Sustaining our Commonwealth of Nature and Knowledge

by Herman Daly

Let’s start with this phrase: “Sustaining our commonwealth.” By sustaining, I don’t mean preserving inviolate; I mean using without using up. Using with maintenance and replenishment is an important idea in economics. It’s the very basis of the concept of income because income is the maximum that you can consume today and still be able to produce and consume the same amount tomorrow—that is, maximum consumption without depleting capital in the broad sense of future productive capacity. By commonwealth, I mean the wealth that no one has made or the wealth that practically everyone has made. So it’s either nature—nobody made it, we all inherited it—or knowledge—everybody contributed to making it, but everyone’s contribution is small in relation to the total and depends on the contributions of others. In managing the commonwealth of nature, our big problem is that we tend to treat the truly scarce as if it were non-scarce. The opposite problem arises with the commonwealth of knowledge, in which we tend to treat what is truly not scarce as if it were.

Clarifying Scarcity

The sun is an example of a non-rival good because its warmth is non-scarce and everyone has unlimited access to it. (Image: CC0, Credit: Alexas_Fotos).

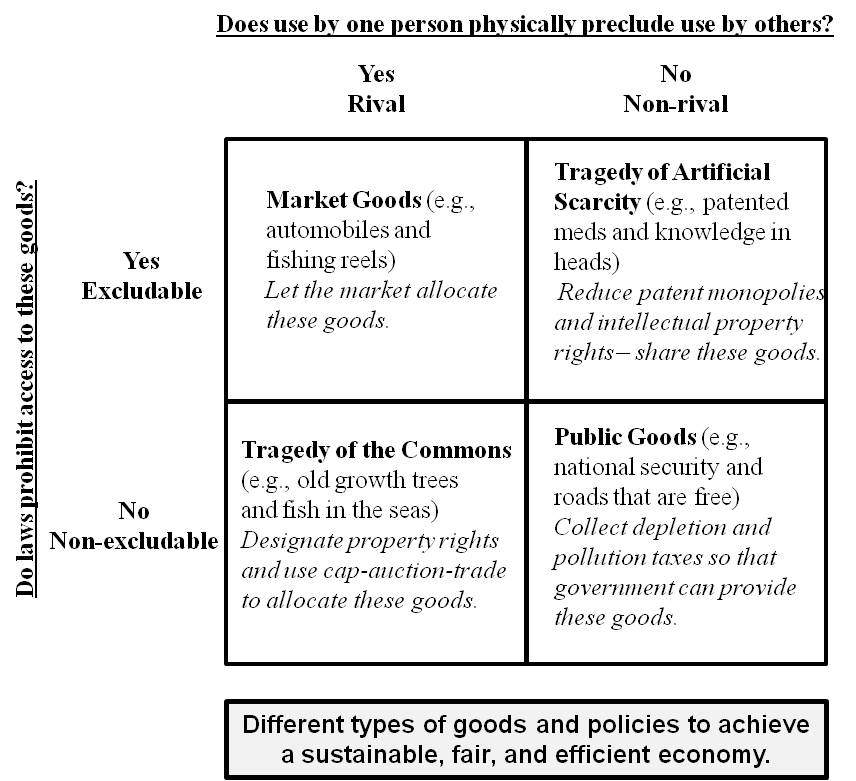

There are two sets of important distinctions about goods and they make four cross-classifications (see figure below). Goods can be either rival or non-rival, and they can be either excludable or non-excludable. My shirt, for example, is a rival good because if I’m wearing it, you can’t wear it at the same time. The warmth of the sun is non-rival because I can enjoy the warmth of the sun, and everyone else can enjoy it at the same time. Rivalness is a physical property that precludes the simultaneous use of goods by more than one person. Goods are also excludable or non-excludable. That’s not a physical concept, that’s a legal concept, a question of property. For example, you could wear my shirt tomorrow if I let you, but that’s up to me because it’s my property. My shirt is both rival and excludable, and that’s the case with most market goods. Meanwhile, the warmth of the sun is both non-rival and also non-excludable. We cannot buy and sell solar warmth; we cannot bottle it and charge for it. Goods that are rival and excludable are market goods. Goods that are non-rival and non-excludable are public goods. That leaves two other categories. Fish in the ocean are an example of goods that are rival and non-excludable. They are rival because if I catch the fish, you can’t catch it. However, they are also non-excludable because I can’t stop you from fishing in the open seas. The management of goods that are rival and non-excludable gives rise to the famous tragedy of the commons—or the tragedy of open-access resources, as it’s more accurately called. Now, the other problematic category consists of goods that are non-rival and excludable. If I use the Pythagorean Theorem, I don’t prevent you from using it at the same time. Knowledge is non-rival, but it often is made excludable through intellectual property and patent rights. So those are two difficult categories that create problems. One is the tragedy of the commons, and the other we could call the tragedy of artificial scarcity.

The Commonwealth of Nature

Fish in the ocean are an example of the commonwealth of nature. I’ll argue that natural goods and services that are rival and have so far remained non-excludable should be enclosed in the market in order to avoid unsustainable use. Excludability can take the form of individual property rights or social property rights—what needs to be avoided is open access. For dealing with the broad class of rival but, up to now, non-excludable goods, the so-called cap-auction-trade system is a market-based institution that merits consideration.

