Eight Fallacies about Growth

by Herman Daly

One thing the Democrats and Republicans will agree on in the current U.S. presidential campaign is that economic growth is our number one goal and is the basic solution to all problems. The idea that growth could conceivably cost more than it is worth at the margin and therefore become uneconomic in the literal sense, will not be considered. Aside from political denial, why do people (frequently economists) not understand that continuous growth of the economy (measured by either real GDP or resource throughput) could in theory, and probably has, in fact, become uneconomic? What is it that confuses them?

Here are eight likely reasons for confusion.

One can nearly always find something whose growth would be both desirable and possible.

For example, we need more bicycles and can produce more bicycles. More bicycles equal growth. Therefore growth is both good and possible. QED.

However, this confuses aggregate growth with reallocation. Aggregate growth refers to growth in everything: bicycles, cars, houses, ships, cell phones, and so on. Aggregate growth is growth in scale of the economy, the size of real GDP, which is a value-based index of aggregate production, and consequently of the total resource throughput required by that production. In the simplest case of aggregate growth, everything produced goes up by the same percentage. Reallocation, by contrast, means that some things go up while others go down and the freed-up resources from the latter are transferred to the former. The fact that reallocation remains possible and desirable does not mean that aggregate growth is possible and desirable. The fact that you can reallocate the weight in a boat more efficiently does not mean that there is no Plimsoll Line. Too much weight will sink a boat even if it is optimally allocated. Efficient reallocation is good; the problem is aggregate growth.

Aggregate growth in our economy would cost more than it is worth because we live in a finite world. (Image: CC0, Credit: A1_Moments_AU).

Reallocation of production away from more resource-intensive goods to less resource-intensive goods (“decoupling”) is possible to some degree and often advocated, but is limited by two basic facts. First, the economy grows as an integrated whole, not as a loose aggregate of independently changeable sectors. A glance at the input-output table of an economy makes it clear that to increase the output of any sector requires an increase in all the inputs to that sector from other sectors, and then increases of the inputs to those inputs, etc. Second, in addition to the input-output or supply interdependence of sectors, there are demand constraints—people are just not interested in information services unless they first have enough food and shelter. So trying to cut the resource-intensive food and shelter part of GDP to reallocate to less resource-intensive information services in the name of decoupling GDP from resources, will simply result in a shortage of food and shelter, and a glut of information services.

Aggregate growth was no problem back when the world was relatively empty. But now the world is full, and aggregate growth likely costs more than it is worth, even though more bicycles (and less of something else) might still be possible and desirable.

That should not be too hard to understand.

Since GDP is measured in value terms, it is therefore not subject to physical limits.

This is another argument given for easy “decoupling” of GDP from resource throughput. But growth refers to real GDP, which eliminates price level changes. Real GDP is a value-based index of aggregate quantitative change in real physical production. It is the best index we have of total resource throughput. The unit of measure of real GDP is not dollars, but rather “dollar’s worth.” A dollar’s worth of gasoline is a physical quantity, currently about one-fourth of a gallon. The annual aggregate of all such dollar’s worth amounts of all final commodities is real GDP, and even though not expressible in a simple physical unit, it remains a physical aggregate and subject to physical limits. The price level and nominal GDP might grow forever (inflation), but not real GDP, and the latter is the accepted measure of aggregate growth. Most people can grasp this, and do not conceive of real GDP as trillions of dollar bills, or as ethereal, abstract, psychic, aggregated utility.

Looking at past totals rather than present margins.

Just look at the huge net benefits of past growth! How can anyone oppose growth when it has led to such enormous benefits? Well, there is a good reason: The net benefits of past growth reach a maximum precisely at the point where the rising marginal costs of growth equal the declining marginal benefits—that is to say, at precisely the point at which further growth ceases to be economic and becomes uneconomic! Before that point wealth grew faster than illth; beyond that point illth grows faster than wealth, making us poorer, not richer. No one is against being richer. No one denies that growth used to make us richer. The question is, does growth any longer make us richer, or is it now making us poorer?

