Three More Growth Fallacies

by Herman Daly

In a previous essay, I identified eight fallacies about growth. Well, at the risk of starting a growth industry, here are three more.

1. As natural resources become scarce, we can substitute capital for resources and continue to grow.

Growth economists assume a high degree of substitutability between factors of production. But if one considers a realistic analytic description of production, as given in Georgescu-Roegen’s fund-flow model, one sees that factors are of two qualitatively different kinds: (1) Resource flows that are physically transformed into flows of product and waste and (2) capital and labor funds, the agents or instruments of transformation that are not themselves physically embodied in the product. There are varying degrees of substitution between different resource flows and between the funds of labor and capital. But the basic relation between resource flow on the one hand, and a capital (or labor) fund on the other, is complementarity. You cannot bake a 100 pound cake with only one pound of ingredients, no matter how many cooks and ovens you have. Efficient cause (capital) does not substitute for material cause (resources). Material cause and efficient cause are related as complements, and the one in short supply is limiting. Complementarity makes possible the existence of a limiting factor, which cannot exist under substitutability. In yesterday’s empty world the limiting factor was capital; in today’s full world remaining natural resources have become limiting.

Growth economists have wrongly substituted capital for natural resources, as seen in their support of mechanized agriculture. (Image: CC0, Credit: wobogre).

This fundamental change in the pattern of scarcity has not been incorporated into the thinking of growth economists. Nor have they paid sufficient attention to the fact that capital is itself made from and maintained by natural resource flows. It is hard for a factor to substitute for that from which it is made! And consider yet another oversight. Substitution is reversible—if capital is a good substitute for resources, then resources are a good substitute for capital. But then why, historically, would we ever have accumulated capital in the first place if nature had already given us a good substitute? In sum, the claim that capital is a good substitute for natural resources is absurd.

In reply to these criticisms, growth economists point to modern agriculture, which they consider the prime example of substitution of capital for resources. But modern, mechanized agriculture has simply substituted one set of resource flows for another, and one set of funds for another. It has partially replaced soil, sunlight, rainfall, and manure, with other resources, namely fossil fuels, chemical fertilizers, pesticides, and water pumped from rivers and aquifers. The old resource flows (soil, sunlight, rain, manure) were to a significant degree replaced by new resource flows (fossil fuels, chemicals, irrigation water), not by capital! The old fund factors of labor, draft animals, and hand tools were replaced by new fund factors of tractors, harvesters, etc. In other words, new fund factors substituted for old fund factors and new resource flows substituted for old resource flows. Modern agriculture involves the substitution of capital for labor (both funds) and the substitution of nonrenewable resources for renewable resources (both flows). In energy terms, it was largely the substitution of fossil fuels for solar energy, a move with short-term benefits and long-term costs. But there was no substitution of capital funds for resource flows. The case of mechanization of agriculture does not contradict the complementarity of fund and flow factors in production.

2. Space, the high frontier, frees us from the finitude of Earth and opens unlimited resources for growth.

In a secular age where many have lost faith in the spiritual dimension of existence and where the concept of “man as creature” is eclipsed by that of “man as creator,” it is to be expected that science fiction might be called on to fill the dead void of space with a happy population of “survivors.” The spiritual insights of millennia are replaced by technocratic projections of the “Singularity” in which mankind attains the final goal of (random?) evolution and becomes a new and immortal species, thanks to the salvific power of exponential growth in information processing technology. Moore’s Law promises eternal silicon-based life for the new elect who can stay alive until the Singularity; oblivion for those who die too soon! And this comes from materialists who think that they have outgrown religion!

Space tourism: An unfounded reason to believe in infinite economic growth. (Image: CC0, Credit: inspaceforum).

Of course, many technical space accomplishments are real and impressive. But how do they free us from the finitude of the earth and open up unlimited resources for growth? Space accomplishments have been extremely expensive in terms of terrestrial resources and have yielded few extra-terrestrial resources—useless moon rocks that some fledgling astronaut managed to steal from NASA in a bungled attempt to sell them for their collector’s value, plus some space tourism for a few billionaires to take orbital joyrides. On the positive side of the ledger, we can list communications satellites but they are oriented to earth, and while they can help us use Earth’s resources more efficiently, they do not bring in new resources. And apparently some orbits are getting crowded with satellite carcasses.