In addition to its practical value, the cap-auction-trade system also sheds light on a fundamental issue of economic theory: The logically separate issues of scale, distribution, and allocation. Neoclassical economics deals mainly with the question of allocation. Allocation is the apportionment of resources among competing uses: how many resources go to produce beans, how many to cars, how many to haircuts. Properly functioning markets allocate resources efficiently, more or less. Yet, the concept of efficient allocation presupposes a given distribution. Distribution is the apportionment of goods and resources among different people: How many resources go to you, how many to somebody else. A good distribution is one that is fair or just—not efficient, but fair. The third issue is scale: The physical size of the economy relative to the ecosystem that sustains it. How many of us are there and how large are the associated matter-energy flows from producing all our stuff, relative to natural cycles, and the maintenance of the biosphere. In neoclassical economics, the issue of scale is completely off the radar screen.

In a cap-auction-trade system, caps would be placed on non-excludable free goods, such as fish. The good would have a price once the cap is reached. (Image: CC0, Credit: 272447).

The cap-auction-trade system works like this. Some environmental assets, such as fishing rights, or the rights to emit sulfur dioxide, have been treated as non-excludable free goods. As economic growth increases the scale of the economy relative to that of the biosphere, it becomes recognized that these goods are in fact physically rival. The first step is to put a cap—a maximum—on the scale of use of that resource, at a level that is deemed to be environmentally sustainable. Setting that cap—deciding what it should be—is not a market decision, but a social and ecological decision. Then, the right to extract that resource or emit that waste, up to the cap, becomes a scarce asset. It was a free good. Now it has a price. We’ve created a new valuable asset, so the question is: Who owns it? This also has to be decided politically, outside the market. Ownership of this new asset should be auctioned to the highest bidder, with the proceeds entering the public treasury. Sometimes rights are simply given to the historical private users—a bad idea, I think, but frequently done under the misleading label of “grandfathering.” The cap-auction-trade system is not, as often called, “free-market environmentalism.” It is really socially constrained, market environmentalism. Someone must own the assets before they can be traded in the market, and that is an issue of distribution. Only after the scale question is answered, and then the distribution question, can we have market exchange to answer the question of allocation.

Another good policy for managing the commonwealth of nature is ecological tax reform. This means shifting the tax base away from income earned by labor and capital and onto the resource flow from nature. Taxing what we want less of, depletion and pollution, seems to be a better idea than taxing what we want more of, namely income. Unlike the cap-auction-trade system, ecological tax reform would exert only a very indirect and uncertain limit on the scale of the economy relative to the biosphere. Yet, it would go a long way toward improving allocation and distribution.