Illth, a negative joint product of wealth, has created nuclear waste, climate change, depleted mines, biodiversity loss, etc. (Image: CC0, Credit: stevepb).

To understand the question requires that we recognize that real GDP has a cost, that illth is a negative joint product with wealth. Examples of illth are everywhere and include nuclear wastes, climate change from excess carbon in the atmosphere, biodiversity loss, depleted mines, eroded topsoil, dry wells and rivers, the dead zone in the Gulf of Mexico, gyres of plastic trash in the oceans, the ozone hole, exhausting and dangerous labor, and the exploding un-repayable debt from trying to push growth in the symbolic financial sector beyond what is possible in the real sector. Since no one buys these annually produced bads (that accumulate into illth), they have no market prices, and since their implicit negative shadow values are hard to estimate in a way comparable to positive market prices, they are usually ignored, or mentioned and quickly forgotten.

The logic of maximization embodied in equating marginal cost with marginal benefit requires a moment’s thought for the average citizen to understand clearly, but surely it is familiar to anyone who has taken Econ 101.

Even if it is theoretically possible that the marginal cost of growth has become greater than the marginal benefit, there is no empirical evidence that this is so.

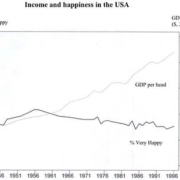

On the contrary, there is plenty of empirical evidence for anyone who has not been anesthetized by the official party line of Madison Avenue and Wall Street. As for empirical evidence of the statistical type, there are two independent sources that give the same basic answer. First are the objective measures that separate GDP sub-accounts into costs and benefits and then subtract the costs from GDP to approximate net benefits of growth. The Index of Sustainable Economic Welfare (ISEW) and its later modifications into the General Progress Indicator (GPI) both indicate that, for the U.S. and some other wealthy countries, GDP and GPI were positively correlated up until around 1980, after which GPI leveled off and GDP continued to rise. In other words, increasing throughput as measured by real GDP no longer increased welfare as measured by GPI. A similar disconnect is confirmed using the different measure of self-evaluated happiness. Self-reported happiness increases with per capita GDP up to a level of around $20,000 per year and then stops rising. The interpretation given is that while absolute real income is important for happiness up to some sufficient point, beyond that point happiness is overwhelmingly a function of the quality of relationships by which our very identity is constituted. Friendships, marriage, family, social stability, trust, fairness, etc.—not per capita GDP—are the overwhelming determinants of happiness at the present margin, especially in high-income countries. If we sacrifice friendships, social stability, family time, environmental services, and trust for the sake of labor mobility, a second job, and quarterly financial returns, we often reduce happiness while increasing GDP. Relative income gains may still increase individual happiness even when increases in absolute income no longer do, but aggregate growth is powerless to increase everyone’s relative income because we cannot all be above average. Beyond some sufficiency, growth in GDP no longer increases either self-evaluated happiness or measured economic welfare, but it continues to increase costs of depletion, pollution, congestion, stress, etc. Why do most economists resist the very idea that we might have reached this point? Why do they resist measuring the costs of growth, and then claim that “there is no empirical evidence” for what is common experience? Read on.

Growth in GDP must be good or it would not have happened.

Many believe that the way we measure GDP automatically makes its growth a trustworthy guide to economic policy. To be counted in GDP, there must be a market transaction, and that implies a willing buyer and seller, neither of whom would have made the transaction if it did not make them better off in their own judgment. Ergo, growth in GDP must be good or it would not have happened. The problem here is that there are many third parties who are affected by many transactions but did not agree to them. These external costs (or sometimes benefits) are not counted in GDP. Who are these third parties? The public in general but more specifically, the poor who lack the money to express their preferences in the market, future generations who cannot bid in present markets, and other species who have no influence on markets at all.