Robotic space exploration is a lot cheaper than manned space missions, and may (or may not) yield knowledge worth the investment to a society that cannot afford basic necessities and elementary education for many. The opportunity cost of indulging the expensive curiosity of a few is to leave undeveloped the capacities of many. Were it not for the heavy military connection (muted in the official NASA propaganda) we would probably be spending much less on space. Cuts in NASA’s budget have led to the over-hyped reaction by the “space community” in proclaiming a pseudo-religious technical quest to discover “whether or not we are alone in the universe,” as opposed to how to zap other Earthlings with laser beams from space. Another major goal is to find a planet suitable for colonization by Earthlings. The latter is sometimes justified by the observation that since we are clearly destroying the earth we need a new home—to also destroy?

The numbers—astronomical distances and time scales—effectively rule out dreams of space colonization. But another consideration is equally daunting. If we are unable to control population and production growth on earth, which is our forgiving and natural home, out of which we were created and with which we have evolved and adapted, then what makes us think we can live as aliens within the much tighter and unforgiving discipline of a space colony on a dead rock in a cold vacuum? There we would encounter limits to growth raised to the hundredth power. Sorry for being such a “pessimist!”

3. Without economic growth, all progress is at an end.

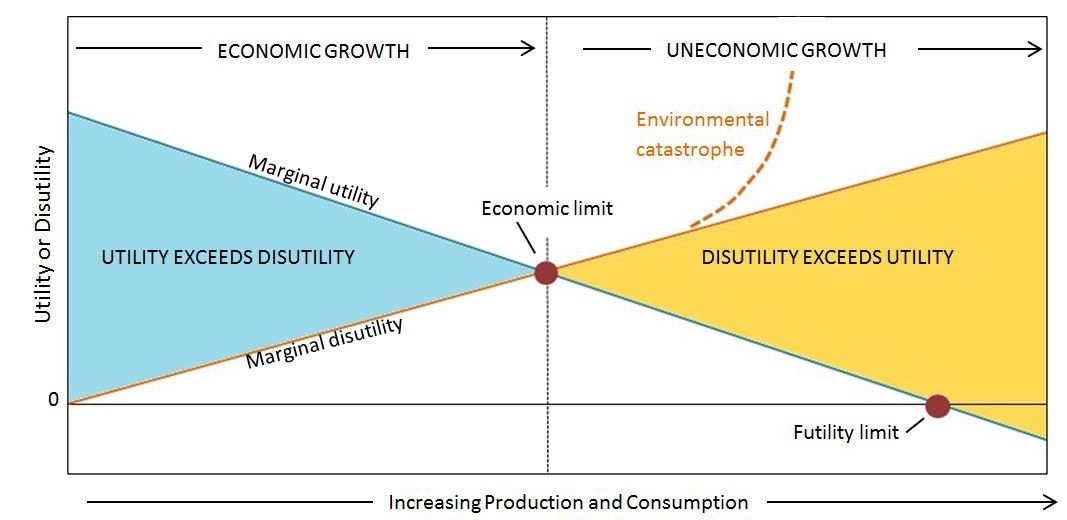

On the contrary, without growth (now actually uneconomic growth if correctly measured), true progress finally will have a chance. As ecological economists have long argued, growth is a quantitative physical increase in the matter-energy throughput, the metabolic maintenance flow of the economy beginning with depletion and ending with pollution. Development, in contrast, is qualitative improvement in the capacity of a given throughput to provide for the maintenance and enjoyment of life in community. The main ways to develop are through technical improvement in resource efficiency, and ethical improvement in our wants and priorities.

Development without growth beyond the Earth’s carrying capacity is true progress. Growth means larger jaws and a bigger digestive tract for more rapidly converting more resources into more waste, in the service of unexamined and frequently destructive individual wants. Development means better digestion of a non-growing throughput and more worthy and satisfying goals to which our life energies could be devoted.

Herman Daly is CASSE Chief Economist, Professor Emeritus (University of Maryland), and past World Bank senior economist.

Herman Daly is CASSE Chief Economist, Professor Emeritus (University of Maryland), and past World Bank senior economist.

Have you looked at Charles Eisenstein’s recent book, Sacred Economics? He’s made it freely available online here:

http://www.realitysandwich.com/homepage_sacred_economics

He paints what appears to be a deeply researched portrait of the history of money and exchange, making the argument that since money is created as debt that must be repayed with interest, there can never enough money to pay off all the debt, so continuous economic growth is necessary to repay the continuously growing debt.