The Commonwealth of Knowledge

If you stand in front of the McKeldin Library at the University of Maryland, you’ll see a quotation from Thomas Jefferson carved on one of the stones: “Knowledge is the common property of mankind.” Well, I think Mr. Jefferson was right. Once knowledge exists, it is non-rival, which means it has a zero opportunity cost. As we know from studying price theory, price is supposed to measure opportunity cost, and if the opportunity cost is zero, then the price should be zero. Certainly, new knowledge, even though it should be allocated freely, does have a cost of production. Sometimes that cost of production is substantial, as with the space program’s discovery that there’s no life on Mars. On the other hand, a new insight could occur to you while you’re lying in bed staring at the ceiling and cost absolutely nothing, as was the case with Renee Descartes’ invention of analytic geometry. Many new discoveries are accidental. Others are motivated by the joy and excitement of research, independent of any material motivation. Yet, the dominant view is that unless knowledge is kept scarce enough to have a significant price, nobody in the market will have an incentive to produce it. Patent monopolies and intellectual property rights are urged as a way to provide an extrinsic reward for knowledge production. Even within that restricted vision, keeping knowledge scarce still makes very little sense, because the main input to the production of new knowledge is existing knowledge. If you keep existing knowledge expensive, that’s surely going to slow down the production of new knowledge.

In Summary

Managing the commonwealth of nature and knowledge presents us with two rather opposite problems and solutions. I argued that the commonwealth of nature should be enclosed as property, as much as possible as public property, and administered so as to capture scarcity rents for public revenue. Examples of natural commons include mining, logging, grazing rights, the electromagnetic spectrum, the absorptive capacity of the atmosphere, and the orbital locations of satellites. The commonwealth of knowledge, on the other hand, should be freed from enclosure as property and treated as the non-rival good that it is. Abolishing all intellectual property rights tomorrow is draconian, but I do think we could grant patent monopolies for fewer “inventions” and for shorter time periods.

Herman Daly is CASSE’s Chief Economist, Professor Emeritus (University of Maryland), and past World Bank senior economist.

Herman Daly is CASSE’s Chief Economist, Professor Emeritus (University of Maryland), and past World Bank senior economist.

Hmm. If new knowledge is treated as if it has an opportunity cost of zero – therefore zero price – that will be a gigantic, powerful market signal which will severely restrict those people who study and think long and hard to form and increase their ability to innovate and come up with new concepts.

“Genius is one per cent inspiration, ninety-nine per cent perspiration” Edison

“I know of no genius but the genius of hard work.” John Ruskin

Brilliant and wise analysis of how markets *should* work. It’s always a pleasure to read something from Daly, even if the message is sobering.

The bit about artificial scarcity is spot on. Knowledge is the one thing that *is* an infinite resource. What a strange world we have created! Finite resources are regarded as infinite, while knowledge is subjected to finite resource constraints through elaborate policing and legal frameworks.

Nick

Herman Daly does recognise that patent monopolies should be granted in the case of “inventions” and “innovations” but it should be granted for a limited period.

Nobody disputes that creating new knowledge is hard work, but that hard work should be rewarded by the community as a whole in the form of public funding, not in the form of an economic rent which is sometimes derived by people who did not contribute to the new knowledge themselves.

Is oil an example of the “the tragedy of the commons” (actually “open access regimes” as you say in “Ecological Economics”)? That is, is oil an example of a rival and excludable commodity (market good), or is it rival and non-excludable (open access regime)?

Intuitively, it seems that oil should fall in the category of “the tragedy of the commons.” We are going after oil just like old growth trees and fish in the sea. It is depleting. Peak oil is upon us, and we need to do something about it. If I consume a barrel of oil, you can’t, so it is definitely rival. We should set up something like a cap-auction-trade system for oil, or Heinberg’s “oil depletion protocol.”

But it seems it is also excludable commodity. All the oil in the world is already (in principle) privately owned, unless someone discovers oil in Antarctica or some place where no country’s laws are operational. I can sit on my oil, buy it, or sell it. According to this analysis it is both rival and excludable and should then be a market good. This doesn’t seem right, though, because the free market is exactly what is preventing us from dealing with peak oil. In other words, I want to put it in the “tragedy of the commons” category but I can’t because it is both rival and excludable.