Many people assume GDP growth is good or it would never have happened. However, many economists do not take into account the consumption of natural capital, which ultimately only causes more harm than good. (Image: CC0, Credit: AhmadArdity)

In addition, GDP, the largest component of which is national income, counts consumption of natural capital as income. Counting capital consumption as income is the cardinal sin of accounting. Cut down the entire forest this year and sell it and the entire amount is treated as this year’s income. Pump all the petroleum and sell it, and add that to this year’s income. But income in economics is by definition the maximum amount that a community can produce and consume this year, and still be able to produce and consume the same amount next year. In other words, income is the maximum consumption that still leaves intact the capacity to produce the same amount next year. Only the sustainable yield of forests, fisheries, croplands, and livestock herds is this year’s income—the rest is capital needed to reproduce the same yield next year. Consuming capital means reduced production and consumption in the future. Income is by definition sustainable; capital consumption is not. The whole historical reason for income accounting is to avoid impoverishment by inadvertent consumption of capital. By contrast, our national accounting tends to encourage capital consumption (at least consumption of natural capital), first by counting it in GDP, and then claiming that whatever increases GDP is good!

As already noted we fail to subtract negative by-products (external costs) from GDP on the grounds that they have no market price since obviously no one wants to buy bads. But people do buy anti-bads, and we count those expenditures. For example, the costs of pollution (a bad) are not subtracted, but the expenditures on pollution clean-up (an anti-bad) are added. This is asymmetric accounting—adding anti-bads without having subtracted the bads that made the anti-bads necessary in the first place. The more bads, the more anti-bads, and the greater is GDP—wheel spinning registered as forward motion.

There are other problems with GDP, but these should be enough to refute the mistaken idea that if something is not a net benefit it would not have been counted in GDP, so, therefore, GDP growth must always be good. Lots of people have for a long time been making these criticisms of GDP. They have not been refuted—just ignored!

Knowledge is the ultimate resource and since knowledge growth is infinite it can fuel economic growth without limit.

I am eager for knowledge to substitute physical resources to the extent possible and consequently advocate both taxes to make resources expensive and patent reform to make knowledge cheap. But if I am hungry I want real food on the plate, not the knowledge of a thousand recipes on the internet. Furthermore, the basic renewability of ignorance makes me doubt that knowledge can save the growth economy. Ignorance is renewable mainly because ignorant babies replace learned elders every generation. In addition, vast amounts of recorded knowledge are destroyed by fires, floods, and bookworms. Modern digital storage does not seem to be immune to these teeth of time, or to that new bookworm, the computer virus. To be effective in the world, knowledge must exist in someone’s mind (not just in the library or on the Internet)—otherwise, it is inert. And even when knowledge increases, it does not grow exponentially like money in the bank. Some old knowledge is disproved or canceled out by new knowledge, and some new knowledge is the discovery of new biophysical or social limits to growth.

New knowledge must always be something of a surprise—if we could predict its content then we would have to know it already, and it would not really be new. Contrary to common expectation, new knowledge is not always a pleasant surprise for the growth economy—frequently it is bad news. For example, climate change from greenhouse gases was recently new knowledge, as was the discovery of the ozone hole. How can one appeal to new knowledge as the panacea when the content of new knowledge must of necessity be a surprise? Of course, we may get lucky with new knowledge, but should we borrow against that uncertainty? Why not count the chickens after they hatch?

Without growth, we are condemned to unemployment.

The Full Employment Act of 1946 declared full employment to be a major goal of U.S. policy. Economic growth was then seen as the means to attain full employment. Today, that relation has been inverted—economic growth has become the end. If the means to attain that end—automation, off-shoring, excessive immigration—result in unemployment, well that is the price “we” just have to pay for the supreme goal of growth. If we really want full employment we must reverse this inversion of ends and means. We can serve the goal of full employment by restricting automation, off-shoring, and immigration work permits to periods of true domestic labor shortage as indicated by high and rising wages. Real wages have been falling for decades, yet our corporations, hungry for cheaper labor, keep bleating about a labor shortage. They mean a shortage of cheap labor in the service of growing profits. Actually a labor shortage in a capitalist economy with 80 percent of the population earning wages is not a bad thing. How else will wages and standard of living for that 80 percent ever increase unless there is a shortage of labor? What the corporations really want is a surplus of labor and falling wages. With surplus labor, wages cannot rise and therefore all the gains from productivity increases will go to profit, not wages. Hence the elitist support for uncontrolled automation, off-shoring, and immigration.

