecological economics? What do they provide that’s any more significant than a new bandwagon to hop aboard, when the old one isn’t working properly any more? A couple examples would help greatly, and might increase the number of responses that are focussed on the content, instead of on trivia about who you did or didn’t refer to by what name.

Personally I don’t know from behavioral economics, but the inherent unsustainability of exponential growth is a Major Topic. We’re destroying the planet in order to maintain an illusion of economic prosperity, as it is currently defined. The hard part is that people don’t *want* to hear that our economy is just as obese as our population, and is perhaps even more in need of slimming down. We measure economic health in terms of its growth rate, but Nature doesn’t do exponential growth, it does sigmoidal growth — things approach a steady state as they mature. If humans continue to grow after we mature, we grow sideways, and it makes us sick. The economy isn’t all that different, and we’re way past the point where it’s making us — and the rest of our life support system — sick.

But we’re going to have to think *way* outside the box in order to shrink the darn thing without hurting people. I don’t know if these new economists have a solution or not, but if they even have a hint of an inkling of an idea, that information would be far more important to include in an article about them than a blow-by-blow of a typical corporate dispute.