He presents a vision of another way forward, including the idea of reviving a gift economy (noting that many areas, from childcare to music, that used to be freely available or unpaid are increasingly being sucked into the monetary economy due to the need for endless growth) and the idea of creating a new kind of money issued with built-in “negative interest” so that it decays in value over time, thereby inducing people to spend it quickly to keep the economy vibrant.

And he, like you, criticizes the absurdity of basing our economic system on endless growth.

Given my minimal, Econ-101 level education, I have a few questions inspired by his writing and yours:

1. In your previous article, you refute the fallacy that “Knowledge is the ultimate resource and since knowledge growth is infinite it can fuel economic growth without limit.” But in the current article, you approvingly suggest a similar sounding possibility when you say “Development, in contrast, is qualitative improvement in the capacity of a given throughput to provide for the maintenance and enjoyment of life in community.” (Would not such development be based on new knowledge?) Anyway, my question is, could sustainable growth in real GDP (sufficient to pay off the endlessly increasing debt resulting from our use of “interest money”) potentially be driven by this kind of development rather than by the sort of growth that increases use of natural resources?

2. Some debts are never repaid, due to bankruptcies and other defaults. Does factoring this in mean that exponential growth, however much it may be promoted by politicians and economists, is not actually necessitated by the money system? (I suspect that bankruptcy/default rates are taken into account in the process of setting interset rates, so that the total amount of money/debt does have to keep growing despite the defaults, just as inflation doesn’t ameliorate these problems since it’s factored out in the computation of real GDP, but economics background isn’t solid enough for me to be sure if I’m thinking about these issues correctly.)

3. Could Eisenstein’s idea of negative interest be implemented effectively? I have the vague notion that interest rates are an emergent property of the whole economy, based on how much profit typical companies are able to generate or something. But I also hear of interest rates being set more or less arbitrarily by the Fed, and I don’t understand how that’s possible. Can the Fed really set interest rates at any level it wants? Would it be possible to just decree a negative interest rate? Wouldn’t profit-motivated people/bankers swoop in and offer positive interest because they could capture deposits and make money by doing so?

I’d very much appreciate any insights you (or your other readers) can offer!

I caught a presentation that Charles gave in Corvallis a few months back, but I still haven’t found the time to read his book yet — thanks for sharing the link. Regarding your questions, you might be able to generate some good discussion (and possibly even some answers) on the SteadyStaters Google group:

https://groups.google.com/forum/?fromgroups#!forum/steadystaters

Thanks,

Rob

Three good questions, Neo. Some thoughts on each:

1. Qualitative development as possible source for growth in real GDP? With a Constant throughput development can increase welfare, assuming improving ethics and technology (knowledge). Without limit? I don’t know, but doubt it. But would increasing welfare register as real GDP increase? GDP is P*Q, and “real” means the price level P is held constant, so as to measure change in Q, which always has a physical dimension, even for services. With constant aggregate resource throughput the physical component of commodities must diminish as the number of commodities “Q” grows, giving rise to “angelized GDP”. So while I advocate development as qualitative improvement in knowledge and morality, I do not think it will save the goal of continually increasing real GDP, and really don’t much care what happens to real GDP, as long as throughput is held to a sustainable level, and used with efficiency and wisdom to maximize welfare.

2. If exponential growth is considered normal, then bankruptcy and debt cancellation must also be taken as normal. To avoid the latter we must not base our economy on the former. With 100% reserve requirement on demand deposits Banks can no longer create money by lending it into existence at interest. Non interest bearing government money can be earned, saved, and then lent by the saver at interest to a willing borrower. The saver is giving up what the borrower receives, unlike a fractional reserve bank. The problem is not interest per se (although it can be easily abused, especially in a society of great inequality) but rather allowing the private Banks to charge interest to the public for the very existence of money, a public utility that the government can supply at negligible cost.

3. As you indicate the interest rate is an emergent property, a price subject to supply and demand in a market economy. The policy variable should be the government issued money supply limited by a price índex to avoid inflation. I think the idea of manipulated negative interest rates, or “demurrage” is unnecessary in a system of 100% reserves in which investment would be limited by savings, mediated by an interest rate. Why try to push growth with a fictitious negative interest rate? Do we need a financial stimulus to grow more when the effective constraint is limited resources in a finite world? Does not make sense to me. There are better ways to deal with unemployment and inequality than stimulating aggregate growth with negative or even very low interest rates.

On #1, thank you, that makes sense.

On #2, I hadn’t known that you propose a 100% reserve requirement, but I can see that with 100% reserves, a saver charging interest isn’t causing more money to be created, so this would be a different way to solve the problem Eisenstein’s book describes.

