Pulling Back the Curtain on Economic Growth’s Magic Act

by Rob Dietz

A good story often includes a touch of magic — just ask Harry Potter or Twilight fans. See if you can spot the magic in the following passage by Charles Wheelan from his book Naked Economics, in which he considers the question, “Who feeds Paris?”:

Somehow the right amount of fresh tuna makes its way from a fishing fleet in the South Pacific to a restaurant on the Rue de Rivoli. A neighborhood fruit vendor has exactly what his customers want every morning — from coffee to fresh papayas — even though those products may come from ten or fifteen different countries. In short, a complex economy involves billions of transactions every day, the vast majority of which happen without any direct government involvement.

Let’s ignore for now that Wheelan’s “right amount” of fresh tuna corresponds to a disappearing fishery (the closure of vast fishing areas in the South Pacific is a story for another time). Wheelan’s argument and the main message of today’s globalized economy is that Twinkies spontaneously sprout on supermarket shelves. Hamburgers originate from the silver stovetops of McDonalds restaurants. Water itself flows from shiny taps, translucent bottles, and fancy vending machines. We don’t need to concern ourselves with trifling matters such as where this stuff comes from or how it arrives. Because of the magic of the market, we only need to know how to get our hands on sufficient cash, credit, or public funds to buy it. In a nutshell, the argument says that all the cheap food, cheap products, and cheap thrills of modern times spring directly from global trade and economic growth.

Is this the guy responsible for perpetual economic growth?

Photo credit: Yang and Yun

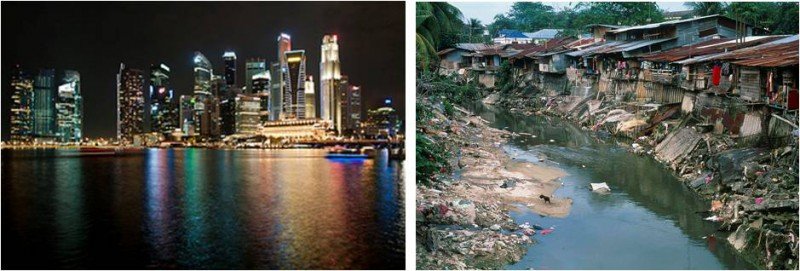

To a neutral observer, it certainly can look like magic — like Adam Smith dressed as Merlin, summoning all this visible wealth with his invisible hand. That’s essentially what Wheelan and other economic analysts are saying. Through the magic of free markets, we can produce and consume an ever-increasing amount of stuff (and as a side note, we’ll be rich enough to clean up any associated environmental messes, or at least export them to less enlightened nations).

That’s some trick, but it’s not real magic — it’s just an illusion. If we take a step back and observe what’s happening, we can expose the illusion and see that the market is hiding something up its sleeve: cheap energy. That’s the crowning achievement of a new book called Energy: Overdevelopment and the Delusion of Endless Growth — it pulls back the curtain on the market’s magic act. With photographs that manage to frighten and inspire at the same time, and with essays that provoke both deep thought and deep concern, Energy clarifies how the economy is able to achieve miracles such as the shipment of papayas to Paris, and it assesses the prospects for keeping the magic going.

Every economic transaction is underwritten by a continuous supply of abundant and cheap energy. This supply “supports the entire scaffolding of civilization.” (p. 8) The complex web of trades and transactions and mass consumption have been made possible by the exploitation of energy-dense fossil fuels. And continued growth of such an economic system requires increasing supplies of energy.

Energy presents facts about the fossil-fueled economy that are well known in several circles but ignored in most:

- One gallon of gasoline, which costs a few dollars, is so energy-dense that it can push a 3,000-pound vehicle twenty miles.

- If human labor were used to meet the energy requirements of a typical American lifestyle, more than 100 people (dubbed “energy slaves”) would have to work around the clock for each American.

- Since the dawn of the industrial revolution, energy use and economic activity have increased in lockstep.

- Fossil fuels are depletable, and burning them produces serious environmental side effects.

These facts help illuminate the predicament of modern society. We’ve built a set of institutions and a way of life that require continuous economic growth. But such growth is entirely dependent on access to cheap energy. And using more and more cheap energy is digging us into a deeper and deeper hole of spoiled landscapes, unstable climate, and biodiversity loss. But politicians, pundits, and the public have swept this predicament away with the insane assumption that economic growth can go on forever because of things like technological ingenuity, market efficiency, and labor productivity (all of which are dependent on access to cheap energy).