Since oil is the prime example of a commodity that should be addressed by ecological economics, I think someone should address this in an authoritative way (you, or one of your graduate students or someone like that).

I think the answer is that oil is actually NOT an excludable commodity. You can refuse to sell me your oil, but I can always go somewhere else and buy that oil at whatever the market price is. Your oil is excludable, but “oil” in general is not. OPEC is actually an example of a group of people trying to make it excludable and pretty much failing, so far. I think that this has something to do with the fact that oil is “fungible” commodity.

Could you or someone else please address this in an authoritative way? I think I’m on the right track but I have no formal training in economics. Oil is a sufficiently important resource so that there should be no ambiguity on this point. This should not simply be left as an “exercise for the student” if we want ecological economics to gain respect.

Keith Akers

In terms of the oil question, my first thought is that the oil needs to be identified in terms of oil deposits and barrels of oil. What a great request by Keith Akers.

In terms of Mr. Daly´s concepts, I think it´s very interesting. Cap auction trade for non-excludable rival goods, though, is one example where I sense the need for elaboration. Current conditions of carbon trading reveal the basic weaknesses of financial practices, since they are market-centric, and ecologically under-literate. Janet Redman of the Institute for Policy Studies has done some great investigations of carbon credits and the Kyoto Protocol mechanisms, involving Mr. Daly´s “alma mater” the World Bank.

Some may have appreciated how I like to function in an interdisciplinary process of reasoning. Here goes. An effective societal educational culture based on ecological literacy needs to be established for a realistic cap. I think the necessary alternative includes the political economic perspectives that include civil society and alternative business models and their “whole cost accounting” impacts, social and environmental. The disciplines of international relations and law have demonstrated a related process in the constructivist and interactionist approaches. As such, the orthodox concepts of interacting parties become reformulated.

For example, the non-profit NGO PIRG´s have started their own green businesses, such as Green Century Mutual Funds, McDonagh Braungart Design Chemistry has developed a green certification for industrial products, economist Michael Conroy has become deeply involved in NGO third party certifications, as has Jared Diamond (formerly WWF), and three members of a food co-operative initiated a fair trade food importer that they subsequently turned into an employee-owned business and worker co-operative, Equal Exchange. Renewable energy co-ops in Europe, such as England´s Baywind and Germany´s FESA´s projects, are related examples.

As economist David Ellerman has helped probe orthodox neoclassical assumptions regarding ownership, and sociologist Philip McMichael has discussed the fair trade and via campesina movements, I find that policy prescriptions themselves have to be evaluated for their assumptions. Whole cost accounting provides an effective overall perspective, I would suggest, which Mr. Daly himself has delved into as a pioneer.

Also, the rhyming in the graphic is pretty slick…..”automobiles and fishing reels” etc…..

It seems to me that the concept of “excludability” requires review and greater clarity. The concept is a graduated one based on components of a social component in the legislative legal context, along with enforceability axis based on geophysical features and monitoring technology. In the case of old-growth trees, legal agreements were made and engineered based on lobbying and party-oriented links under various administrations permitting expanded corporate logger access. In the case of some kinds of royalties alone, there were problems I recall reading in recent years. In terms of policy ideals, I would suggest the additional need for pollution and depletion taxes in this category, in accordance with what Doc Daly mentions in his piece.

Nevertheless, third party certifications like the Forest Stewardship Council discussed in Jared Diamond´s Collapse and Michael Conroy´s Branded already represent an approach in which other dimensions are managed. A variety of scholars have written on the dynamics of transaction cost barriers and social power relations with hints of such elements in J.S. Mill´s work, from Thorstein Veblen to J.K. Galbraith, to William Dugger, Mark Lutz, and most recently, David Ellerman.

Thus, I suggest the concept of excludability requires greater clarity. The greater examination of Doc Daly´s reference to “property rights” can especially involve the discussion of transaction cost barriers and social power relations and undue influence. Without this discussion and expanded treatment, the process of auctioning rights to the highest bidder still faces underlying issues. I would suggest the “socially responsible business model,” an expanded notion of a firm based on existing co-operative models and expanded to include whole cost accounting and green business categories.