But I still have a suspicion there’s some basic flaw in Eisenstein’s argument that I’m not seeing. Look at his little story under the bold header “An Economic Parable” starting about 3 screens down on this page:

http://www.realitysandwich.com/sacred_economics_ch_6_usury

and the first 3 paragraphs of the section after it called “The Growth Imperative.”

Does his analogy seem correct to you? That is, do you agree that the fact that money is lent at interest may be the root cause driving our society’s constant push for growth?

On #3, I still wonder how the Fed is able to set interest rates if they should be an emergent property of the economy? Is it because they have the power to create arbitrary amounts of money, so actually they’re modifying the economy itself in such a way that interest rates end up being whatever they want to set them at?

As for the negative interest idea, Eisenstein definitely does *not* see this as a tool to promote growth, since he also argues for an end to growth. (Right after chapter 12 “Negative-Interest Economics” is chapter 13, “Steady-State and Degrowth Economics.”)

I think he sees negative interest more as a way to discourage hoarding of wealth and promote vibrant local economies, in addition to its primary feature of ending the spiral of endlessly increasing debt that he sees as the root driver of economic growth. (He also suggests that there should be many separate local negative-interest currencies at different geographical scales, and he imagines curriencies “backed” by things with intrinsic value, such as clean water, rather than something shiny but relatively useless like gold, though I’m not clear how that would work in practice.) I wonder what he’d think about a 100% reserve requirement as an alternative strategy.

I think Eisenstein makes many good points. I will read him more carefully. But for now I will mention some problems I have with what I have read so far at your suggestion. My comments are interspersed in the following quoted paragraph:

“The problems start with interest. Because interest-bearing debt accompanies all new money [no, government-issued currency is not interest-bearing, and in a 100% reserve system it would be the only money in existence] at any given time, the amount of debt exceeds the amount of money in existence. The insufficiency of money drives us into competition with each other and consigns us to a constant, built-in state of scarcity. [the insufficiency of money is easily relieved by printing more and even in inflationary times with money superabundant scarcity persists. Scarcity of non rival goods such as knowledge is a social construct, but scarcity of rival goods is real when need exceeds availability] It is like a game of musical chairs, with never enough room for anyone to be secure. Debt-pressure is endemic to the system [to the fractional reserve banking system.] While some may repay their debts, overall the system requires a general and growing state of indebtedness.”[a growing economy can get away with growing indebtedness for a while, but collapses when real growth cannot keep up. As Frederick Soddy said “You cannot permanently pit an absurd human convention, such as the spontaneous increment of debt [compound interest], against the natural law of the spontaneous decrement of wealth [entropy]” . This realization led Soddy to 100% reserves. I think it should lead Eisenstein to the same conclusion, but so far I have seen no advocacy, or even consideration of 100% reserves, even though I see much else of value.

As for the chicken economy parable, it is instructive, but the villagers could say to the banker, “thank you very much for introducing us to the idea of money, but rather than pay you perennial interest for creating it at negligible cost to yourself, we will just create it ourselves at negligible cost, without paying interest to you or anyone. Here is a gift of five chickens as a token of our appreciation for your teaching us about money. Goodbye.”

Getting rid of interest as a payment for the very existence of money is clearly a good idea. 100% reserves does that. But if you earn and save this non interest bearing money, and I want to borrow some from you, and you agree with my plan, then prohibition of interest on such a loan is much less clear. You are actually giving up what I receive. In a non growing economy interest on such a loan would be paid out of redistribution rather than growth, and reasons for opposing it would be based on ethical limits on distribution, as with the ancient Hebrews’ jubilee year. Maybe qualitative development would be sufficient to justify positive interest, but at a much lower rate than in a growth economy. The idea of negative interest rates still seems to me a non starter. We already have negative real interest rates driven by the Fed’s eagerness to promote growth.

These are important and difficult issues. The best thinking I have found on the subject comes from Frederick Soddy. For more see,

http://www.paulcraigroberts.org/2012/07/30/nationalize-money-not-banks-herman-daly/

Thank you, though I’m not sure I understand this yet…

I like your idea for the chicken parable! In our current system, though, it doesn’t seem like a realistic option, since our fiat currency must be accepted for all debts.

You say “[no, government-issued currency is not interest-bearing, and in a 100% reserve system it would be the only money in existence]”.

I can see that a 100% reserve system would be different, but I think Eisenstein’s critique is of our system as it currently operates, and I’m trying to understand whether his discussion of the current system is accurate.