It can be a real downer to contemplate the way humanity has used so many energy resources (resources that were given to us by nature) to dig this hole. But the authors of Energy refuse to wallow at the bottom of the hole. Instead, they construct a ladder with rungs made out of ideas for change — ideas like educating the public to develop widespread energy literacy, conserving both energy resources and natural landscapes, and establishing resilient communities. These rungs offer a hopeful transition to better ways and better days. The hopeful conclusion is that we can figure out how to live the good life in a powered-down economy — an economy that accepts enough as its organizing principle rather than more.

In her lyrical and contemplative afterword, Lisi Krall writes, “Perhaps the real question of progress is not how to forge a new energy frontier, but how to forge a different model of economic organization and purpose, a model that isn’t predicated on never-ending growth and a belief that there are no real biophysical limits.” She believes that it’s time to give the magicians the hook. Luckily Krall and her colleagues in ecological economics, along with the authors of Energy, have been working on an economic model that is based on scientific observation and humility rather than magical thinking and arrogance.

Rob Dietz brings a fresh perspective to the discussion of economics and environmental sustainability. His diverse background in economics, environmental science and engineering, and conservation biology (plus his work in the public, private, and nonprofit sectors) has given him an unusual ability to connect the dots when it comes to the topic of sustainability. Rob is the author, with Dan O’Neill, of Enough Is Enough: Building a Sustainable Economy in a World of Finite Resources.

Rob Dietz brings a fresh perspective to the discussion of economics and environmental sustainability. His diverse background in economics, environmental science and engineering, and conservation biology (plus his work in the public, private, and nonprofit sectors) has given him an unusual ability to connect the dots when it comes to the topic of sustainability. Rob is the author, with Dan O’Neill, of Enough Is Enough: Building a Sustainable Economy in a World of Finite Resources.

In my opinion, “energy” is not the full answer to the “Who feeds Paris?” question. The Soviet Union produced and used enormous amounts of energy, yet did not succeed in making consumer products available where they were desired. Clearly, there is more than energy inputs that makes an economy function.

Now consider a steady-state economy that has to live on an annual solar energy budget. Would a free-market system manage to “feed Paris” under these conditions? Or would free markets collapse without growth? Would a Soviet-style central planning system be more efficient under no-growth conditions? Or some other form of economic organisation that we have not yet discovered? I hope your upcoming book will have some good answers.

You are correct, cheap energy does make waste. In fact, what percentage of the economy is waste? We have a lot of room for improving our efficient use and still maintain our quantity of life. It is unfortunate that subsidies and other externalities mask the real costs of energy, so we can’t begin living within our means.

But I will defend the wisdom of Adam Smith and the invisible hand. The invisible hand theory does not state that it is an infallable hand, but that billions of decisions from a vast population generates precise outcomes. If ecological values were included in those billions of decisions, then the invisible hand would guide us toward different outcomes. In fact, I believe that the invisible hand is thee only way to meet our ecological goals. I describe this system as ecocommerce, and its application as symbiotic demand: https://prezi.com/tpfaewgz1jie/symbiotic-demand-an-economic-means-to-apportion-ecological-values/

Very good points Gidon.

The system must accurately account for the “actual costs” of extraction, production, consumption, depletion of non-renewable resources, and waste disposal, and preferably do so in terms of net energy per unit per time per capita. This would require something akin to net energy-based money or credits system reserved 100% and at a velocity of 1.0 to total net energy required at the sustainable standard of material consumption per capita, i.e., sustainable exergetic equilibrium per capita.

“Money” allowed to be a commodity and leveraged via fractional reserve banking in order to make money from money only leads to a rate of money growth far exceeding sustainable production and wages, leading inevitably to debasement of the medium of exchange, fatal loss of purchasing power of labor, profits, and gov’t receipts, and economic, financial, social, and political crises at increasing scale.

Today’s national income accounting in the form of GDP, as many now realize, is hardly more than an inflationary price-accounting scheme, not a measure of optimal utilization of resources and physical and human capital per capita.