In thinking of the oil question, my thinking is that oil deposits are highly excludable, since claims can be staked. I recall reading in recent years that royalties owed governments by corporations from public land extraction was lagging, however. In this case we see the public use of land in a similar sense to leased claims on private property.

The example of Alaska´s yearly payment to residents of an oil revenue stipend represents a social philosophy touching on broad public ownership, with majority excludability generated for the corporation in question.

Hundreds of dynamic non-profits like Amnesty International, Oxfam, and Global Witness have joined in a coalition, Publish What You Pay, to advocate for transparent accounting and financing in extractive industries to address the complications of the social dimensions of transaction cost barriers and social power relations. Excludability, the legal power to establish some level of property rights to a commodity claim, then relates us to additional underlying implications of property rights.

If we then combine Alaska´s citizen petroleum rebate, with the consumer oil co-ops of the 1930s, with BP, Shell and others green energy investments, with a multi-billion high tech employee owned firm like SAIC (discussed in W. Greider´s The Soul of Capitalism), we can begin to imagine the impacts of policies impacting corporate governance, especially towards the “socially responsible business model.”

In researching my master´s thesis, I came across the European Working Councils, related to the ILO´s tripartite governance model, and a reference to the existence of environmental corporate governance imperatives in one or more European countries.

Corporate governance, and the economics of the firm, then, is one of the categories I am suggesting offer greater clarity of the issues we´re discussing here.

Sorry, it´s the European Work Councils…. Wheeler for one, and Mueller and Rueb for another have written on the subject. The concept of corporate governance, however, remains unchanged.

Incidentally, if anyone on the board of CASSE is looking for a doctoral student, I´m in the market….; ^)

Ok. Renewable energy offers an excellent example of the redefinition of excludability in electrical power generation and distribution. Through citizen action, protests inspired artisans, and neighbors got organized, all of which makes the inspiring story of the Danish pioneers of modern wind technology beginning in the 1970s.

While renewable energy efforts in the US were largely shut down for years, Germany soon followed suit with farmers spurring their domestic manufacturers. The UK got going with some boost from an initiative by some Swedes, and at some point some people in the Minnesota and elsewhere in the US made some progress in decentralized energy. Canada has some efforts, and the general policy of Feed in Tariffs is creating opportunities around Europe, the world, and even the US.

Jeff Goodell has written a great book, Coal, with some vivid accounts of the formative years of the centralized generation and distribution model. I´d write a book on the subject, but I´m still not affiliated with a supportive situation. Nevertheless, this subject is fascinating and helped fill my master´s work with interesting material.

Hi Mark R.,

I just found your blog by following your link. Very interesting.

Daly’s four-fold classification is important but a bit confusing. Excludable / rival, excludable / not-rival, not-excludable / rival, and not-excludable / not-rival. I had to read the appropriate texts in “Ecological Economics” several times before I got it. Excludability is a legal concept, and rival is a physical concept. Patents and software are excludable but not rival: I can make you pay for them, but there is no reason in principle why we can’t both use them physically. “Open access regimes” (= so-called “tragedy of the commons”) are things where there are no legal limitations at all, just go ahead and chop down those trees, we don’t care — but there are physical limitations on our both using them; if I chop down a tree then that tree is not available to you.

I think that oil is more like old-growth forests and fishing rights than it’s like ordinary market goods like pizza. It’s true that you can own oil, but it is a natural resource which can be obtained by anyone and there is a market for it. For all practical purposes, it functions like a “commons.” Anyone can, via the market, go after it, buy it, and burn it. You can hang on to your 0.0000001% of the world supply — maybe. OPEC is the only brake on this process, and they are setting quotas only out of a sense of maintaining the long-term profitability of their oil, not for ecological reasons. And OPEC quotas are frequently dodged, anyway. So I’d say oil is rival but for all practical purposes not excludable. To make it excludable in practice would take a treaty of some sort like Kyoto aspired to be.