Two Meanings of “Economic Growth”

By Herman Daly

The term “economic growth” has two distinct meanings. Sometimes it refers to the growth of that thing we call the economy (the physical subsystem of our world made up of the stocks of population and wealth, and the flows of production and consumption). When the economy gets physically bigger we call that “economic growth.” This is normal English usage. But the term has a second, very different meaning—if the growth of some thing or some activity causes benefits to increase faster than costs, we also call that “economic growth”—that is to say, growth that is economic in the sense that it yields a net benefit or a profit. That too is accepted English usage.

Now, does “economic growth” in the first sense imply “economic growth” in the second sense? No, absolutely not! Economic growth in the first sense (an economy that gets physically bigger) is logically quite consistent with uneconomic growth in the second sense, namely growth that increases costs faster than benefits, thereby making us poorer. Nevertheless, we assume that a bigger economy must always make us richer. This is pure confusion.

Economic growth does not equate to a comfortable life for everyone. (Image: CC0, Credit: Billy Cedeno)

That economists should contribute to this confusion is puzzling because all of microeconomics is devoted to finding the optimal scale of a given activity—the point beyond which marginal costs exceed marginal benefits and further growth would be uneconomic. Marginal Revenue = Marginal Cost is even called the “when to stop rule” for growth of a firm. Why does this simple logic of optimization disappear in macroeconomics? Why is the growth of the macroeconomy not subject to an analogous “when to stop rule”?

We recognize that all microeconomic activities are parts of the larger macroeconomic system, and their growth causes displacement and sacrifice of other parts of the system. But the macroeconomy itself is thought to be the whole shebang, and when it expands, presumably into the void, it displaces nothing and therefore incurs no opportunity cost. But this is false of course. The macroeconomy too is a part, a subsystem of the biosphere, of the Greater Economy of the natural ecosystem. Growth of the macroeconomy too imposes a rising opportunity cost that at some point will constrain its growth.

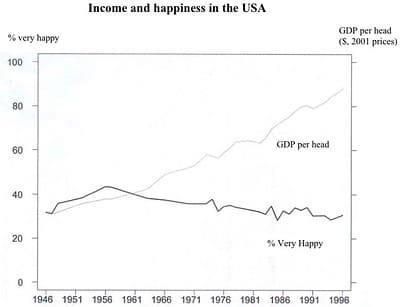

Income and happiness in the US. (Image: CC BY 2.0, Credit: Jorge Cortell)

But some say that if our empirical measure of growth is GDP, based on voluntary buying and selling of final goods and services in free markets, then that guarantees that growth consists of goods, not bads. This is because people will voluntarily buy only goods. If they in fact do buy a bad then we have to redefine it as a good. True enough as far as it goes, which is not very far. The free market does not price bads, true—but nevertheless bads are inevitably produced as joint products along with goods. Since bads are un-priced, GDP accounting cannot subtract them—instead it registers the additional production of anti-bads, and counts them as goods. For example, we do not subtract the cost of pollution, but we do add the value of the pollution clean-up. This is asymmetric accounting. In addition we count the consumption of natural capital (depletion of mines, well, aquifers, forests, fisheries, topsoil, etc.) as if it were income. Paradoxically, therefore, GDP, whatever else it may measure, is also the best statistical index we have of the aggregate of pollution, depletion, congestion, and loss of biodiversity. Economist Kenneth Boulding suggested, with tongue only a little bit in cheek, that we re-label it Gross Domestic Cost. At least we should put the costs and the benefits in separate accounts for comparison. Not surprisingly, economists and psychologists are now discovering that, beyond a sufficiency threshold, the positive correlation between GDP and self-evaluated happiness disappears.

In sum, economic growth in sense one can be, and in the USA has become, uneconomic growth in sense one. And it is sense two that matters.

Herman Daly is CASSE Chief Economist, Professor Emeritus (University of Maryland), and past World Bank senior economist.

Herman Daly is CASSE Chief Economist, Professor Emeritus (University of Maryland), and past World Bank senior economist.

Dear Colleagues

After the ACSE Conference in Washington in January I remarked that there was a lot of impressive “brain-power” but very little traction.

We all do what we know best. I am trained as an engineer (metrics), in economics (metrics) and accountancy (metrics) and concluded that unless the issues that were raised by Professor Daly were addressed … that is getting the metrics reformed … there was never going to be any traction.

People like Professor Muhammad Yunus have also observed that metrics that are solely about profit are not going to help get resources allocated to things that are important for society, and I would agree. A couple of years ago I made a commitment to Dr. Yunus that I would develop a system of accounting that had not only the profit dimension, but also a value dimension. This is now emerging as Community Analytics (CA) which combines all the values that society thinks are important for the community as well as the profit dimension that currently dominates Bloomberg News and the stockmarket … and goes beyond the cash and debt thinking that dominates the dialog about Government in Washington.

The idea that this country has a 50 year backlog of infrastructure maintenance … and 10% or more unemployment suggests an economic system that has broken down.