But the inflationary debt-money system resulting in gross distortions to price signals and misallocation of savings and resources is not an accident; it is a rentier-parasitic system of extraction of future labor product, profits, and gov’t receipts by a vanishingly small share of the population. Today the US banks (and by extension their owners) own assets equivalent to twice public and private wages. Total US credit market debt owed now has a cumulative compounding interest to term equivalent to US GDP. The debt overhang precludes any further growth of real US GDP per capita indefintely.

Each similar episode in history going back a couple of centuries or more (1930s-40s, 1890s, 1830s-40s, 1780s-90s, 1730s-40s, and 1680s-90s) has ended in debt-deflationary contractions, banking and currency crises, social unrest, wars, and periods of revolution.

We now face a similar debt-deflationary period but this time with Peak Oil and oil exports; falling crude oil production per capita; population overshoot and impending bottleneck; climate change; depletion of forests, aquifers, and arable land; fiscal constraints; increasing automation of labor and loss of jobs and purchasing power, and an incipient Boomer demographic drag taking hold for the next 10-30 years.

Yet, like it or not, we cannot ignore that the evolutionary process tends to self-organize from low-order, low-entropy scale to high-order, high-entropy increasing complexity to the top of a hierarchical structure. We should thus expect that net energy, capital, wealth, income, and political power will continue to concentrate to the top 0.1-1% of households and associated institutions while the bottom 99% will experience falling resources, employment, purchasing power, wealth, and power. The next 9% after the top 0.1-1% still self-identify with the rentier’s extractive values of the top 0.1-1% and the associated economic, financial, social, and political privilege and power derived therefrom. History and human nature implies that there will be no fundamental reform or paradigm shift until the second 9% begin to suffer materially and are abandoned by the top 0.1-1%.

There exists no historical or textbook set of policy prescriptions for the cumulative global effects of the challenges we face as a species hereafter. Capitalism, colonialism, imperialism, socialism, corporate-statism, fascism, anarchism, or all other “isms” have in one way or contributed to where we are today.

Tim, how would one avoid a board of trade for such ecoservices being taken over and increasingly leveraged and financialized by Goldman Sachs, for-profit exchanges, et al.?

The digitized leveraging and financialization of labor, profits, gov’t receipts, and risk in general (creating risk to speculate and profit from increasing risk) via the futures markets around the world is only possible because of the built-in assumption of perpetual growth of output, incomes, profits, taxes, gov’t receipts, and debt-money inflation.

While a local or regional board of trade might function as proposed for a while and for reasons unique to a particular geographic area, if real GDP per capita growth is no longer possible, a system of pricing and allocating scarce resources based on perpetual growth and leverage is not viable.

People are forever saying that a free-market system must be good *because* a soviet-style system is bad, which is a bit like saying a punch on the nose is good *because* a stab is bad :) It’s faulty logic.

There are plenty of other options, such as a mixed system (for example the UK has a free market, ish, in food, but not in healthcare). When food was short, we curtailed the free market by rationing, so everybody got enough. This hasn’t always been the case in, say, Paris: Wheelan, at least in that extract, failed to think about that city’s interesting historical relationship with food!

In response to:

‘Tim Gieseke says:

October 15, 2012 at 8:46 am’

and in reference to:

‘…an economy that accepts enough as its organizing principle rather than more…’

Hi Tim,

It is interesting to hear your comments and I share your views. In trying to solve the issue of excessive greed, which I believe creates the increasing wastefulness within a global economy, we need to see an ‘invisible hand’ move us towards greater efficiency.

As a population becomes wealthier preferences towards sustainability change, but can/should we expect this from a developing nation [for example]? How do we create an organizing principle of ‘enough’, without imposing restrictions (ethically dubious) on those that are out to improve their lot?

The question that I like to challenge myself with, and would be interested to hear your thoughts on is… How can we engage individuals and markets to adopt more sustainable principles without being consciously altruistic?

For fun – have you read The Invisible Hook?

Thanks for the thought provoking article.

Olly

Grosse Domestic Product

Were it a person visiting the doctor it would be advised to have its mouth wired shut

It is a measurement of mass that does not distinguish between muscle and f[i]at

Without real work , inputs turn to fat and strangle vital organs

My brother ecommended I might like this website. He was once totally right.

This submit truly made my day. You cann’t beoieve simply how so mucfh time I had spent for this

info! Thank you!