We live in a globalized economy and have no choice but to compete in the global growth race.

Not so! Globalization was a policy choice of our elites, not an imposed necessity. Free trade agreements had to be negotiated. Who negotiated and signed the treaties? Who pushed for free capital mobility and signed on to the World Trade Organization? Who wants to enforce trade-related intellectual property rights with trade sanctions? The Bretton Woods system was a major achievement aimed at facilitating international trade after WWII. It fostered trade for mutual advantage among separate countries. Free capital mobility and global integration were not part of the deal. That came with the WTO and the effective abandonment by the World Bank and IMF of their Bretton Woods charter. Globalization is the engineered integration of many formerly relatively independent national economies into a single tightly bound global economy organized around absolute, not comparative, advantage. Once a country has been sold on free trade and free capital mobility it has effectively been integrated into the global economy and is no longer free not to specialize and trade. Yet all of the theorems in economics about the gains from trade assume that trade is voluntary. How can trade be voluntary if you are so specialized as to be no longer free not to trade? Countries can no longer account for social and environmental costs and internalize them in their prices unless all other countries do so and to the same degree. To integrate the global omelet you must disintegrate the national eggs. While nations have many sins to atone for, they remain the main locus of community and policy-making authority. It will not do to disintegrate them in the name of abstract “globalism,” even though we certainly require some global federation of national communities. But when nations disintegrate there will be nothing left to federate in the interest of legitimately global purposes. “Globalization” (national disintegration) was an actively pursued policy, not an inertial force of nature. It was done to increase the power and growth of transnational corporations by moving them out from under the authority of nation-states and into a non-existent “global community.” It can be undone, as is currently being contemplated by some in the European Union, often heralded as the forerunner of more inclusive globalization.

If the growth boosters will make a sincere effort to overcome these eight fallacies, then maybe we can have a productive dialogue about whether or not what used to be economic growth has now become uneconomic growth, and what to do about it. Until these eight fallacies have been addressed, it is probably not worth extending the list. It is too much to hope that the issue of uneconomic growth will make it into the 2012 election, but maybe 2016, or 2020 . . . or sometime? One can hope. But hope must embrace not just a better understanding regarding these confusions, but also more love and care for our fellow humans, and for all of Creation. Our decision-making elites may tacitly understand that growth has become uneconomic. But they have also figured out how to keep the dwindling extra benefits for themselves, while “sharing” the exploding extra costs with the poor, the future, and other species. The elite-owned media, the corporate-funded think tanks, the kept economists of high academia, and the World Bank—not to mention GoldSacks and Wall Street—all sing hymns to growth in harmony with class interest and greed. The public is bamboozled by technical obfuscation, and by the false promise that, thanks to growth, they too will one day be rich. Intellectual confusion is real, but moral corruption fogs the discussion even more.

Herman Daly is CASSE Chief Economist, Professor Emeritus (University of Maryland), and past World Bank senior economist.

Herman Daly is CASSE Chief Economist, Professor Emeritus (University of Maryland), and past World Bank senior economist.

There is only one word to describe this article BRILLIANT…

Excellent analysis on uneconomic growth, with clear connections to my last blog-post, exploring these possibilities:

What if… a): There is plenty of development going on without growth

What if… b): A steady state economy is the normal (and in the long run, desirable) condition

What if… c): Growth is not prosperity

What if… d): The fantasy of risk-free yields is extremely expensive and dangerous

What if… e): (Most of) the financial sector is dispensable

http://annaborgeryd.tumblr.com/post/27858359491/the-ups-and-downs-of-growth-what-if-this-is-the-case

Basically, the same conclusions as Tim Meadows in ‘Prosperity without Growth’ which began as a report for the UK’s Sustainable Development Commission. But ignored by the UK Government and mainstream politicians.

Tim Jackson actually. But yes he provided a good body of empirical evidence for the argument here.