The idea that the banking and financial sector can be near broke in February and super profitable in December … without the real economy getting any benefit is incredible … and in reality, probably not real anyway … but what does it mean?

I am looking forward to being engaged with the dialog

Peter Burgess

Community Analytics (CA)

@Peter Burgess

Dear colleague,

As far as the alternative instruments of measurement of the economy, you might be interested in reading the article of Roefie Rueting presented during the Paris International Conference on Economic Degrowth in 2008 (http://tinyurl.com/degrowthpedia-Hueting).

Please not also that a working group entitled “Indicators for degrowth. Do we need to measure progress towards sustainable degrowth and if so, how?” will be organized during the Barcelona International Degrowth Conference at the end of March (http://www.degrowth.eu/v1/index.php?id=9).

Regards,

François Diaz Maurin

DegrowthPedia.org

The Daly New, way cool, very necessary, broadly needed. How broadly? Well, with a tad of patience, this Sunday, last day of February, I was pointing out some intriguing aspects of Frederick Soddy’s “Wealth, Virtual Wealth and Debt” to two thirteen year-olds, over lunch, at a ski lodge (the part about economists who avoid thinking about things like justice and entropy also avoid troubling themselves with thought but don’t add to the dignity of the subject) (the kids appreciated the wry humor). After they returned to the slopes a waitress, call her Mrs. Mom, suddenly sat down at my table and asked me, “So what should we do? Exactly.” She took pity on my momentarily speechless incomprehension and explained that she had been listening to me talk with the kids, who themselves had quite a bit to say about the world’s problems. The waitress and I talked seriously for an hour or so. She is very educated. Totally clear about how externalized profits are exemplified in honeybee economics and the ancient bacteria which made an atmosphere for us to live in. She and her husband have a small business and work to externalize profit to their community by employing and helping as small scale capitalists, and they’re proud of it. She was stoked to learn that corporatists are not capitalists and that most if not all their profits are simply the money they save from not cleaning up after themselves. The world is waiting for us to tell our story, my friends. The Daly news is needed everywhere by unexpected people. Many people are hungry for a vision of a new way, something more fun and with liberty and justice for all life forms.

I believe that Mr. Daly has hit upon the crux of the matter in showing the ambiguity of the meaning of economic growth. That is probably the reason that so many people feel they cannot support a steady state economy. They observe rightly that many people who are hungry need to be fed. People without work need to have found what will benefit not just them, but the whole web of being. It is clear also that Infractructure that is in disrepair needs to be mended and replaced.

I propose that the term “economic growth”, used in the second sense, be changed to “fruitful sufficiency.” This term implies that, when everyone has what is needed, there will still be life

galore.

This looks like it will be a very instructive blog. Given that a lot of people in economic development look at economic growth (first definition) as a measure of progress for the developing world; and particulary at per capita GDP as a measure of progress out of poverty:

(1) what replaces the idea of looking at a growing economy (def 1) to determine if there are significantly more resources available to a population on a per capita basis (leaving aside the distribution issues)?; and

(2) in order to reach a steady state economy globally, does that mean that we need to reach a steady state global population and if so, do we know what the carrying capacity of the natural ecosystem is for that population?

Just trying to understand how these pieces fit together.

Professor Daly makes a sound and astute argument, highlighting the confusion in naming all growth in the economy as “economic growth,” when in fact is has been “uneconomic” growth for some time now.

@MaryJo, another benefit of a steady state economy will be the refocusing and redistribution of energy, resources, and wealth. The new economics foundation (nef) recently released a report on redistributing work called “21 hours” (here: http://www.neweconomics.org/publications/21-hours). The concept is great and would work in any country, not just the UK. I would happily work 10% less to eliminate our 10% unemployment here in the states – there is more than enough work to go around.

Great kick off of the new blog!

Cheers,

Joshua Nelson

Excellent that CASSE has launched this blog, and that eminent voices like Mr Herman Daly are contributors!

Concerning Professor Daly’s reference to ‘assymetric accounting’:

The public are very antagonistic about fallible accounting at the moment in the wake of the GFC – the high priests of this fiasco are being questioned by those who don’t usually concern themselves with economics.

This could be the way to talk to the public about steady state economics – ie. you thought the GFC was bad, wait until you find out about the rest of the dodgy accounting.

Daly’s phrase ‘The Greater Economy’ is a wonderful meme, and one we should make use of – people understand concepts like ‘London’ and ‘Greater London’ that London sits within.

Josh – I’d love to work four days a week. I could, except for one thing. Housing in Australia [including rental housing, with high purchase costs passed on] is ridiculous at the moment because of all the easy credit that has been pumped out into the market, with people overextending and bidding ever higher prices. Renting a [decent] place right now would eat up 50% of my wage each month – anything over 33% of your income going on housing = housing stress. Housing affordability is a big determinant of whether you can elect to drop a day and spend it on things other than work. I would love to do so – if I did not have to compete with all these fools borrowing ever more money and sending housing costs skyrocketing!