A Practical Proposal to Erase Externalities

by Randy Hayes and Brent Blackwelder

As the global economy grows, it expands into pristine habitats, interferes with critical ecosystems, consumes more resources, and emits more pollutants. Many activities that fall under the banner of economic growth are undercutting the planet’s ecological systems. At the heart of this tragedy are pollution damages that are imposed on society but not factored into company costs. These damages are called externalities because they are externalized by the businesses generating them.

Every day, producers of myriad products impact the biosphere in ways unknown to customers, investors, and policy makers in both host and home countries. By not undertaking the measures necessary to protect ecosystems, these companies avoid responsibility for the damages. And because they have failed to account for the true costs of their businesses, they can sell their products at lower prices than more ecologically responsible companies, gaining an unfair advantage and reaping undeserved profits.

The consumption patterns in many product markets would change if the true costs of production were reflected in the prices of the products, or even if customers, investors, and policy makers had better access to accurate information. There are many possible paths to full internalization of these externalities, but there is no clear map of the territory. As the United Nations Environmental Programme puts it, “in the current absence of sufficient and comparable company disclosures on the environmental impacts of operations and supply chains,” it is difficult to puzzle our way out of the dilemma. In fact, it is virtually impossible to achieve a sustainable economy unless something is done about pollution externalities.

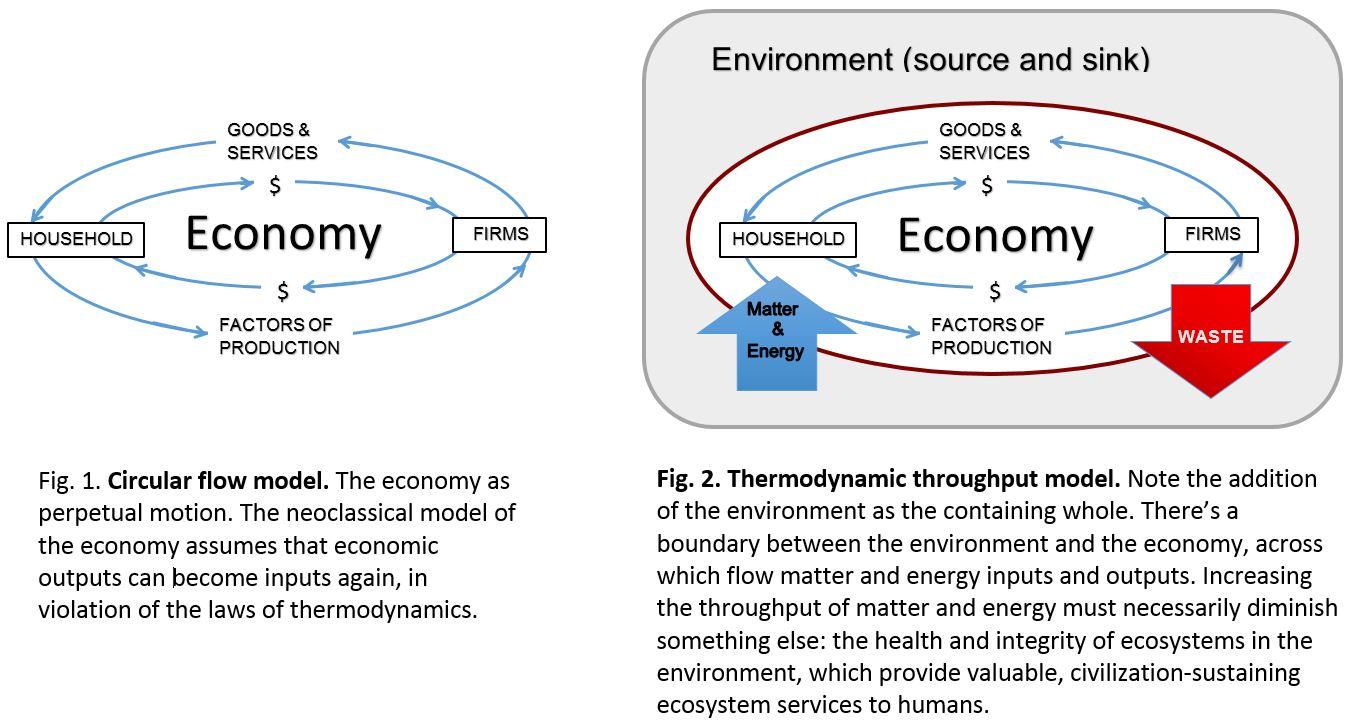

A true-cost economy would align our economic system with nature’s life support systems. Biologists teach us that each living system has feedback loops that allow it to adjust and operate within carrying capacity limits. The human economy is no exception, but we’ve short-circuited an important feedback loop by letting companies externalize the costs of their pollution. The time has come to adopt systematic rules that add pollution costs to the prices of goods and services. Such rules would provide critical information that is necessary to keep the scale of the economy within the planet’s carrying capacity. A true-cost system would solve real problems, but how can we put such a system in place?