He writes:

“Money originates when the Fed… purchases interest-bearing securities (traditionally, Treasury notes…) on the open market…. The money created accompanies a corresponding debt, and the debt is always for more than the amount of money created.” Is this correct?

So even with paper currency, the Fed doesn’t just give it to a bank at zero interest (well, except sometimes, in real terms, in severe recessions like right now). Rather, they use it to buy securities that bear interest. So every new dollar the bank gets, it eventually has to pay back to the Fed with interest, right? And that extra money, the interest, must have come from someone else who also originally got it from the Fed, also at interest. So somewhere along the line, some of the banks are guaranteed not to be able to repay the Fed except by taking on a new, larger debt just to pay off the old debt.

I think you say something similar in your “Nationalize Money” article when you write “the money supply no longer has to grow in order for people to pay back the principal plus the interest required by the loan responsible for the money’s very existence in the first place.”

So if I understand this, there are really two changes you’re proposing: (1) requiring 100% reserves, and (2) making the Fed (or the Treasury) lend newly created money to banks at zero interest rather than using it to buy interest-bearing securities.

Later you say “[the insufficiency of money is easily relieved by printing more]”.

But I think Eisenstein’s point is, in our current system, money is created simultaneously with interest-bearing debt, so there will always necessarily be insufficient money to repay the debt. The fact that the Fed could theoretically print more money to relieve the insufficiency (and ship it to the banks like a Christmas present to pay off their otherwise delinquent debts?) isn’t very satisfying since the Fed never considers doing that. Or maybe the recent bank bailouts were just such a case and could be seen as having ultimately been caused by the Fed’s purchases of interest-bearing (rather than zero-interest) securities, and all the other factors like the housing bubble, credit default swaps, etc, were just the details that determined which institutions ended up “last in the chain” so they were the ones that couldn’t repay their debts to the Fed and had to be bailed out?

I may be getting off track here, so I hope you’ll point out if I’m misunderstanding something. Thanks again for helping me understand this!

Our present system is screwy and good for Eisenstein, along with many before him, for recognizing this. The issue is that the 100% reserve policy is a better substitute for the present system than his convoluted suggestions, and that he fails even to consider it. With 100% reserves the Fed can be abolished. Money is created by the treasury without interest, and directly spent by the government into circulation to pay its expenses, independently of banks. I am proposing only the first change you indicate, not the second. I think things will be clearer if you set aside Eisenstein and read Frederick Soddy or Irving Fisher, or have a look at the web site “positive money”. Cheers, HD.

Oh I see, so you propose having the Treasury spend money into existence (at zero interest) rather than having the Fed lend it at zero interest. I’m not sure how those two would be different, but from my perspective, either way, this eliminates the interest that currently gets created together with money. I’ll look around on positivemoney.org.uk – thanks for the pointer.

So, I just found where Eisenstein gives his take on the 100% reserve idea and even cites Frederick Soddy:

“A 100-percent reserve system, it is claimed, would prevent debt from outstripping money–but how, then, to prevent concentration of wealth in the presence of interest?… Frederick Soddy, among the first modern economists to recognize the impossibility of unlimited exponential growth and to distinguish between money and wealth, proposed a 100-percent reserve requirement for banks, excluding them from the business of money creation, but also provided that the government would spend money into existence at levels sufficient to prevent deflation” (from chapter 11).

So he thinks money created with interest leads not just to a systemic problem of ever-increasing debt, but also to a moral problem of allowing those who already have wealth to accumulate more. And while he acknowledges that 100% reserves would fix the problem of interest-money driving exponential growth, he thinks negative interest would be a better solution for moral reasons.

So now I’m back to wondering how/whether a negative interest system would actually work, and why you think the 100% reserve idea is better.

Perhaps, as you suggested, negative interest would also drive excessive levels of economic growth due to people wanting to spend or invest all their money rather than save it and watch it lose its value.

And probably, people with wealth, rather than holding it in bank accounts, would then invest it in income-producing assets like real estate or stocks, so I don’t see how this would prevent wealth from concentrating; I’d think it would just encourage concentration of wealth via income-producing investments rather than via interest-producing lending.

But would the economic activity driven by negative interest actually necessitate growth? (I can see how the need to pay off debts in an interest-money system creates a need for the whole economy to keep growing, but it’s not so clear to me how negative interest would lead to economy-wide growth, as opposed to merely a shift in preferences from savings toward spending and investment.)