A small change at SEC headquarters could have big effects.

The mission of the U.S. Securities and Exchange Commission (SEC) is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. Although the SEC requires public companies to disclose certain financial information, it does not require them to disclose information about their health and environmental externalities. Changing the requirements could produce widespread positive impacts.

Public companies are responsible for as much as one-third or more of all pollution externalities. By requiring these companies to track and report the costs that they typically externalize, we would not only set a legal precedent, but we would also begin to instigate the much deeper social and cultural changes needed to achieve a true-cost economy. If we can compel the largest and often most intransigent corporations to disclose how they are impacting the planet, truth and honesty can begin to displace “dark costs” and secrecy. With such a cultural shift, we will perhaps no longer be talking about imposing disclosure requirements, but rather enjoying increased cooperation and forthrightness.

In the meantime, the transition to a true-cost economy calls for mandatory, annual disclosure of externalities — ecological impact disclosures — by every company that falls under SEC jurisdiction (effectively all U.S. public companies and some foreign issuers as well). Adoption of ecological impact disclosures can be done by successfully petitioning the SEC, passing federal legislation, or both.

CERES (a prominent nonprofit organization), religious groups, and pension funds have pushed for shareholder resolutions and achieved important successes toward institutionalizing broader disclosures. Other groups have petitioned the SEC to adopt a flexible environmental, social, and governance (ESG) reporting framework, such as that developed by the Global Reporting Initiative. These efforts are worth applauding, but we need a bigger, bolder solution that confronts the magnitude of the problem and paves the way for a sustainable, true-cost economy.

The best route is to empower the SEC to force each public company to provide an annual ecological impact disclosure. Such a disclosure would be more effective than a flexible or voluntary framework — it would require specific data, reported in standard forms. Each reporting company would provide information about its own operations as well as those of other companies in its supply chain. In addition to aggregate, company-wide information, companies would provide site-specific data so that the public can determine where impacts are occurring.

Many investors have been calling for this sort of information to help them make better decisions about where to put their money. But this is precisely the kind of information that has been kept from the public for the past century. Keep an eye on the efforts at Foundation Earth over the next year to remedy this situation.

—

Randy Hayes is the founder of the Rainforest Action Network. Brent Blackwelder, a regular contributor to the Daly News, is the president emeritus of Friends of the Earth.

A good step, but it certainly falls totally short of the claim of title to “erase” externalities. There is an exaggerated belief in reporting as a tool of change. Two decades of sustainability reporting hasn’t changed a lot, and the triple bottom lines have little impact. The notion that investors’ ethics are important drivers of change lacks empirical evidence, sadly. It is much more powerful to change the real drivers of business.

It certainly can be one of the erasers. Also the recent creation of the SASB (Sustainability Accounting Standards Board) and the application of ecocommerce for landscape pollution/ecoservices. These efforts are all based on the concept that natural capital exists and is a significant generator of wealth for our economic system. The great challenge on ecosystem-based externalities is the free-ridership, as many get to enjoy the benefits created from an individual, and the transaction costs often outweigh the value created. Both of these high hurdles are cleared with a new economic concept (and an old ecological concept) called symbiotic demand. It should give an economist goosebumps. https://prezi.com/87xwfvhpnas0/symbiotic-demand/

Well Tim, I appreciate your efforts, but don’t believe in the concept. It is true that “The tragedy of the commons” is the tragedy of the economy, so far I am with you. As a matter of fact Hardin modified, or elaborated, his theory quite a lot later on. There are thousands of examples of how well commons are managed totally without economic drivers, by communities caring for their join future. I believe that approach has a lot more to offer than the financialisation of natural capital. “natural capital” as well as “ecosystem services” are good ways of making people understand that there is value there. But I believe we should leave it at that, not trying to actually pay for them, as that will ultimately lead to privatization of nature. And your assurance that the prices will decrease has little support in reality, the opposite is much more likely the case..

We seek just to disclose pollution externalities and make that information public. Correct, exposure doesn’t eradicate, but it is a key step. Dracula was so bad that just the light of day could kill him. The Dracula strategy isn’t sufficient, but it also is a step.

Putting a price (eventually) on problematic practices (which I do favor) is vastly different the putting a price on ecosystem functions (which I don’t favor). With a more true cost economy the cleanest is the cheapest. This is a more level playing field and helps achieve a more fair market economy.